1.4 — Perfect Competition II

ECON 326 • Industrial Organization • Spring 2023

Ryan Safner

Associate Professor of Economics

safner@hood.edu

ryansafner/ioS23

ioS23.classes.ryansafner.com

Firm's Long Run Supply Decisions

Firm Decisions in the Long Run I

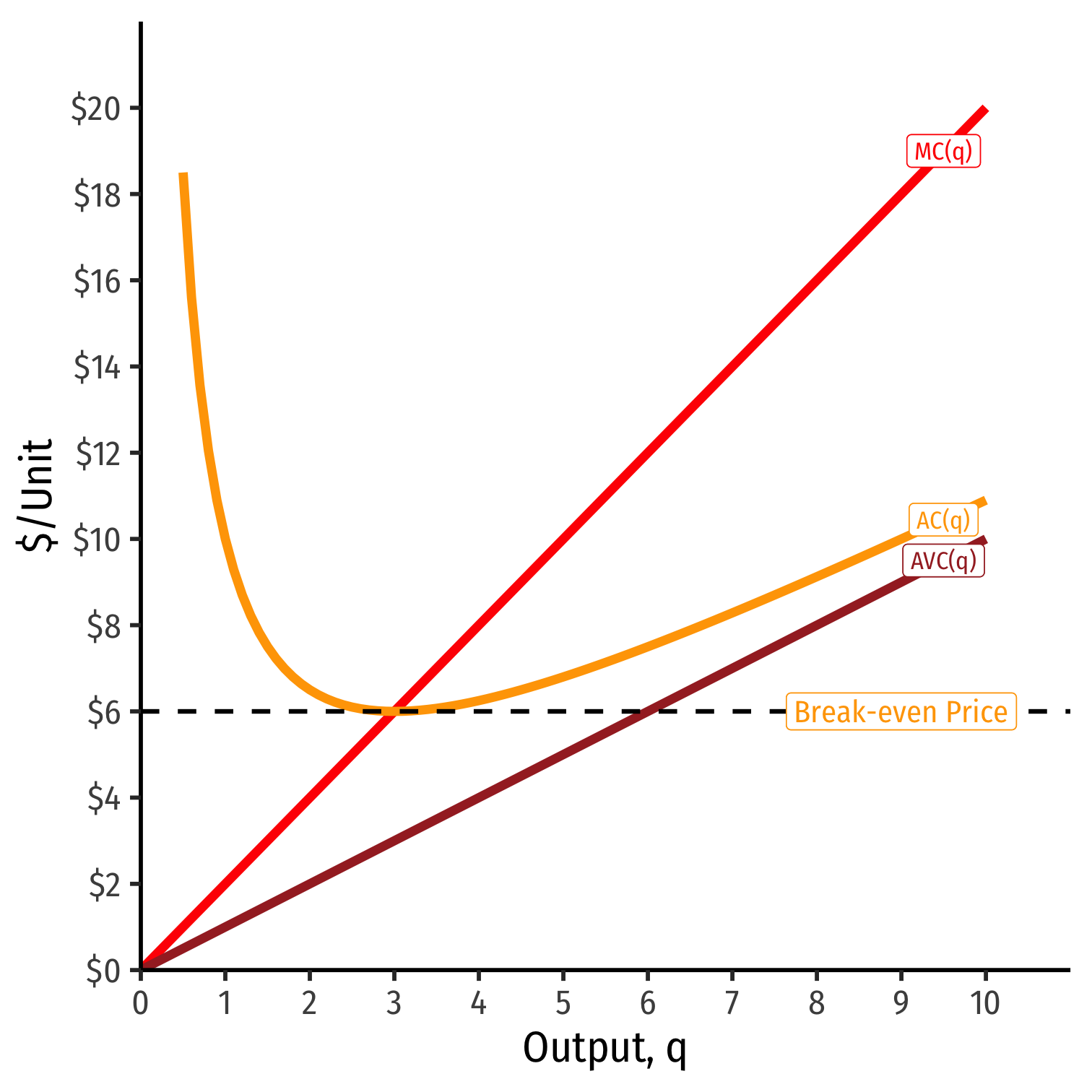

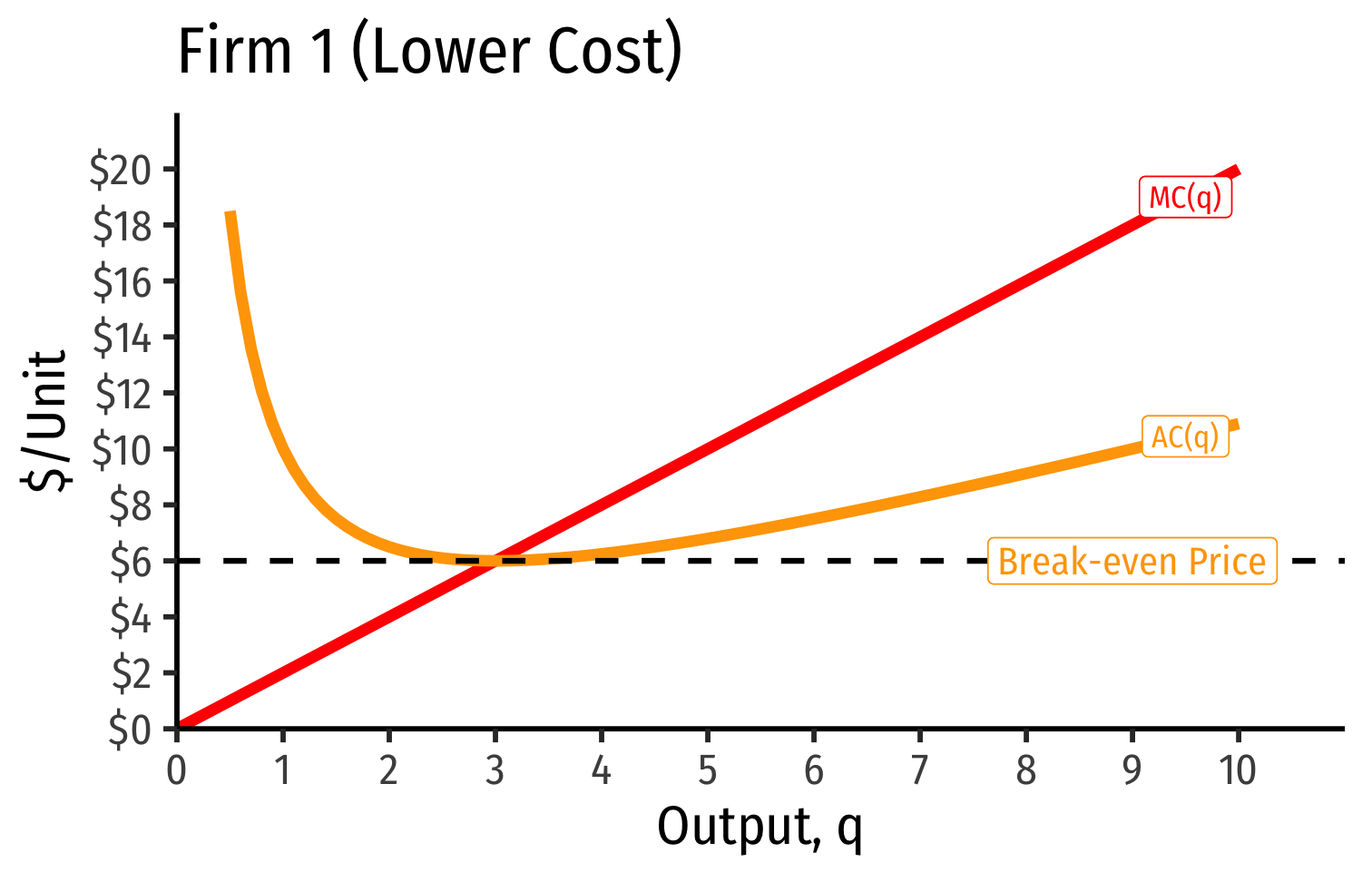

AC(q)min at a market price of $6

- Firm earns “normal” economic profits

At any market price below $6.00, firm earns losses

- Short Run: firm shuts down if p<AVC(q)

At any market price above $6.00, firm earns “supernormal” profits (>0)

Firm Supply Decisions in the Short Run vs. Long Run

- Short run: firms that shut down (q∗=0) stuck in market, incur fixed costs π=−f

Firm Supply Decisions in the Short Run vs. Long Run

Short run: firms that shut down (q∗=0) stuck in market, incur fixed costs π=−f

Long run: firms earning losses (π<0) can exit the market and earn π=0

- No more fixed costs, firms can sell/abandon f at q∗=0

Firm Supply Decisions in the Short Run vs. Long Run

Short run: firms that shut down (q∗=0) stuck in market, incur fixed costs π=−f

Long run: firms earning losses (π<0) can exit the market and earn π=0

- No more fixed costs, firms can sell/abandon f at q∗=0

Entrepreneurs not currently in market can enter and produce, if entry would earn them π>0

