1.1 — Introduction to IO

ECON 326 • Industrial Organization • Spring 2023

Ryan Safner

Associate Professor of Economics

safner@hood.edu

ryansafner/ioS23

ioS23.classes.ryansafner.com

About Me

Edinburgh, 2019

Ph.D (Economics) — George Mason University, 2015

B.A. (Economics) — University of Connecticut, 2011

7th year teaching at Hood

Specializations:

- Law and Economics

- Austrian Economics

Research interests

- modeling innovation & economic growth

- political economy & economic history of intellectual property

- Substack: Increasing Returns

What's Keeping Me Busy

What is Industrial Organization About?

Industrial Organization

How are industries organized, and why do they operate the way they do?

How do we properly regulate industry?

How does, and should, actual competition between firms work?

IO is Applied Microeconomics

George Stigler

1911-1991

Economics Nobel 1982

“Let us start this...on a higher plane of candor than [we] will always maintain, there is no such subject as industrial organization,” (p.1).

“These courses deal with the size, structure, the effects of concentration on competition, the effects of competition upon prices, investment, innovation, and so on. But this is precisely the content of economic theory — price or resource allocation theory, now often given the unfelicitious name of microeconomics,” (p.1).

Stigler, George J, 1968, The Organization of Industry

You Already Know a Lot of IO Basics

You (hopefully) learn(ed) in Microeconomics (206, 306):

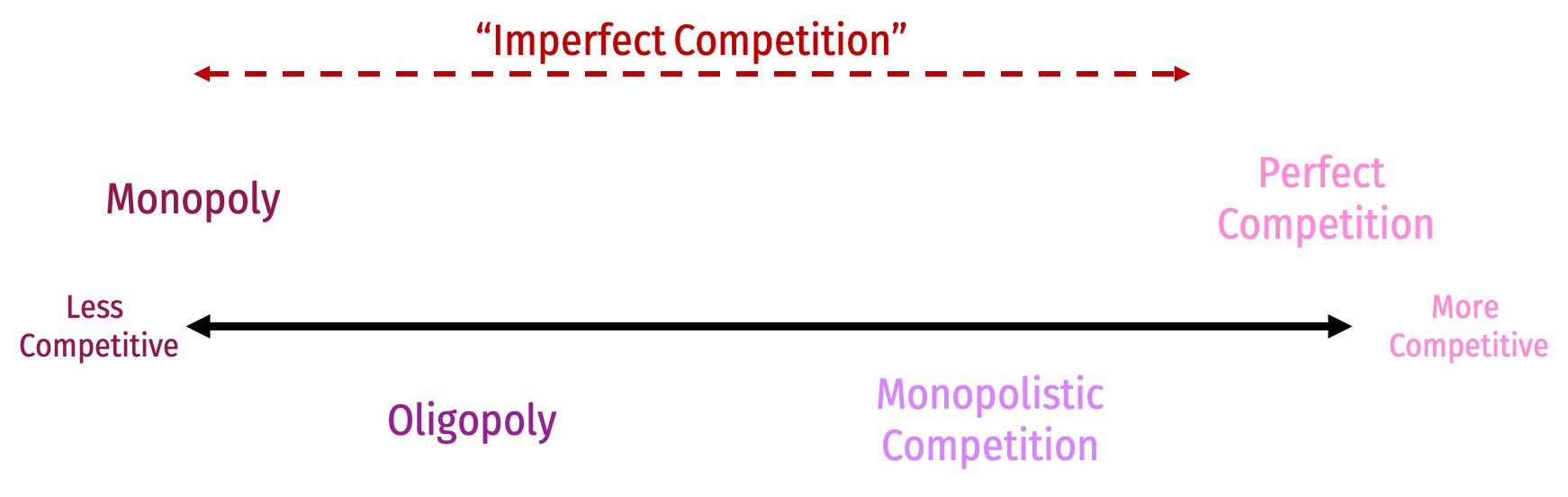

Market structures:

- perfect competition

- monopoly

- monopolistic competition

- oligopoly

You Already Know a Lot of IO Basics

You (hopefully) learn(ed) in Microeconomics (206, 306):

Something about the following concepts:

- pricing

- game theory

- antitrust

- entrepreneurship

- market failures/regulation/welfare

Spectrum of Market Structures

Classic Elements of Industrial Organization

Structure-Conduct-Performance (SCP) paradigm

Price theory and Game theory

Economics of Organization/Firms

Antitrust and economics of regulation

Structure-Conduct-Performance Paradigm

- An industry’s “Performance”

- Price (high, low)

- Output (high, low)

- Profit

- Productive efficiency

- Allocative efficiency (CS, DWL)

- Quality, safety, etc.

