1.3 — Perfect Competition I

ECON 326 • Industrial Organization • Spring 2023

Ryan Safner

Associate Professor of Economics

safner@hood.edu

ryansafner/ioS23

ioS23.classes.ryansafner.com

Recall: The Firm's Two Problems

1st Stage: firm's profit maximization problem:

Choose: < output >

In order to maximize: < profits >

2nd Stage: firm's cost minimization problem:

Choose: < inputs >

In order to minimize: < cost >

Subject to: < producing the optimal output >

- Minimizing costs ⟺ maximizing profits

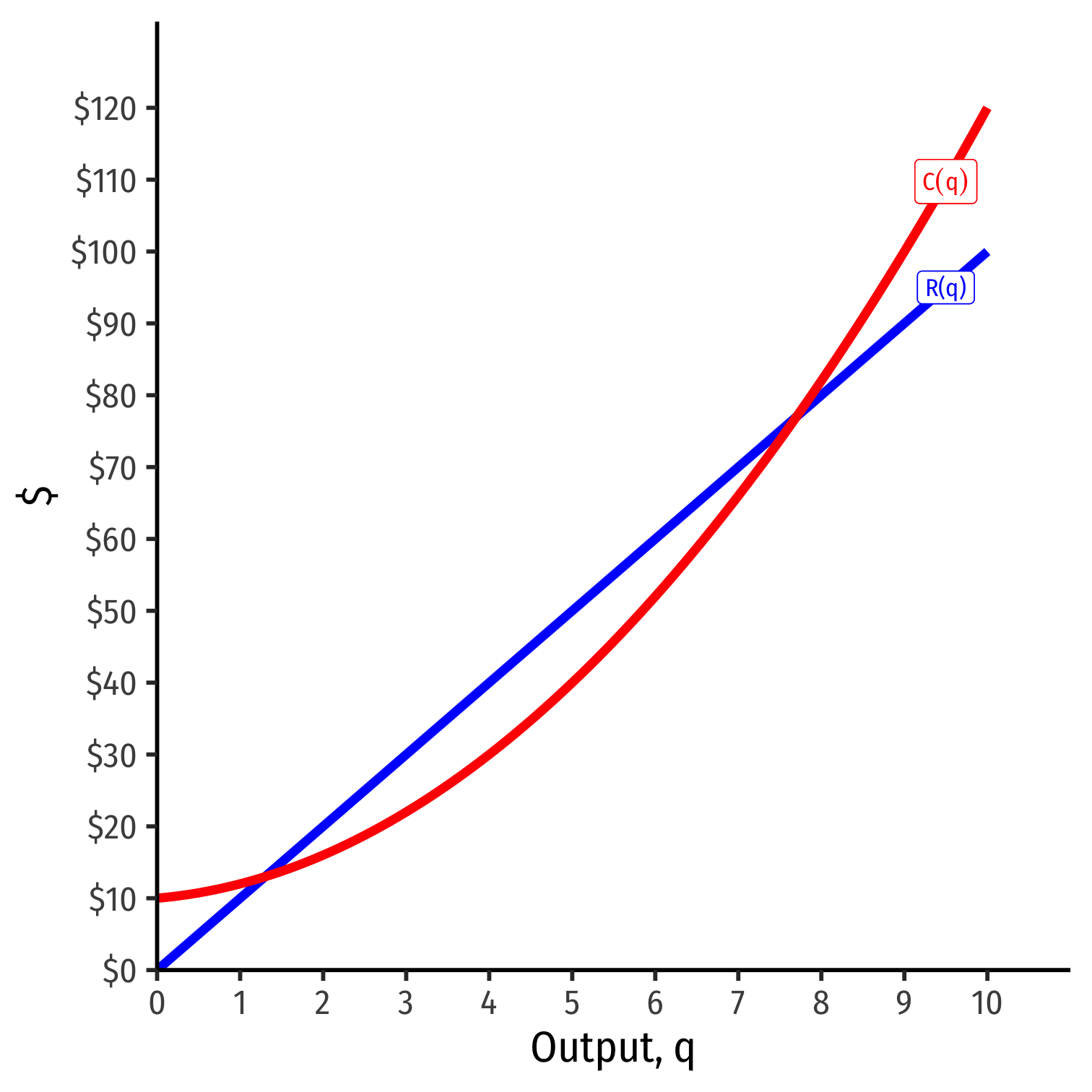

Visualizing Total Profit As R(q)−C(q)

- π(q)=R(q)−C(q)

Visualizing Total Profit As R(q)−C(q)

- π(q)=R(q)−C(q)

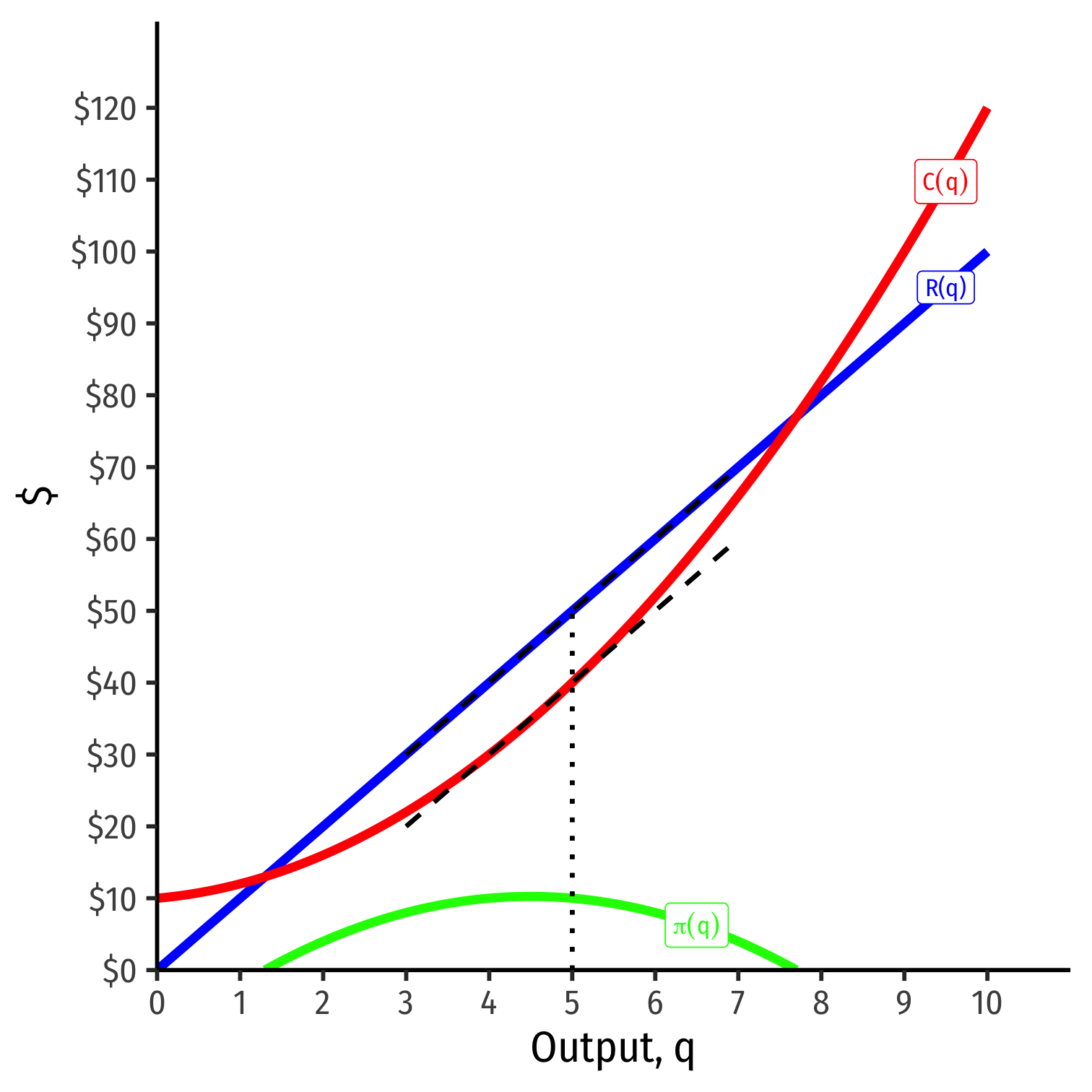

Visualizing Total Profit As R(q)−C(q)