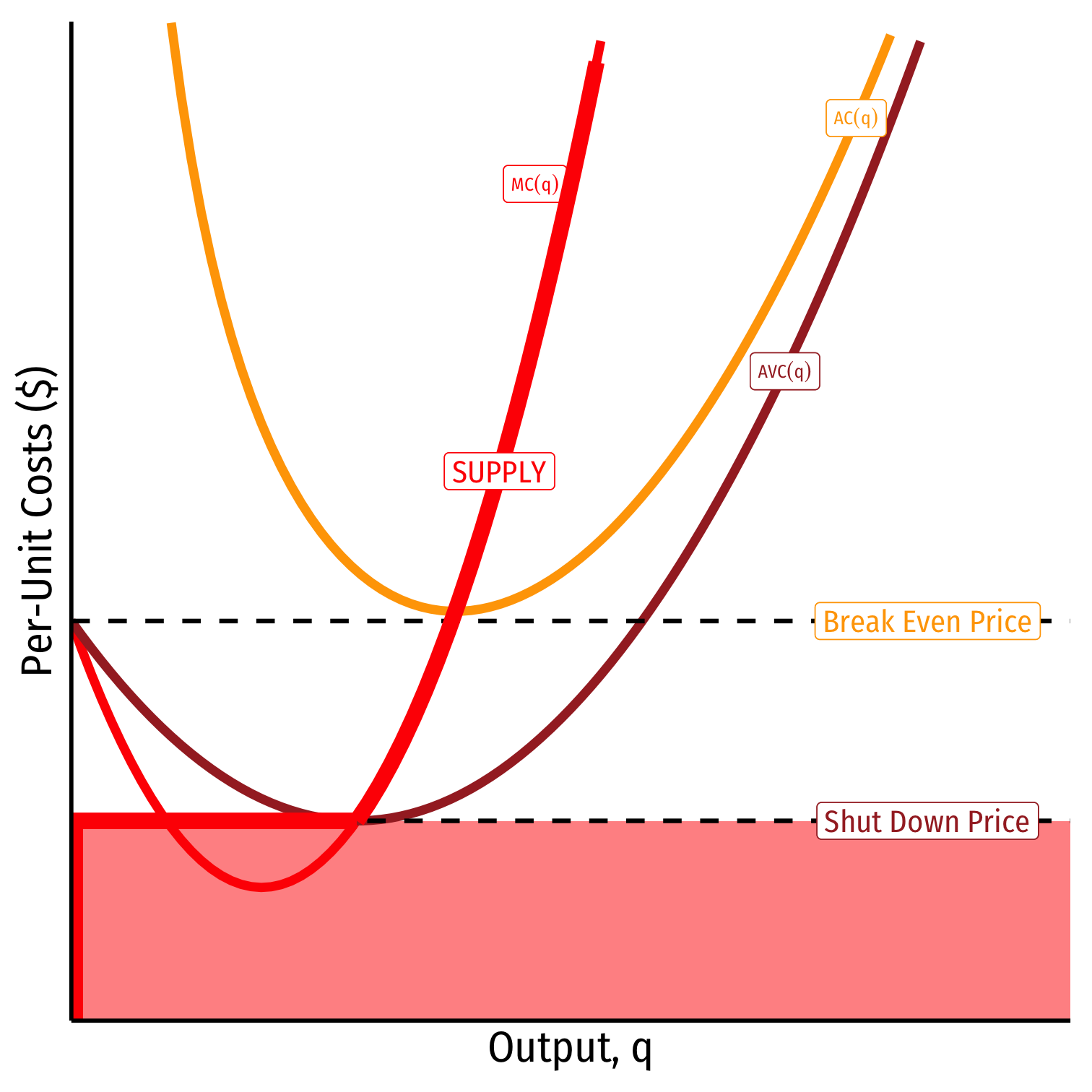

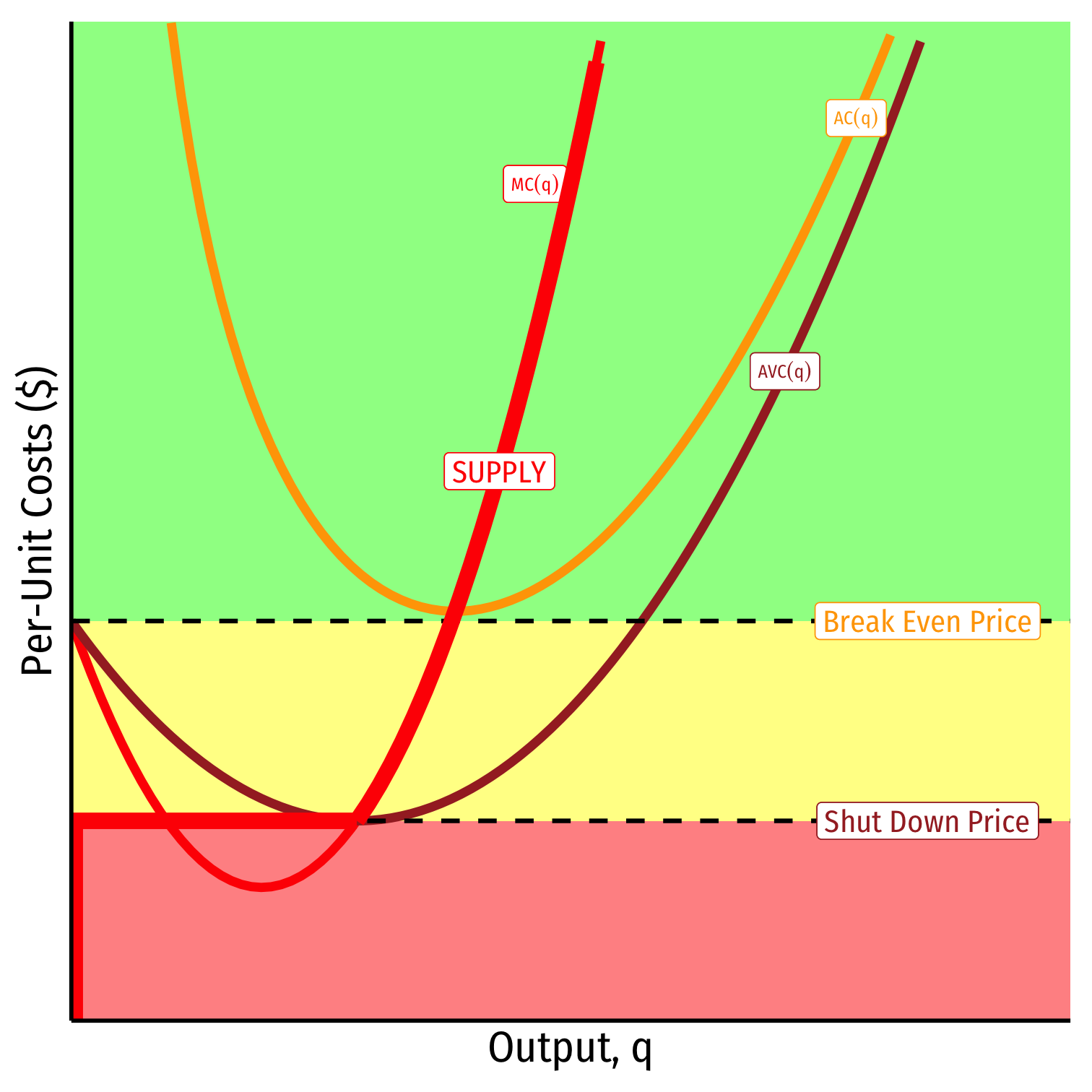

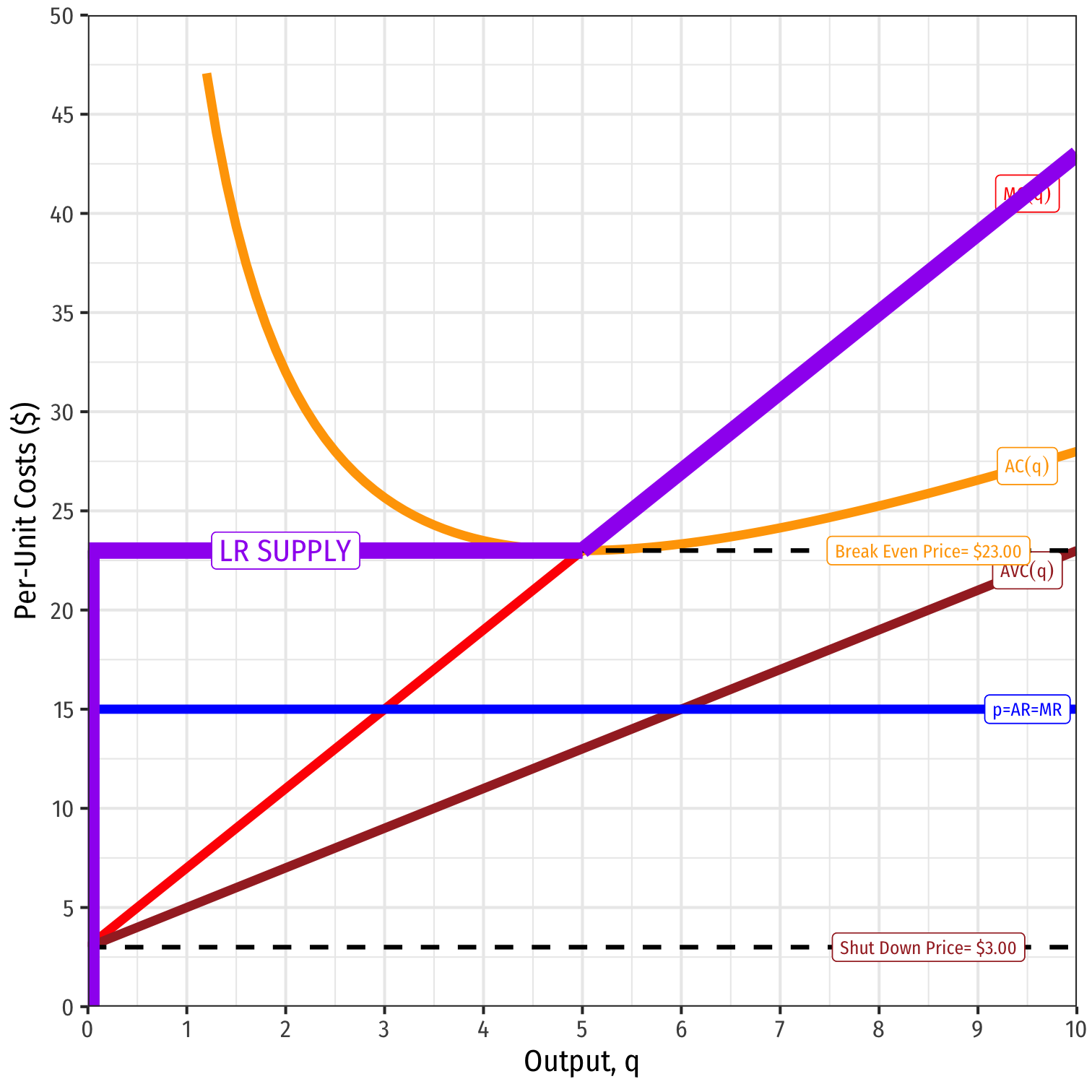

Firm's Long Run Supply: Visualizing

When p<AVC

Profits are negative

Short run: shut down production

- Firm loses more π by producing than by not producing