Structure-Conduct-Performance Paradigm

- ... which is determined by its firms’ “Conduct”

- Pricing behavior

- Output choices

- Advertising

- Lobbying

- Lawsuits

- Entry and exit

- Collusion

- Innovation

Structure-Conduct-Performance Paradigm

- ... which is determined by the industry’s “Structure”

- Number of buyers

- Number of sellers

- Product differentiation

- Vertical integration

- Barriers to entry

Structure-Conduct-Performance Paradigm

- ... which is determined (exogenously) by the product’s “Technology”

- Consumer demand (price and income elasticity, substitutes, location, etc)

- Product’s features: experience, information, durability, rivalry, excludability

- Production features: economies of scale, economies of scope, network externalities, two-sided platforms

Structure-Conduct-Performance Paradigm

- Government policy can affect nearly every stage

- Entry regulation

- Price regulation

- Antitrust lawsuits

- Taxes and subsidies

A Brief Sketch of IO History

Theory of perfect competition perfected 1920—1930s

SCP paradigm dominant (1950s—1970s)

- cross-industry comparisons

- positive correlation between industry concentration and profits

A Brief Sketch of IO History

“New learning” rejects SCP paradigm (1970s-1980s)

- game theory in imperfect competition, strategic behaviors

- efficiency arguments for firm behaviors

- revolution in antitrust thinking

“New Empirical Industrial Organization” (1980s-present)

- better data & better theory

- focus on individual industries, micro-level

- 1990s credibility revolution in econometrics, counterfactual modeling

Price Theory

Economics is a way of thinking based on a few core ideas:

People respond to incentives

- Money, punishment, taxes and subsidies, risk of injury, reputation, profits, sex, effort, morals

Environments adjust until they are in equilibrium

- People make adjustments until their choices are optimal given others’ actions

Price Theory: Optimization & Equilibrium

Optimization

Agents have objectives they value

Agents face constraints

Make tradeoffs to maximize objectives within constraints

Price Theory: Optimization & Equilibrium

Optimization

Agents have objectives they value

Agents face constraints

Make tradeoffs to maximize objectives within constraints

Equilibrium

Agents compete with others over scarce resources

Agents adjust behaviors based on prices

Stable outcomes when adjustments stop

Price Theory: Optimization and Equilibrium

If people can learn and change their behavior, they will always switch to a higher-valued option

If there are no alternatives that are better, people are at an optimum

If everyone is at an optimum, the system is in equilibrium

Economics (Price Theory) Is Broader Than You Think

Remember: All Models are Wrong!

Caution: Don't conflate models with reality!

Models help us understand reality.

A good economist is always aware of:

- "ceterus paribus"

- "...and then what?"

- "...compared to what?"

Economics IO Often Uses, but Is Not Limited to, Math

The Economics of Organization

Studying the problem of economic organization provides more perspectives

Firms (hierarchies) and markets are substitutable methods of production

Team production of many economic goods and services

Organize to minimize transaction costs in production

The Economics of Organization

Most production takes place in firms

Firms grapple with their own principal-agent problems:

- management vs. labor, management vs. owners

Firms must relate to other firms

- specialization & division of labor

- up/downstream market power

- mergers & acquisitions, vertical integration

Efficiency Arguments and Antitrust

- A lot of business activities that appear anti-competitive may actually be pro-competitive (i.e. they improve consumer welfare)

Game Theory and Strategic Behavior

- Game theory: a set of tools that model strategic interactions ("games") between rational players, 3 elements:

- Players

- Strategies that players can choose from

- Payoffs are jointly-determined from combination of all players' strategies

Game Theory vs. Price Theory Models I

Optimization models ignore all other agents and just focus on how can you maximize your objective within your constraints

- Other agents are a primary cause of your constraints - but not considered in the model!

- Consumers max utility; firms max profit, etc.

Outcome: optimum: decision where you have no better alternatives

Game Theory vs. Price Theory Models II

Traditional economic models are often called Decision theory:

Equilibrium models assume that there are so many agents that no agent's decision can affect the outcome

- P.C.: firms are price-takers

- Monopoly: the only buyer or seller

- Ignores all other agents' choices!