π(q)=R(q)−C(q)

Graph: find q∗ to max π⟹q∗ where max distance between R(q) and C(q)

Visualizing Total Profit As R(q)−C(q)

π(q)=R(q)−C(q)

Graph: find q∗ to max π⟹q∗ where max distance between R(q) and C(q)

Slopes must be equal: MR(q)=MC(q)

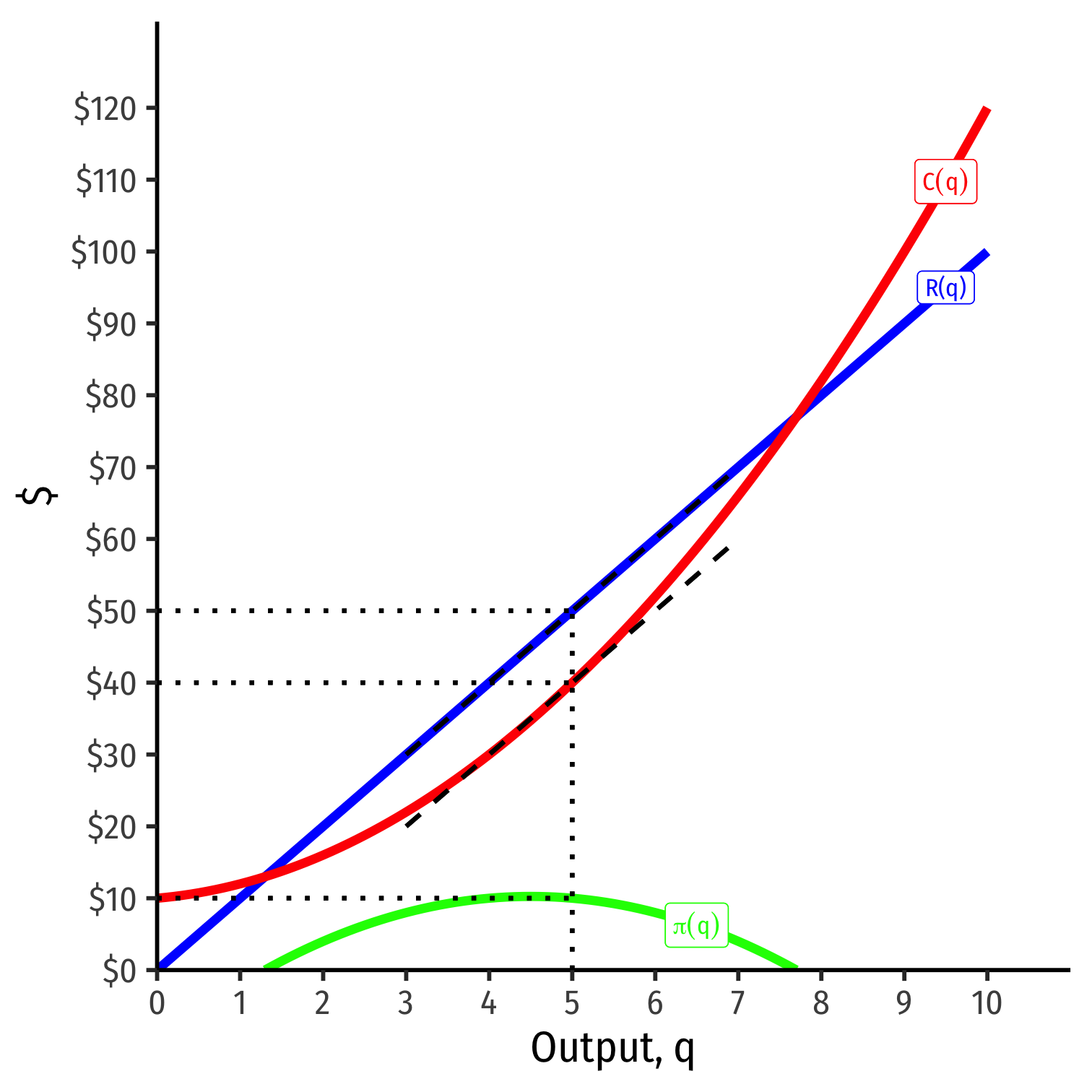

Visualizing Total Profit As R(q)−C(q)

π(q)=R(q)−C(q)

Graph: find q∗ to max π⟹q∗ where max distance between R(q) and C(q)

Slopes must be equal: MR(q)=MC(q)

- At q∗=5:

- R(q)=50

- C(q)=40

- π(q)=10

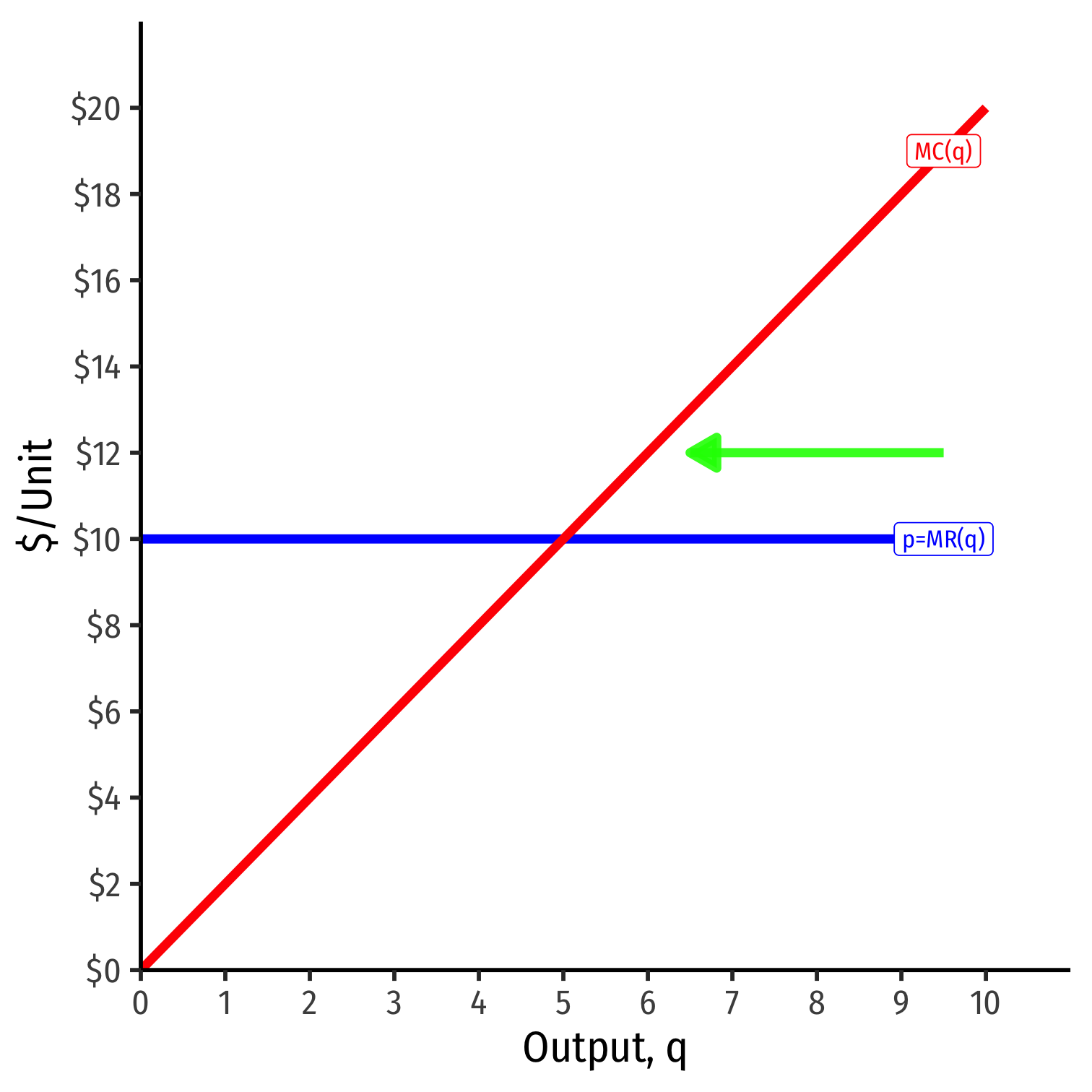

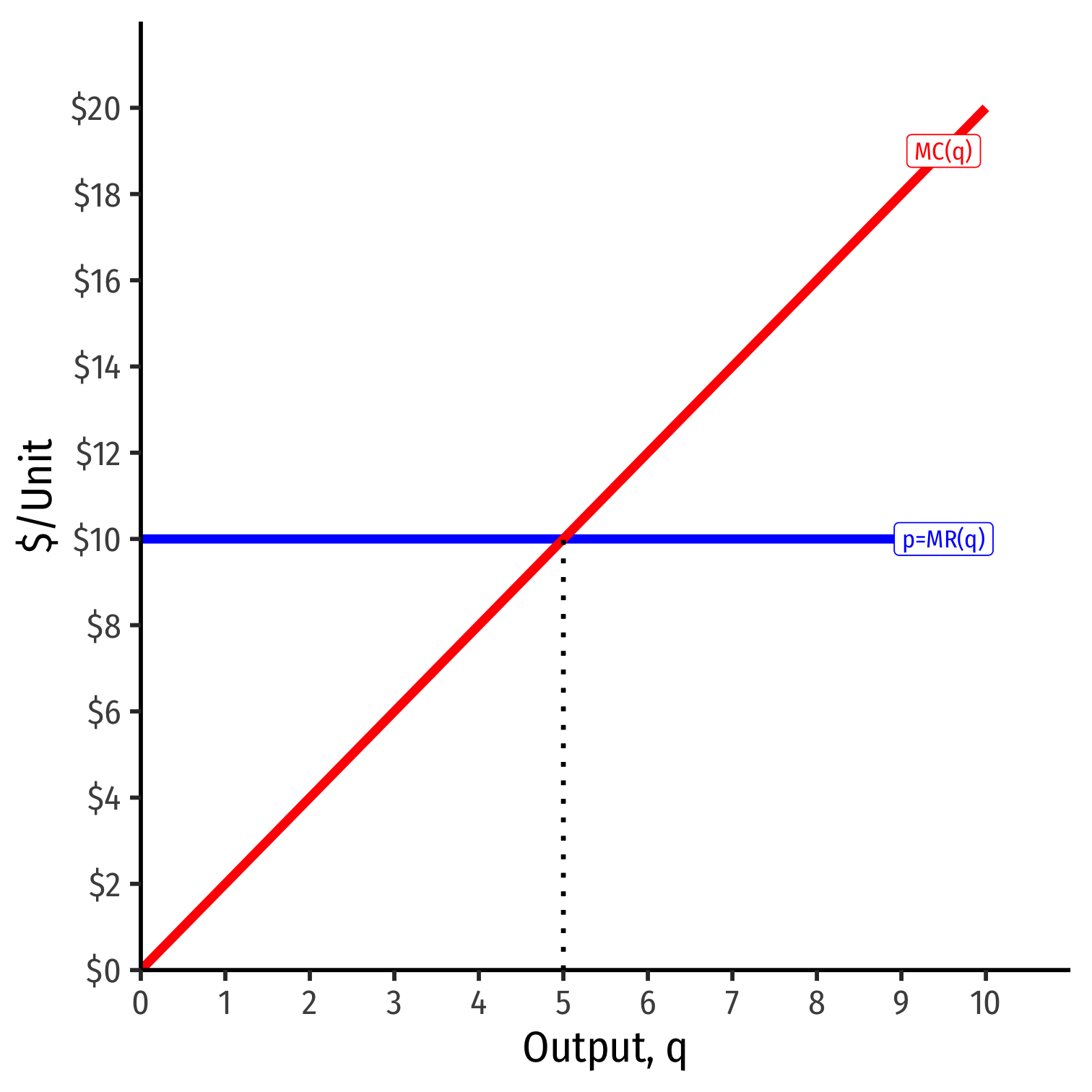

Visualizing Profit Per Unit As MR(q) and MC(q)

- At low output q<q∗, can increase π by producing more: MR(q)>MC(q)

Visualizing Profit Per Unit As MR(q) and MC(q)

- At high output q>q∗, can increase π by producing less: MR(q)<MC(q)

Visualizing Profit Per Unit As MR(q) and MC(q)

- π is maximized where MR(q)=MC(q)