Long run: firms in industry exit the industry

- No new firms will enter this industry

Firm's Long Run Supply: Visualizing

When AVC<p<AC

Profits are negative

Short run: continue production

- Firm loses less π by producing than by not producing

Long run: firms in industry exit the industry

- No new firms will enter this industry

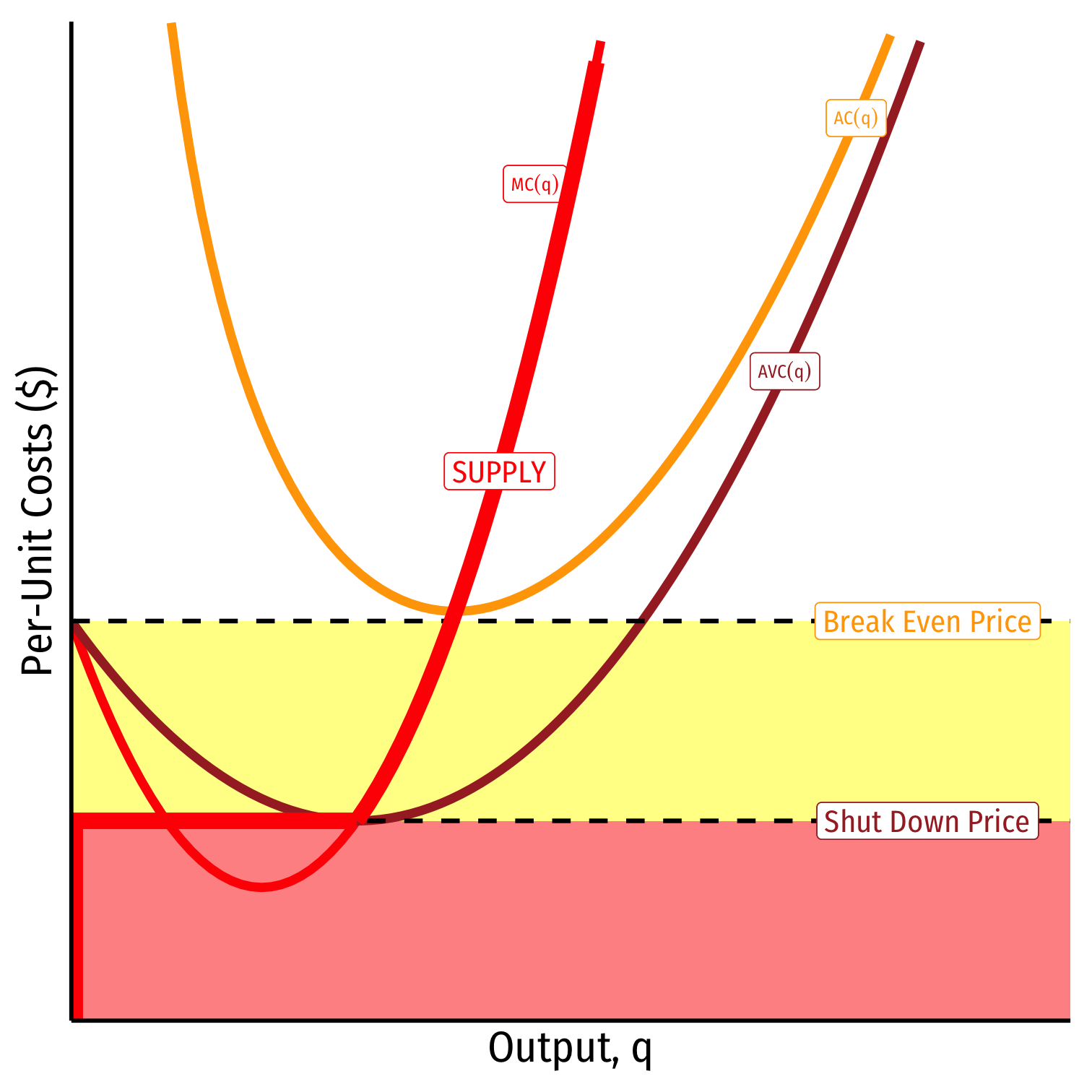

Firm's Long Run Supply: Visualizing

When AC<p

Profits are positive

Short run: continue production

- Firm earning profits

Long run: firms in industry stay in industry

- New firms will enter this industry

Profit Maximization Rules for Firms:

1. Choose q∗ such that MR(q)=MC(q)

2. Profit π=q[p−AC(q)]

3. Shut down in short run if p<AVC(q) AVC(q)min=MC(q)

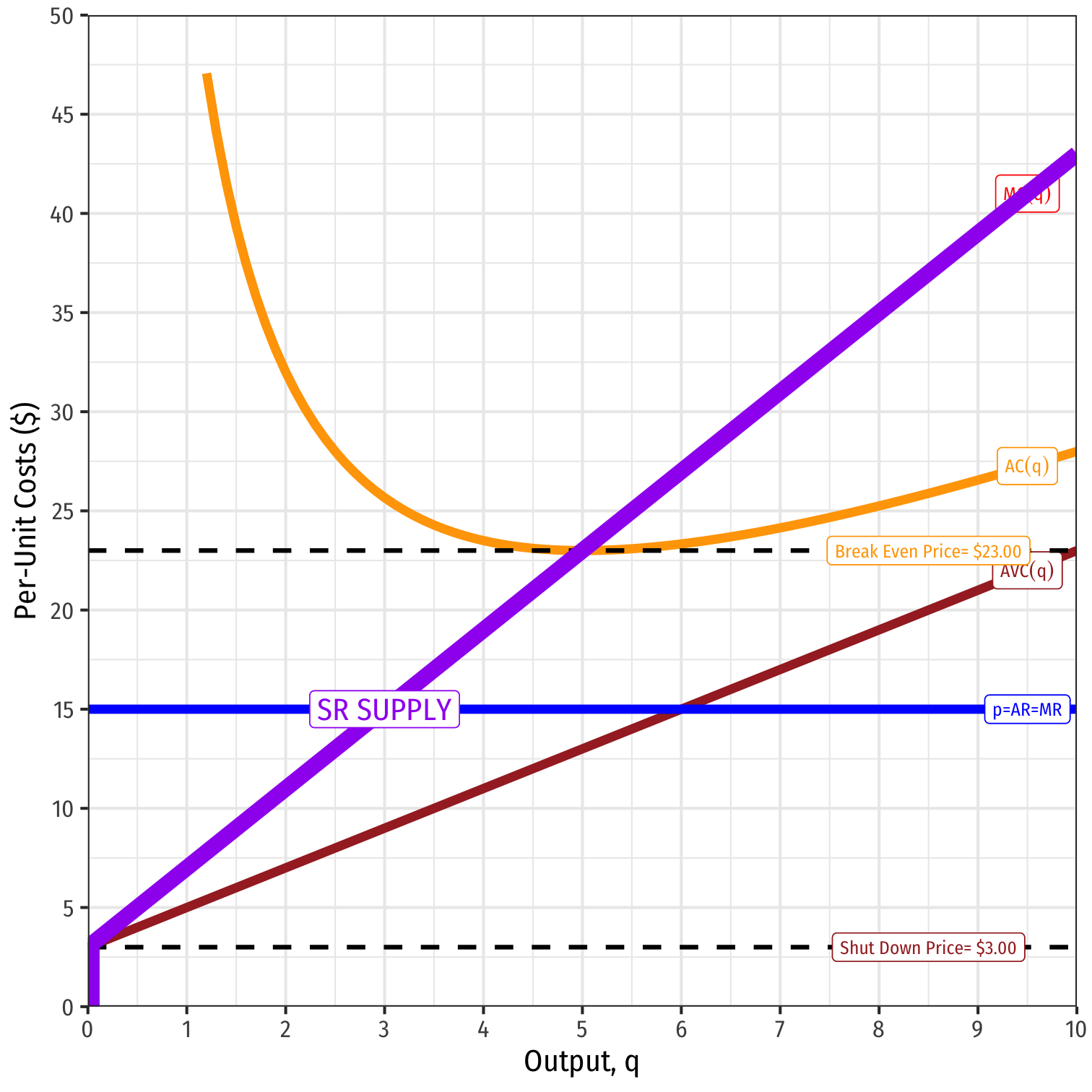

Firm’s short run supply curve:

4. Exit in long run if \\(p<AC(q)\\)

ACmin(q)=MC(q)

Firm’s long run supply curve:

Market Entry and Exit

Exit, Entry, and Long Run Industry Equilibrium I

Now we must combine optimizing individual firms with market-wide adjustment to equilibrium

Since π=[p−AC(q)]q, in the long run, profit-seeking firms will:

Exit, Entry, and Long Run Industry Equilibrium I

Now we must combine optimizing individual firms with market-wide adjustment to equilibrium

Since π=[p−AC(q)]q, in the long run, profit-seeking firms will:

- Enter markets where p>AC(q)

Exit, Entry, and Long Run Industry Equilibrium I

Now we must combine optimizing individual firms with market-wide adjustment to equilibrium

Since π=[p−AC(q)]q, in the long run, profit-seeking firms will:

- Enter markets where p>AC(q)

- Exit markets where p<AC(q)