Outcome: equilibrium: where nobody has no better alternatives

Game Theory vs. Price Theory Models III

Game theory models directly confront strategic interactions between players

- How each player would respond to a strategy chosen by other player(s)

- Lead to a stable outcome where everyone has considered and chosen their best responses

Outcome: Nash equilibrium: where nobody has a better strategy given the strategies everyone else is playing

Challenges to Consider

Positive correlation between concentration (fewer, bigger firms) and profits across industries

Is this because: a. big firms buy up their rivals to capture market share and then earn higher profits (anti-competitive) b. more efficient firms earn higher profits and outlast inefficient firms earning losses that go out of business or are acquired (pro-competitive)

Challenges to Consider

- Are the following business practices

- anti-competitive (and worth regulating/prosecuting) OR

- pro-competitive (creates efficiency & benefits consumers):

- price discrimination

- mergers & acquisitions

- franchising, exclusive dealing

- vertical restraints

- resale price maintenance

- advertising/marketing

Challenges to Consider

How do you define "an industry" or a market?

- What does Coca Cola compete with?

- What does Google compete with?

Substitutes in production vs. substitutes in consumption

Geographic boundaries

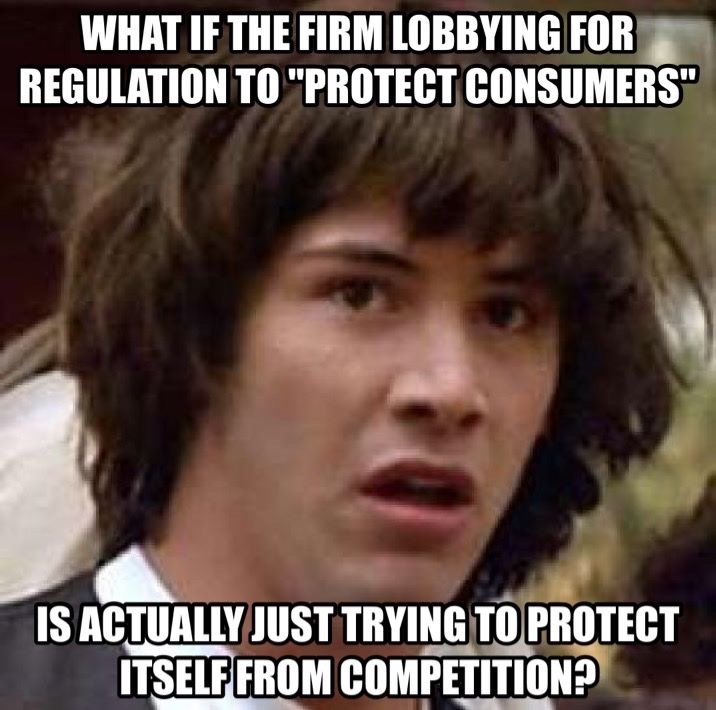

Challenges to Consider

Is regulation used by the government to regulate firms in the public interest?

Or is regulation used by firms to bludgeon their competition?

(Or something else?)