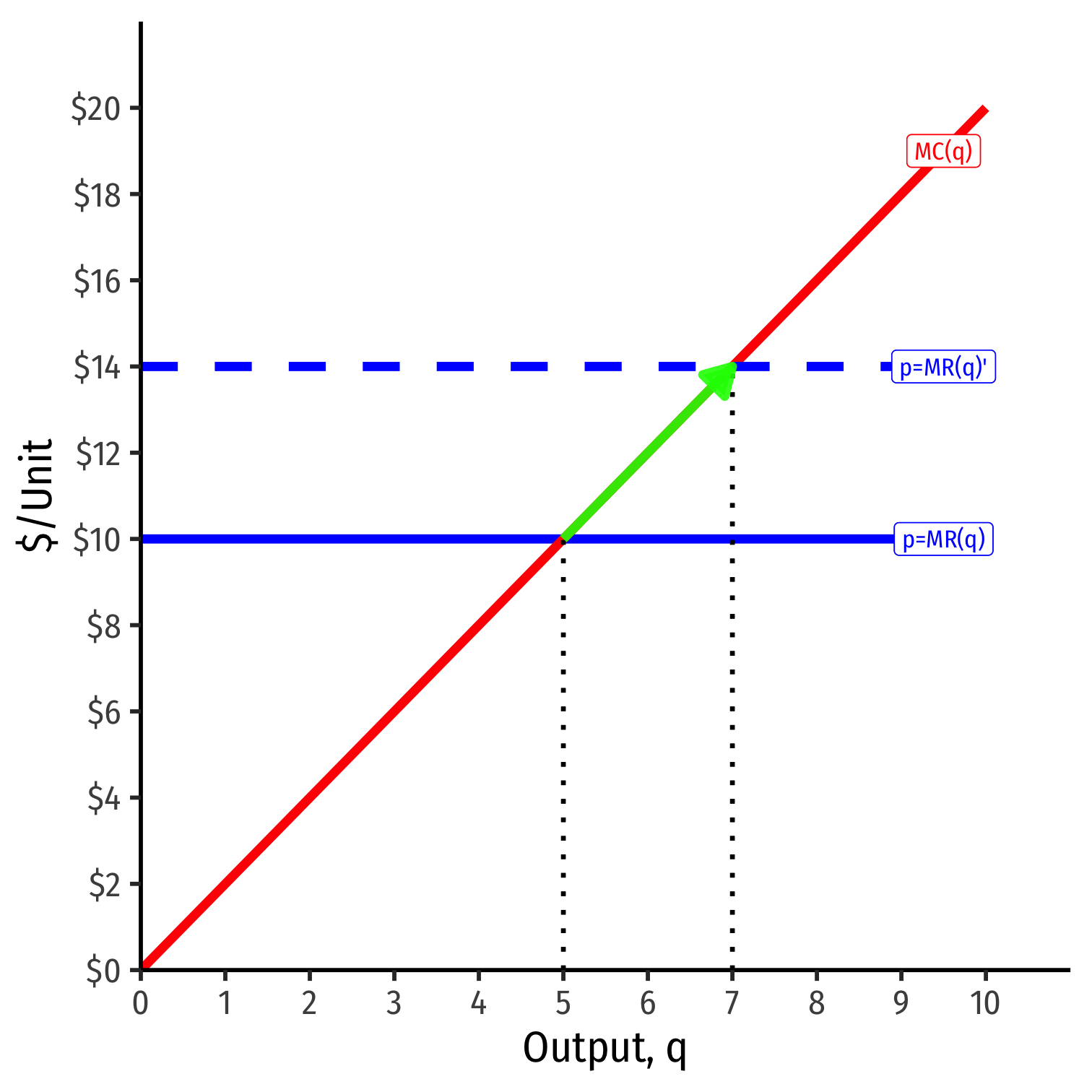

Comparative Statics

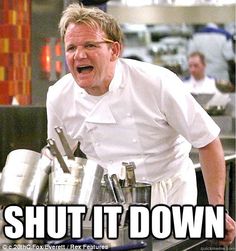

If Market Price Changes I

Suppose the market price increases

Firm (always setting MR=MC) will respond by producing more

If Market Price Changes II

Suppose the market price decreases

Firm (always setting MR=MC) will respond by producing less

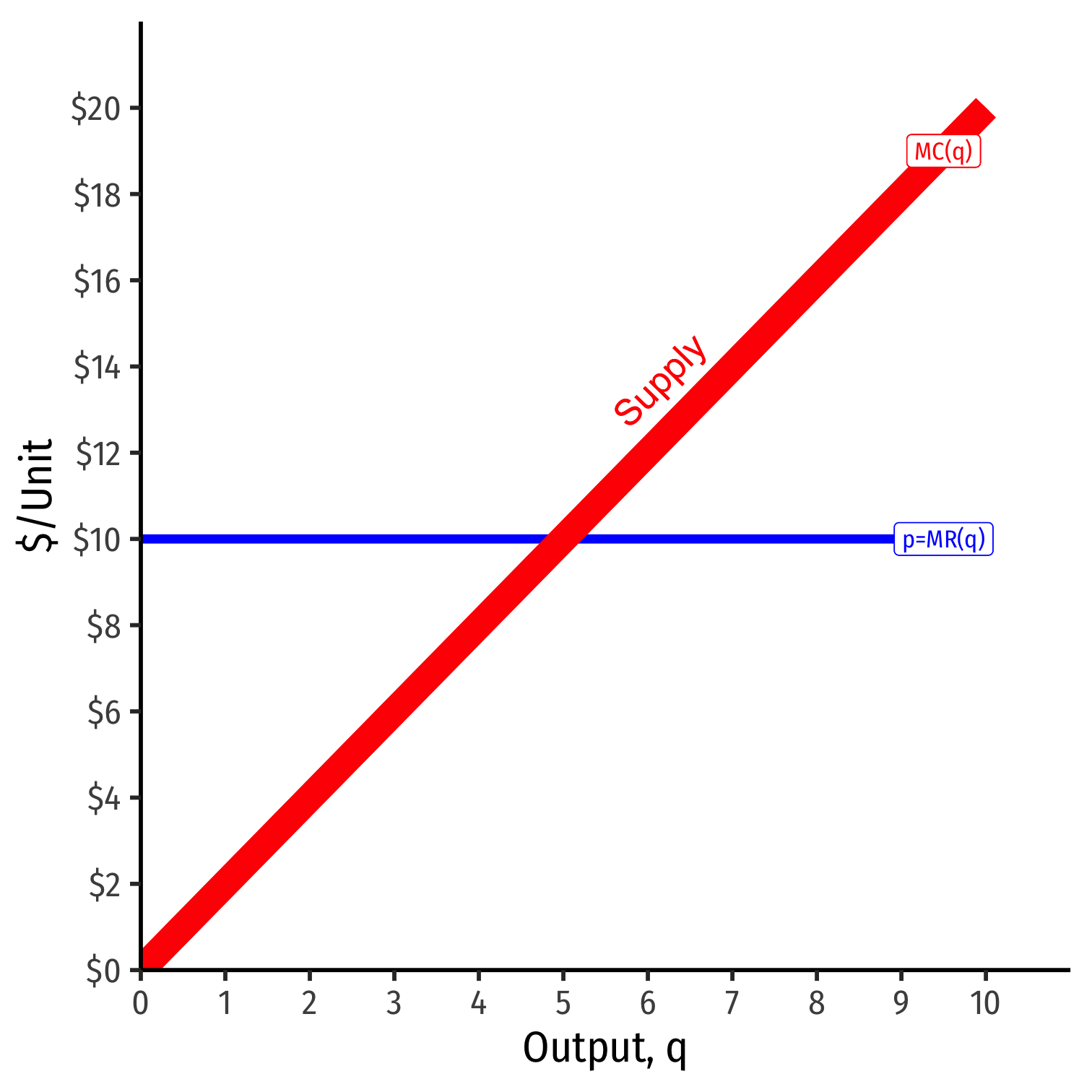

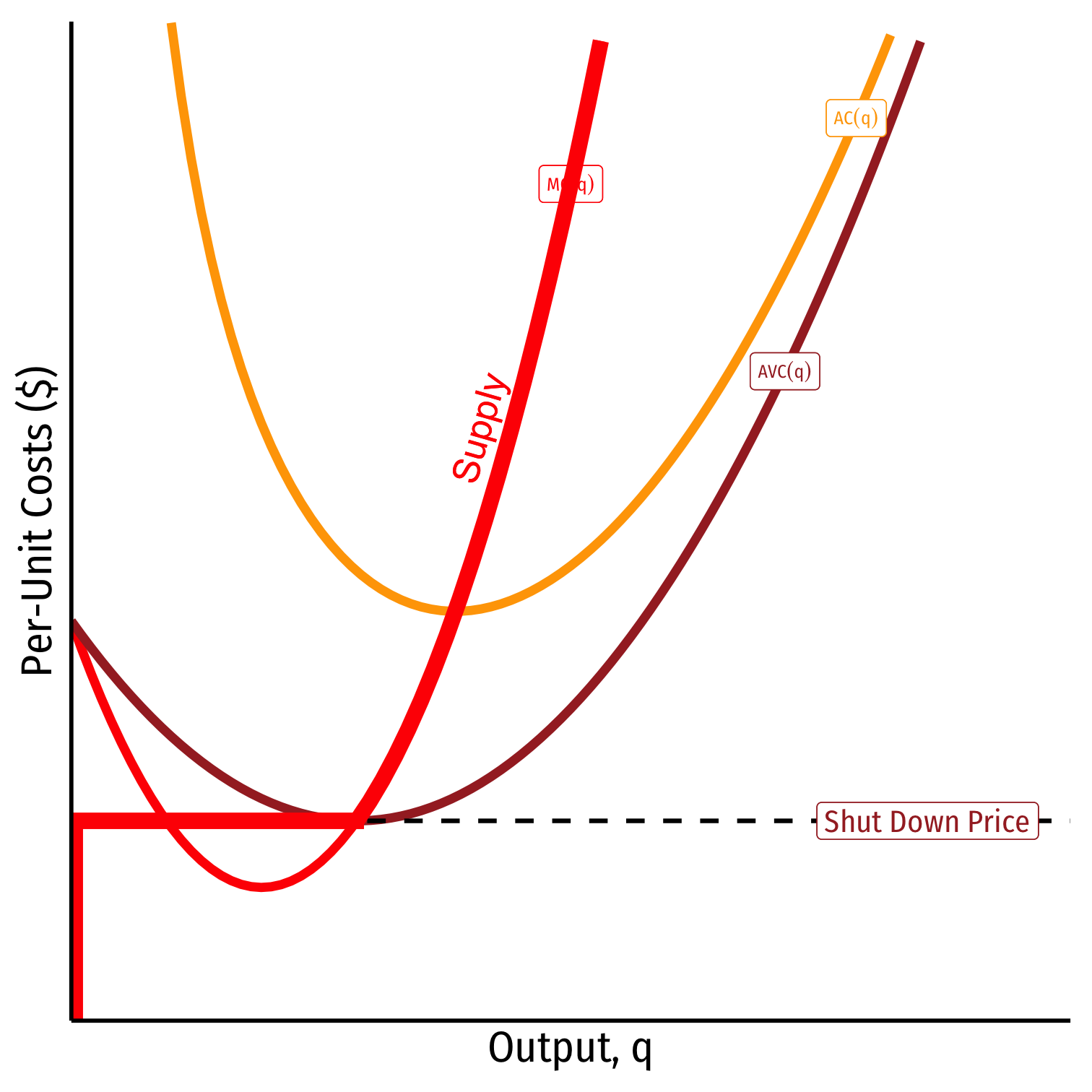

The Firm’s Supply Curve

- The firm’s marginal cost curve is its supply curve‡

p=MC(q)

- How it will supply the optimal amount of output in response to the market price

- Firm always sets its price equal to its marginal cost

‡ Mostly...there is an important exception we will see shortly!