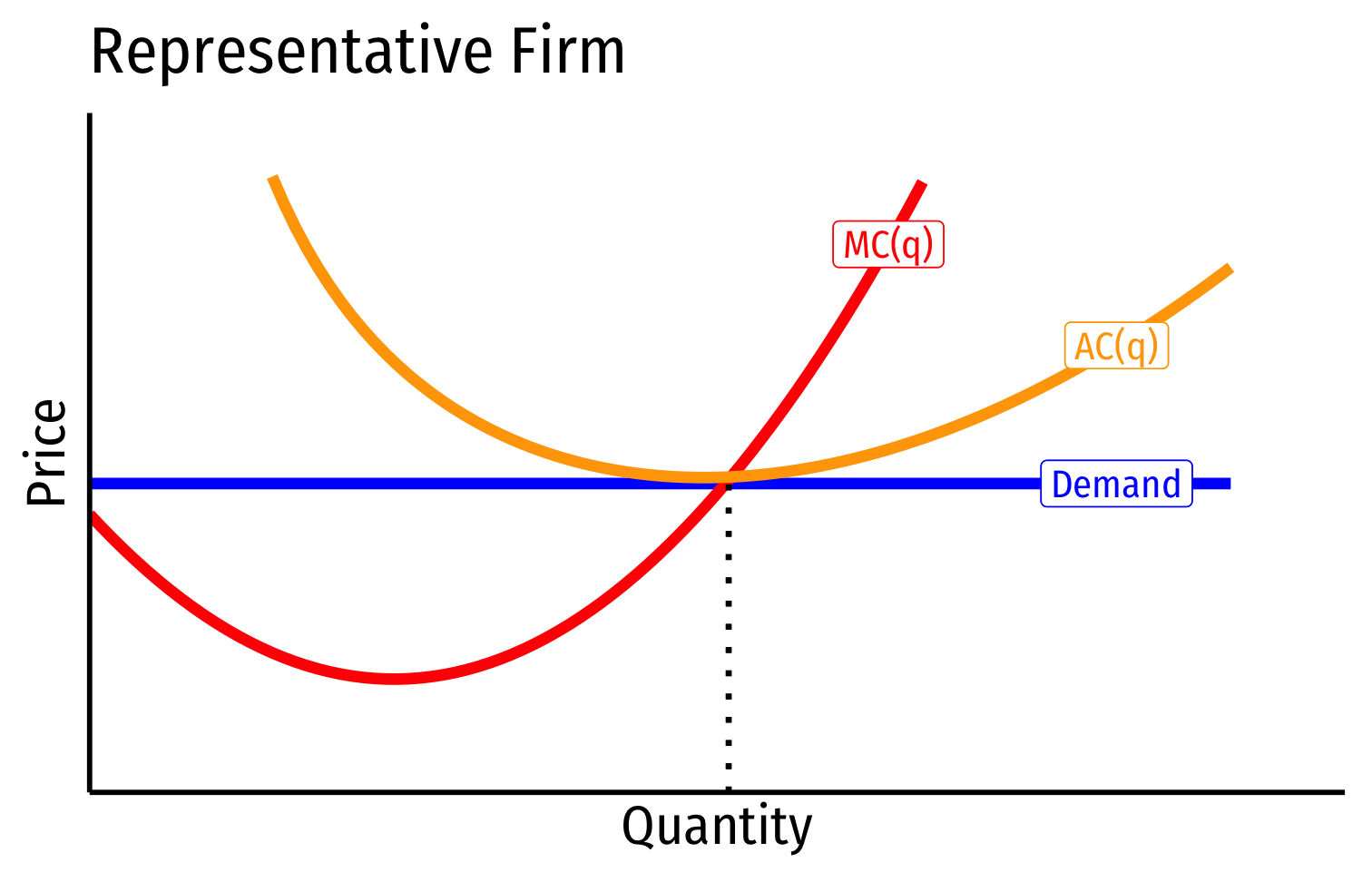

Exit, Entry, and Long Run Industry Equilibrium II

- Long-run equilibrium: entry and exit ceases when p=AC(q) for all firms, implying normal economic profits of π=0

Exit, Entry, and Long Run Industry Equilibrium II

Long-run equilibrium: entry and exit ceases when p=AC(q) for all firms, implying normal economic profits of π=0