Motivating Issues in the World

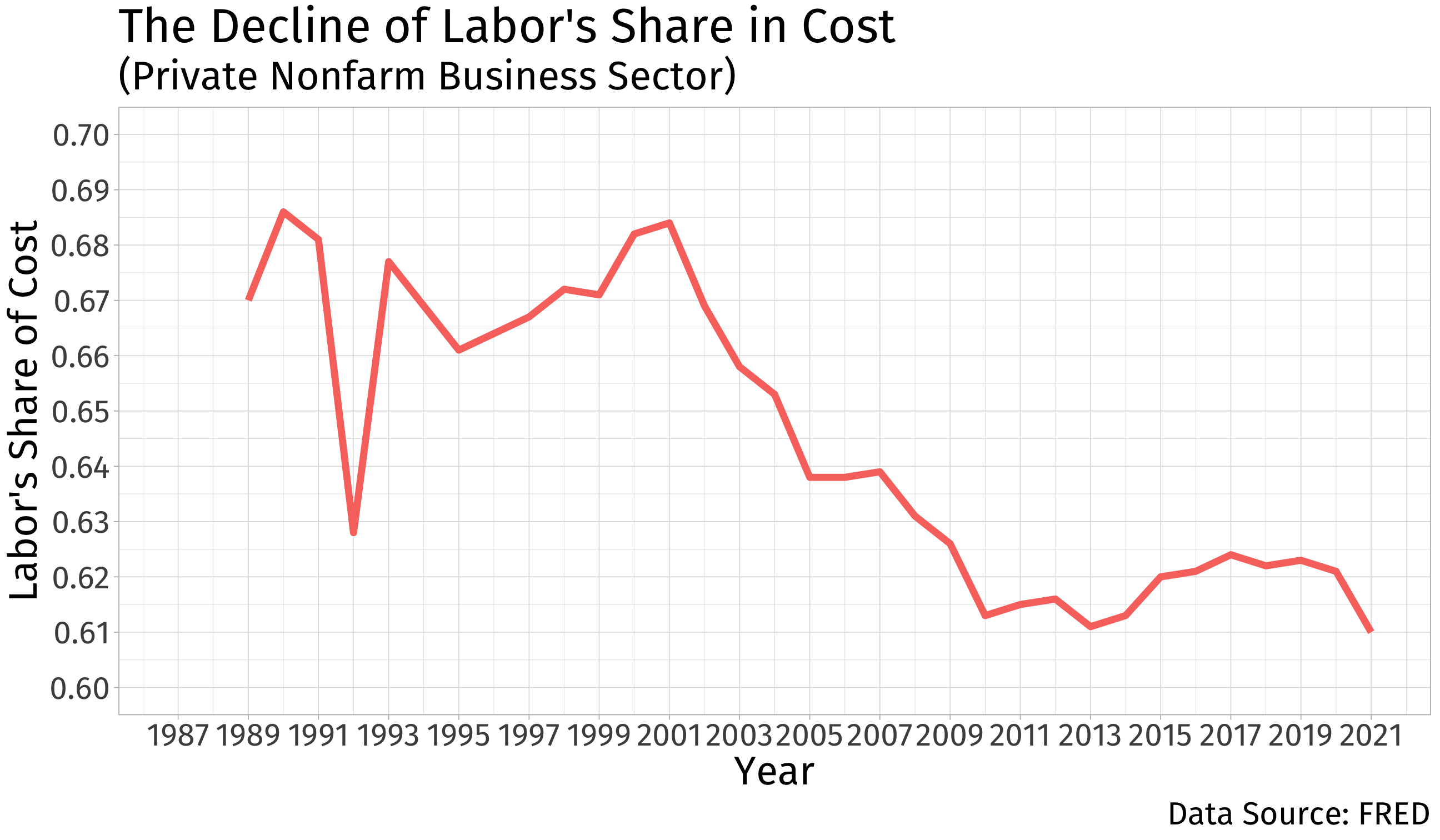

Unequal Growth, or Unshared Prosperity? I

Common argument: "real wages have been stagnant since 1970" or "real wages have not kept up with productivity since 1970"

Labor's share of national income has gone down recently

Might this be because of increasing market power?