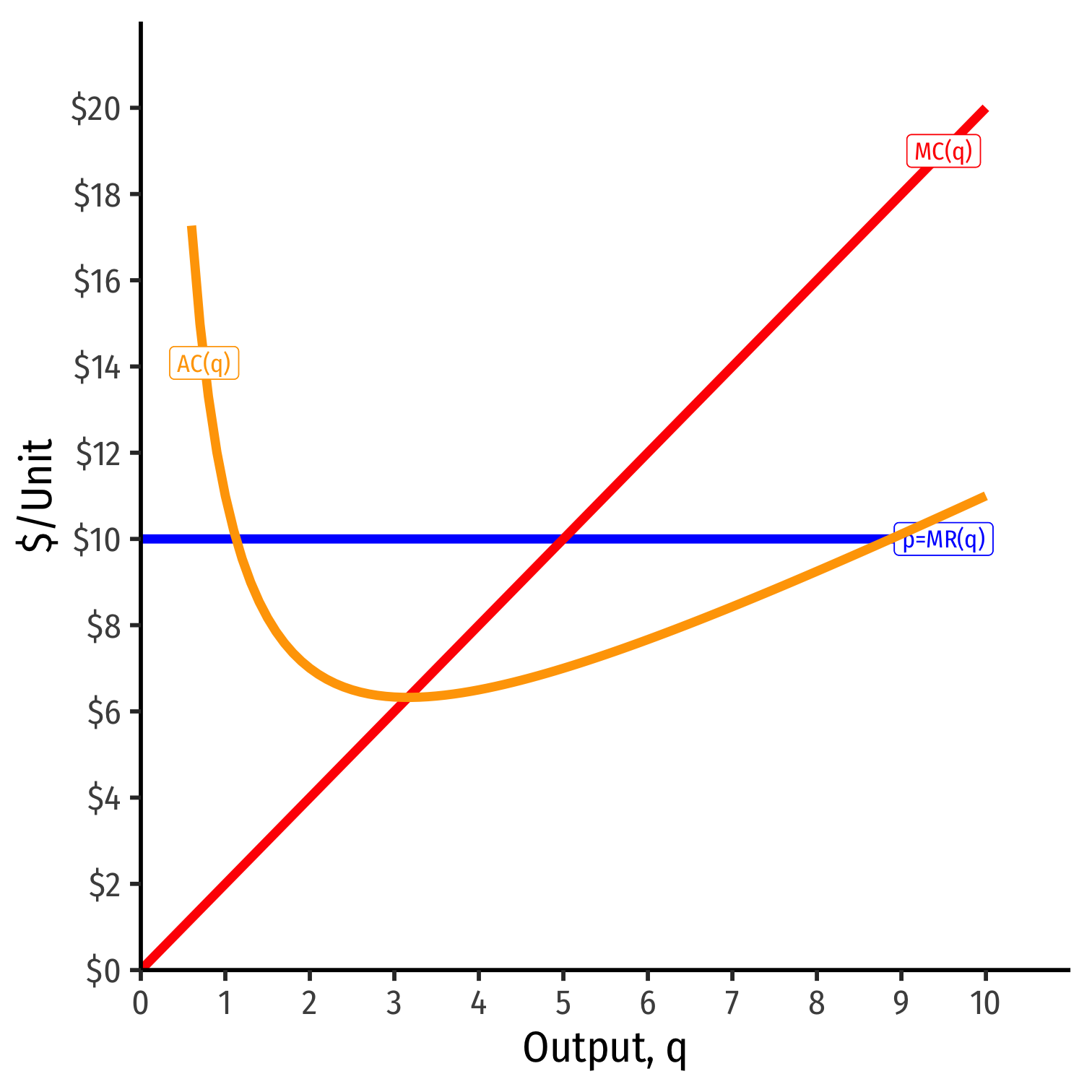

Calculating Profit

Calculating (Average) Profit as AR(q)-AC(q)

- Profit is π(q)=R(q)−C(q)

Calculating (Average) Profit as AR(q)-AC(q)

Profit is π(q)=R(q)−C(q)

Profit per unit can be calculated as: π(q)q=AR(q)−AC(q)=p−AC(q)

Calculating (Average) Profit as AR(q)-AC(q)

Profit is π(q)=R(q)−C(q)

Profit per unit can be calculated as: π(q)q=AR(q)−AC(q)=p−AC(q)

Multiply by q to get total profit: π(q)=q[p−AC(q)]

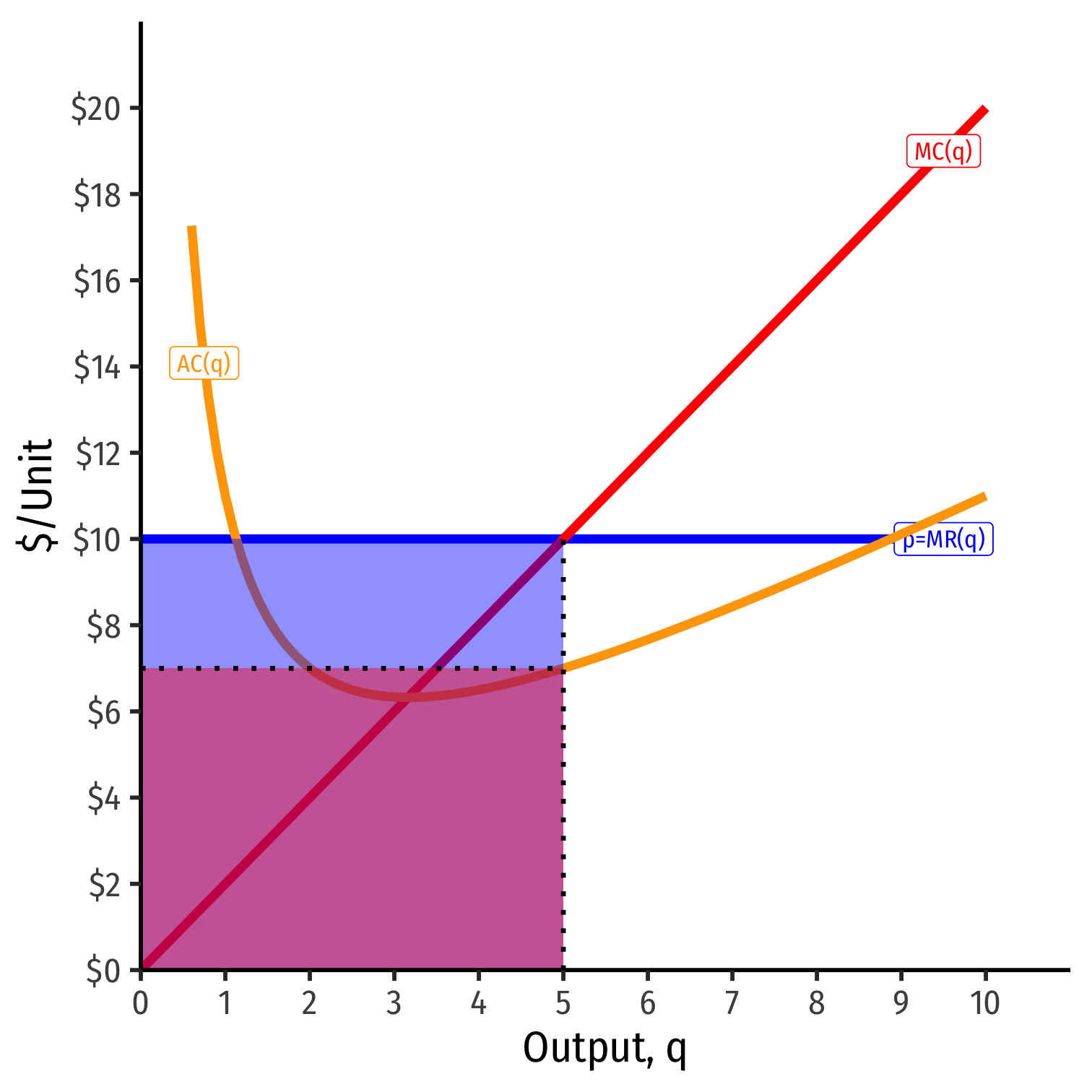

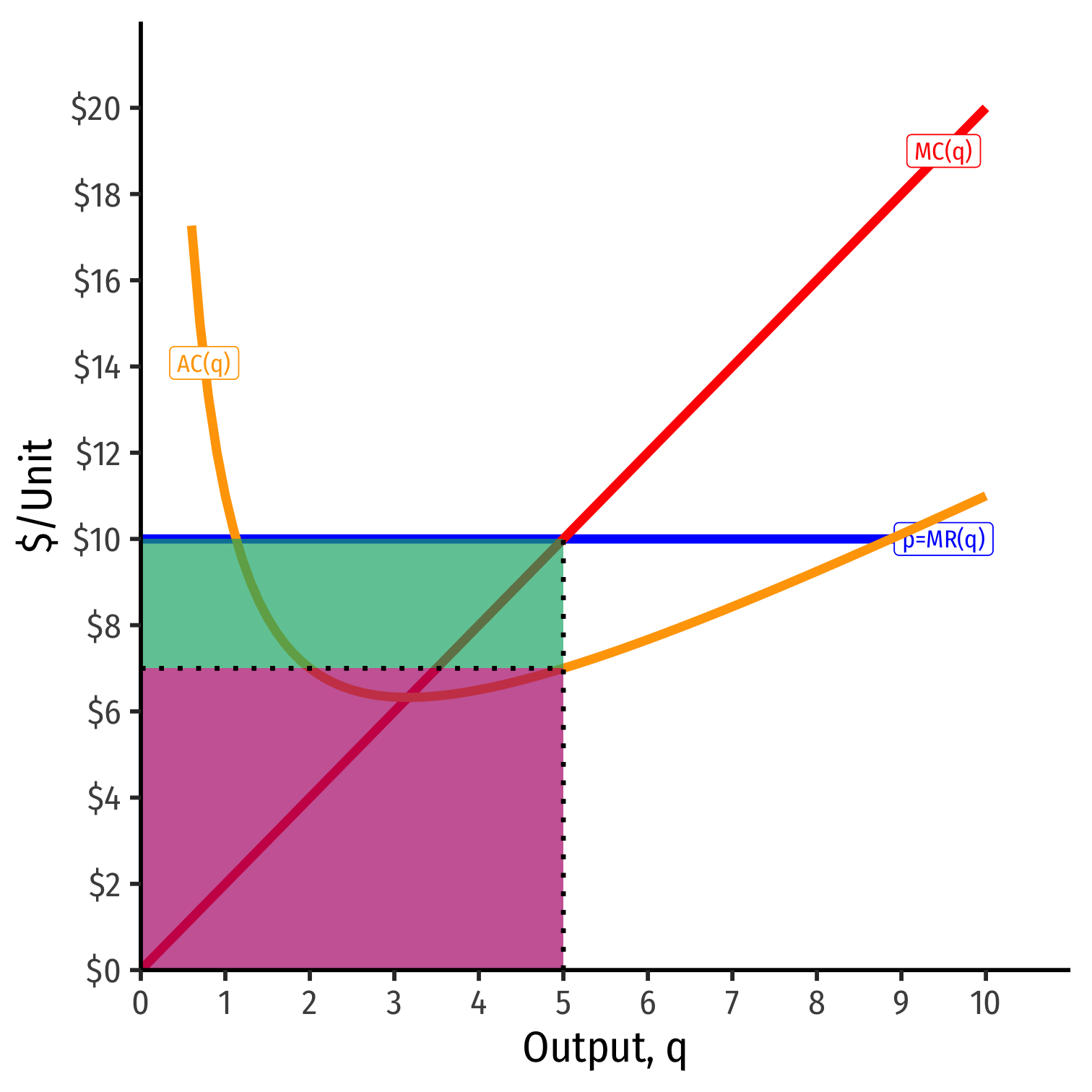

Calculating (Average) Profit as AR(q)-AC(q)

At market price of p* = $10

At q* = 5 (per unit):

At q* = 5 (totals):

Calculating (Average) Profit as AR(q)-AC(q)

At market price of p* = $10

At q* = 5 (per unit):

- AR(5) = $10/unit

At q* = 5 (totals):

- R(5) = $50

Calculating (Average) Profit as AR(q)-AC(q)

At market price of p* = $10

At q* = 5 (per unit):

- AR(5) = $10/unit

- AC(5) = $7/unit

At q* = 5 (totals):

- R(5) = $50

- C(5) = $35

Calculating (Average) Profit as AR(q)-AC(q)

At market price of p* = $10

At q* = 5 (per unit):

- AR(5) = $10/unit

- AC(5) = $7/unit

- Aπ(5) = $3/unit

At q* = 5 (totals):

- R(5) = $50

- C(5) = $35

- π = $15

Calculating (Average) Profit as AR(q)-AC(q)