Unequal Growth, or Unshared Prosperity? II

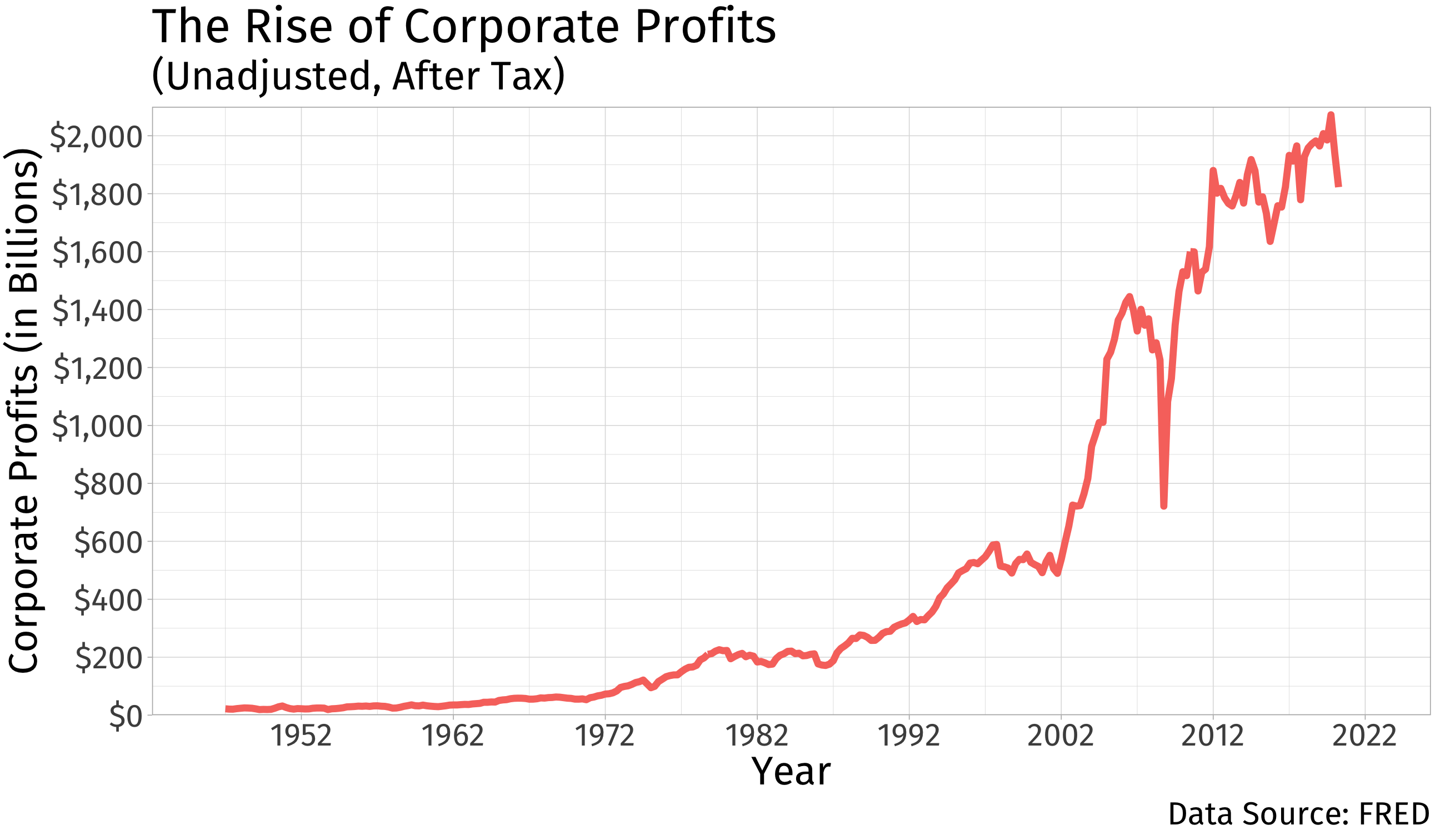

Unequal Growth, or Unshared Prosperity? III

The Rise of Market Power?