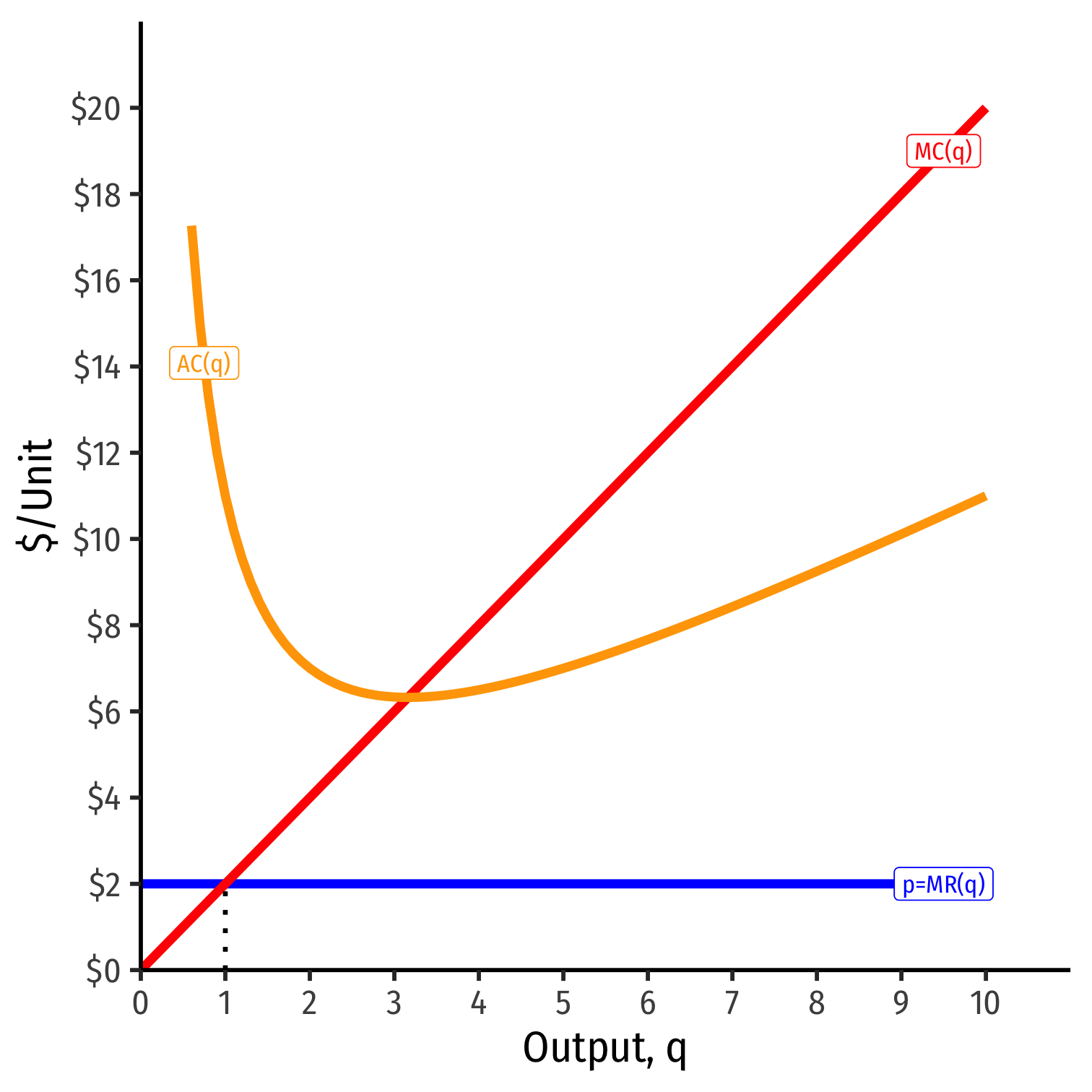

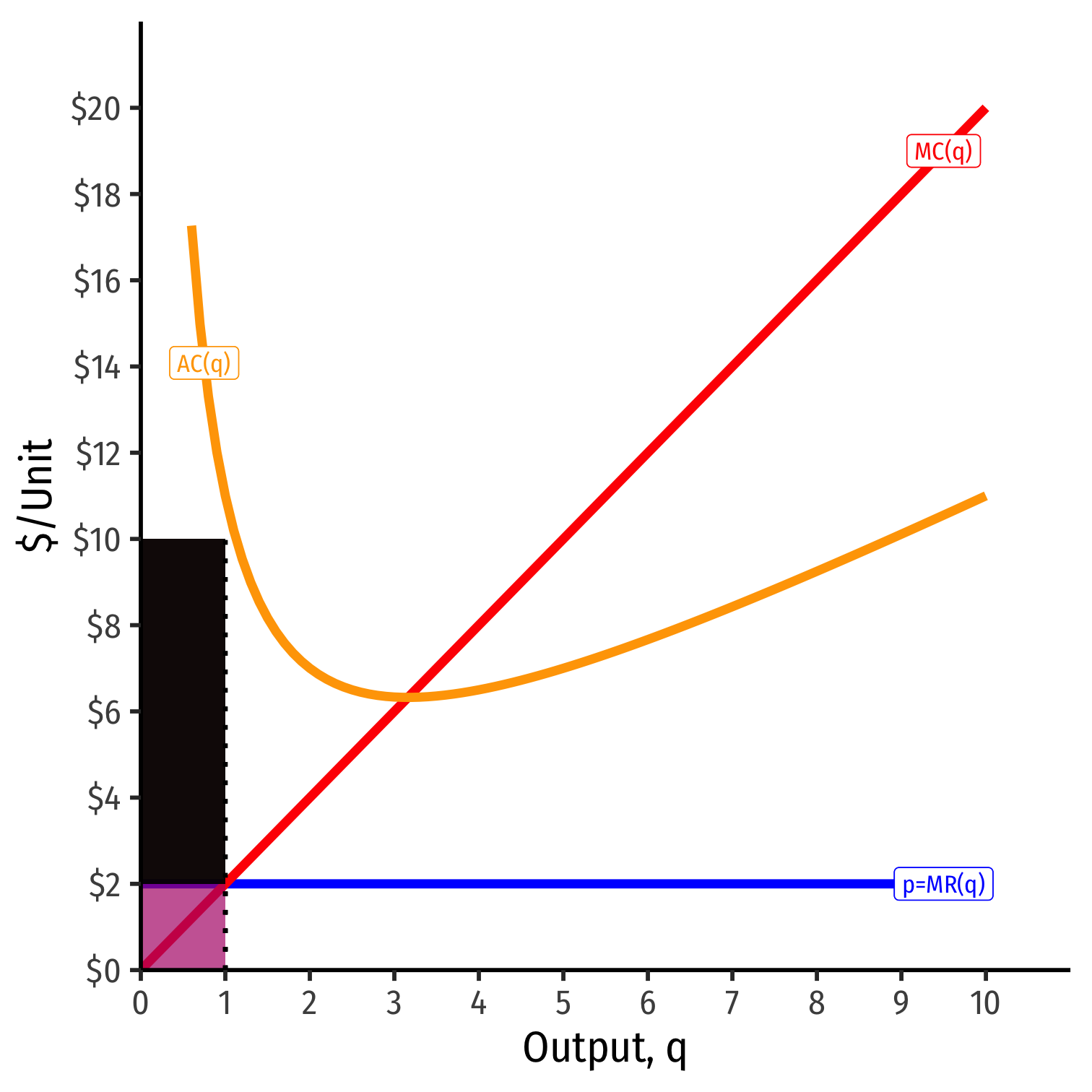

At market price of p* = $2

At q* = 1 (per unit):

At q* = 1 (totals):

Calculating (Average) Profit as AR(q)-AC(q)

At market price of p* = $2

At q* = 1 (per unit):

- AR(1) = $2/unit

At q* = 1 (totals):

- R(1) = $2

Calculating (Average) Profit as AR(q)-AC(q)

At market price of p* = $2

At q* = 1 (per unit):

- AR(1) = $2/unit

- AC(1) = $10/unit

At q* = 1 (totals):

- R(1) = $2

- C(1) = $10

Calculating (Average) Profit as AR(q)-AC(q)

At market price of p* = $2

At q* = 1 (per unit):

- AR(1) = $2/unit

- AC(1) = $10/unit

- Aπ(1) = -$8/unit

At q* = 1 (totals):