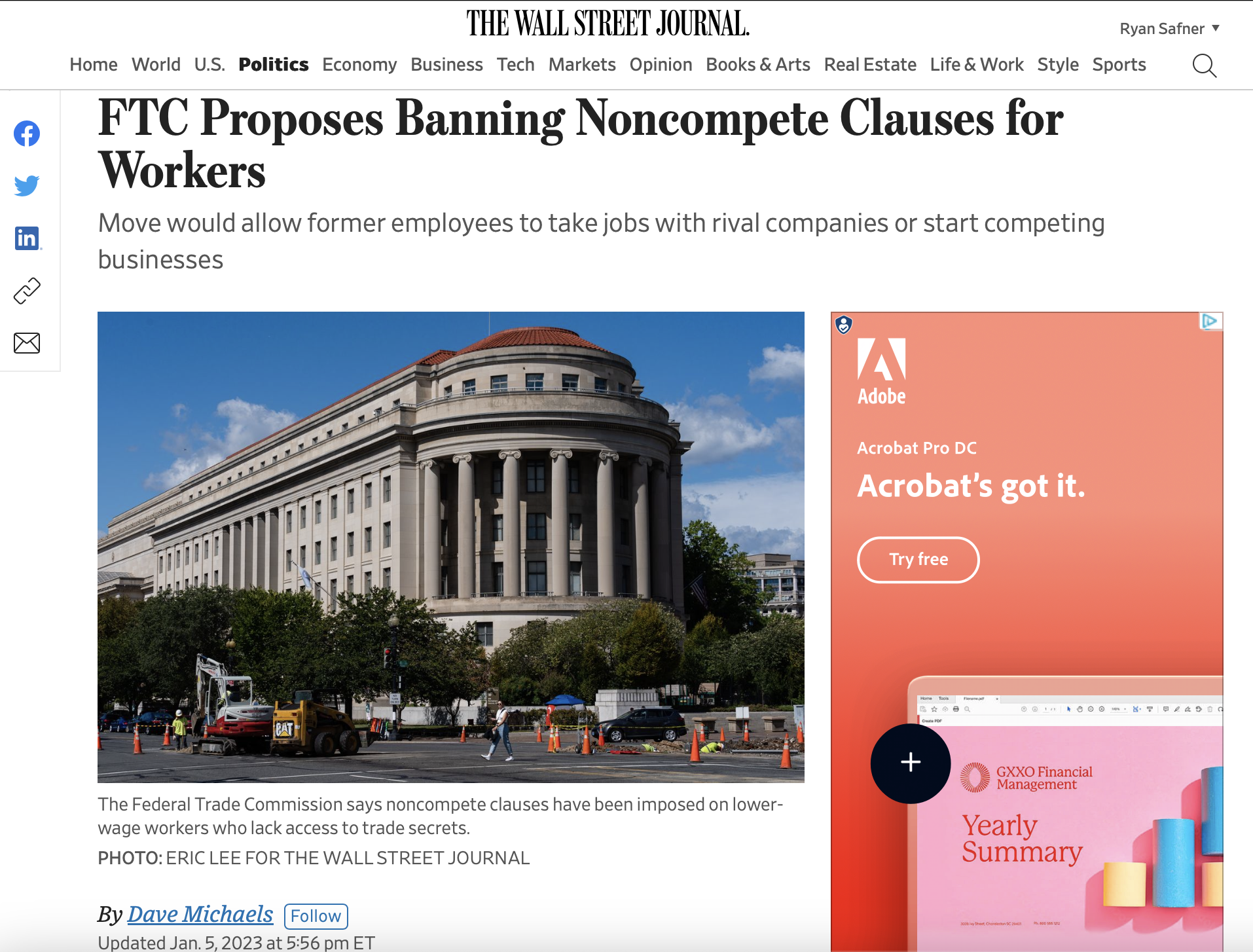

Is New Antitrust Action Necessary?

Is New Antitrust Action Necessary?

Is New Antitrust Thinking Necessary?

Some Questions for the Semester

Has there been a general increase in market power/concentration?

If so, what should we do about it?

Should we revitalize antitrust laws?

Are platforms like Facebook, Amazon, Google, etc. uniquely problematic? How should we regulate them?

Should your data be owned (and compensated) as labor?

Will automation take all the jobs? If so, what do we do about that?

About This Course

Learning Goals I

.smaller[

Understand key economic models of perfect competition, monopoly, monopolistic competition, oligopoly (Bertrand, Cournot, and Stackelberg competition), and contestable markets

Apply models of competition to different industries and regulatory regimes

Simulate strategic and game theoretic interactions and apply them to industry behavior

Discuss how firms actually compete with one another

Critique textbook models and theories of regulation and antitrust

Understand the economic problems that firms solve, create, and grapple with

Debate regulatory solutions to problems and current events in various industries

A Course in Five Acts

- I. Models/Review

- Production theory (technology, costs, etc)

- Market structures (perfect competition, monopoly)

- Some extensions beyond ECON 306 (factors markets, etc.)

- Some math & practice (HWs, Midterm)

A Course in Five Acts

- II. Oligopoly

- Oligopoly models

- (Static) game theory

- Playing games in class (Moblab)

A Course in Five Acts

- III. Economic Organization

- Theory of the firm: why firms exist (and look/act the way they do)

- Efficiency rationales for firm organization & behavior

A Course in Five Acts

IV. Strategic Behavior

- Dynamic/sequential game theory

- Repeated games

- Entry barriers

- Anticompetitive behavior

More readings and discussions with some lecture

A Course in Five Acts

V. Regulation & Applications

- Antitrust (theory, history, applications)

- Regulating natural monopoly

- Automation, gig economy

- Networks, platforms, ownership of data

More readings and discussions with some lecture

Assignments

| Assignment | Percent | |

|---|---|---|

| n | Participation (Average) | 10% |

| n | Homework (Average) | 20% |

| 1 | Midterm | 20% |

| 1 | Final (Take-home) | 30% |

| 1 | Industry Report | 20% |

See more details at the assignments page

Textbooks You Might Want

It's free online (PDF): https://works.bepress.com/jeffrey_church/23

But you may purchase a hard copy if you wish

And So We Can Play Games

Tips for Success, Or: How to College

Take notes. On paper. Really.

Read the readings. I've optimized them for you.

Participate*

You are learning how to learn

See the reference page for more