- R(1) = $2

- C(1) = $10

- π(1) = -$8

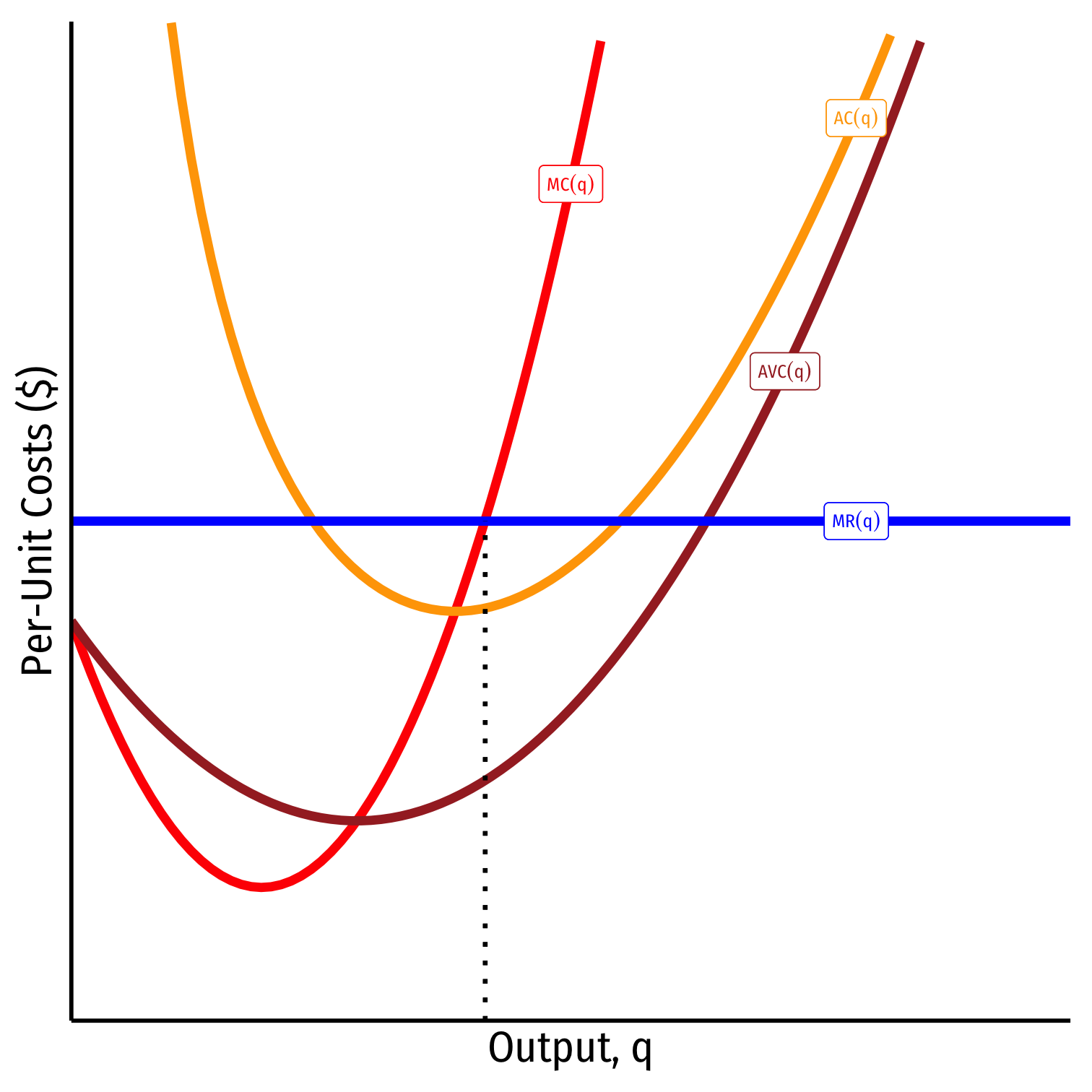

Short-Run Shut-Down Decisions

Short-Run Shut-Down Decisions

What if a firm's profits at q∗ are negative (i.e. it earns losses)?

Should it produce at all?

Short-Run Shut-Down Decisions

Suppose firm chooses to produce nothing (q=0):

If it has fixed costs (f>0), its profits are:

π(q)=pq−C(q)

Short-Run Shut-Down Decisions

Suppose firm chooses to produce nothing (q=0):

If it has fixed costs (f>0), its profits are:

π(q)=pq−C(q)π(q)=pq−f−VC(q)

Short-Run Shut-Down Decisions

Suppose firm chooses to produce nothing (q=0):

If it has fixed costs (f>0), its profits are:

π(q)=pq−C(q)π(q)=pq−f−VC(q)π(0)=−f

i.e. it (still) pays its fixed costs

Short-Run Shut-Down Decisions

- A firm should choose to produce no output (q=0) only when:

π from producing<π from not producing

Short-Run Shut-Down Decisions

- A firm should choose to produce no output (q=0) only when:

π from producing<π from not producingπ(q)<−f

Short-Run Shut-Down Decisions

- A firm should choose to produce no output (q=0) only when:

π from producing<π from not producingπ(q)<−fpq−VC(q)−f<−f

Short-Run Shut-Down Decisions

- A firm should choose to produce no output (q=0) only when:

π from producing<π from not producingπ(q)<−fpq−VC(q)−f<−fpq−VC(q)<0

Short-Run Shut-Down Decisions

- A firm should choose to produce no output (q=0) only when:

π from producing<π from not producingπ(q)<−fpq−VC(q)−f<−fpq−VC(q)<0pq<VC(q)

Short-Run Shut-Down Decisions

- A firm should choose to produce no output (q=0) only when:

π from producing<π from not producingπ(q)<−fpq−VC(q)−f<−fpq−VC(q)<0pq<VC(q)p<AVC(q)

- Shut down price: firm will shut down production in the short run when p<AVC(q)

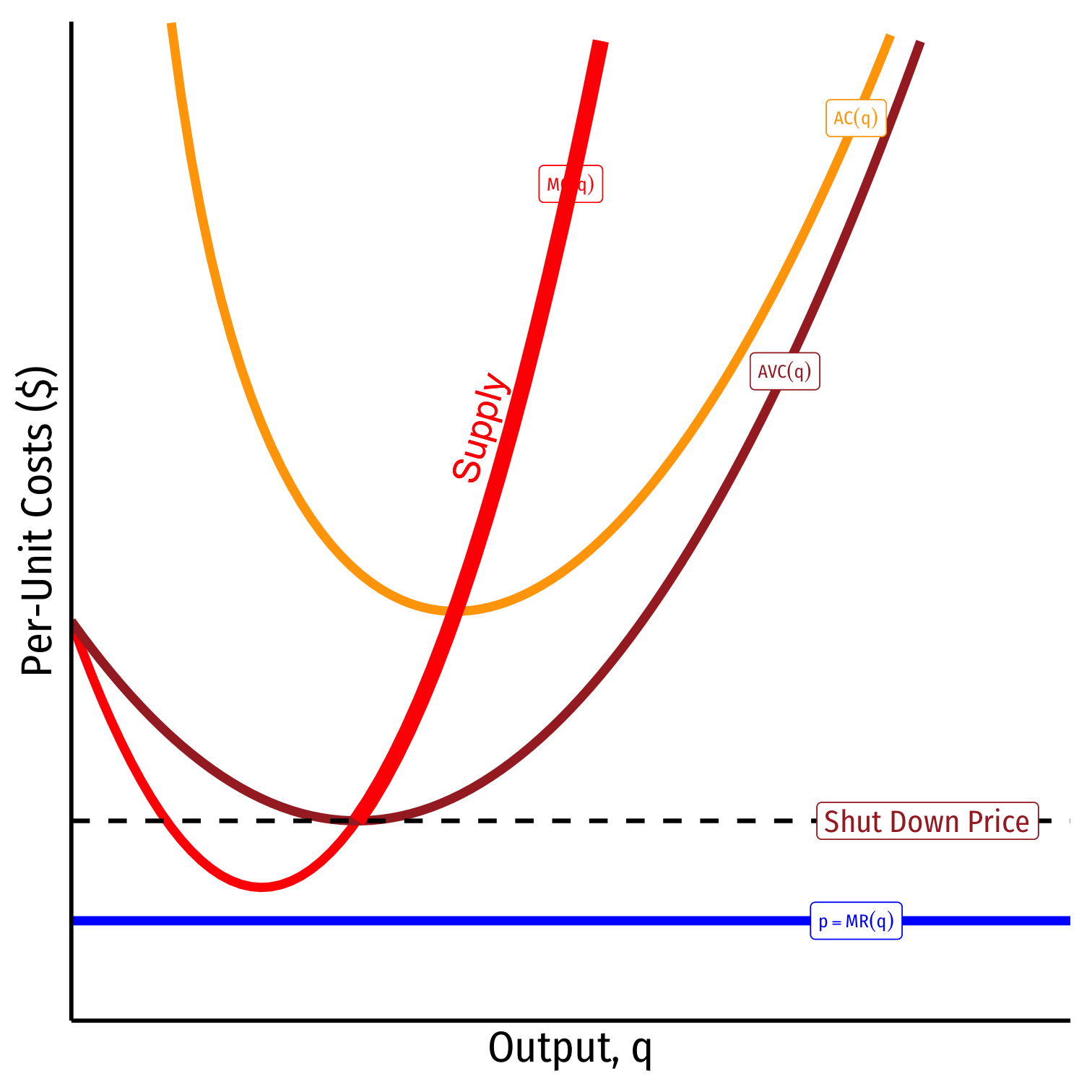

The Firm’s Short Run Supply Decision

The Firm’s Short Run Supply Decision

The Firm's Short Run Supply Decision

The Firm's Short Run Supply Decision

The Firm's Short Run Supply Decision

The Firm's Short Run Supply Decision

The Firm's Short Run Supply Decision

Firm’s short run supply curve:

The Firm's Short Run Supply Decision

Firm’s short run supply curve:

Summary:

1. Choose q∗ such that MR(q)=MC(q)

Summary:

1. Choose q∗ such that MR(q)=MC(q)

2. Profit π=q[p−AC(q)]

Summary:

1. Choose q∗ such that MR(q)=MC(q)

2. Profit π=q[p−AC(q)]

3. Shut down if p<AVC(q)

Summary:

1. Choose q∗ such that MR(q)=MC(q)

2. Profit π=q[p−AC(q)]

3. Shut down if p<AVC(q)

Firm's short run (inverse) supply:

{p=MC(q)if p≥AVCq=0If p<AVC