Long run economic profits for all firms in a competitive industry are 0

Firms must earn an accounting profit to stay in business

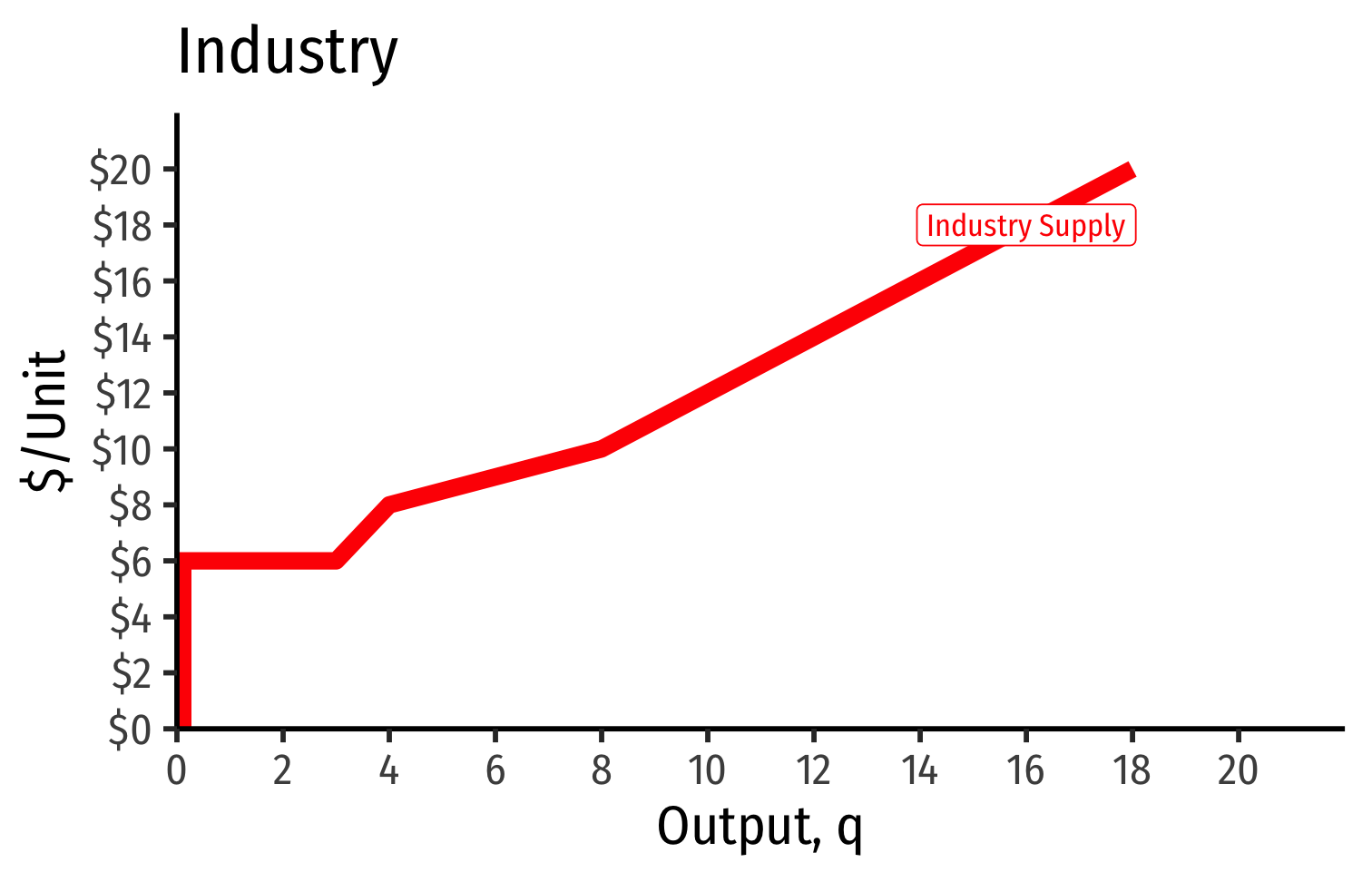

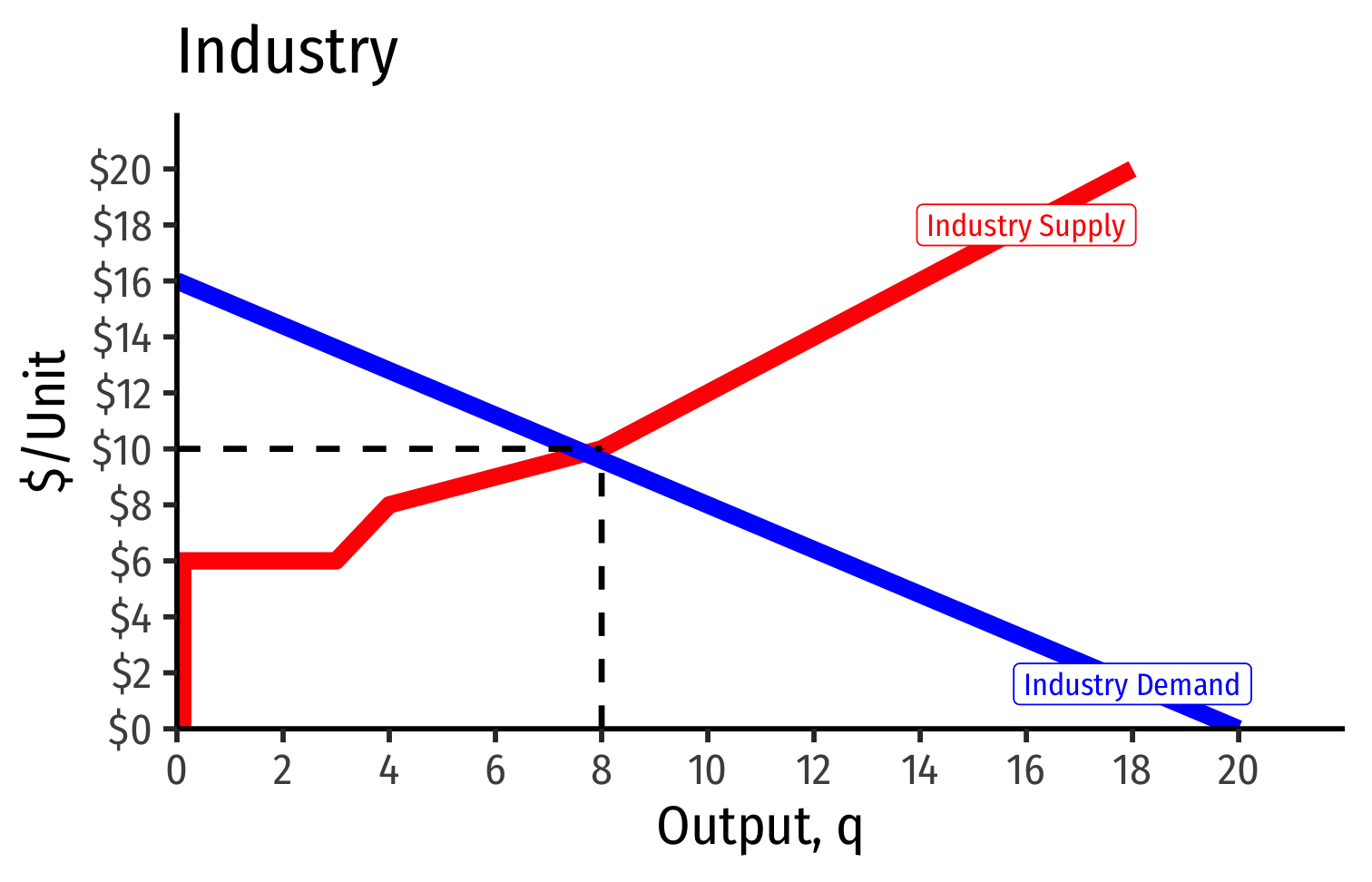

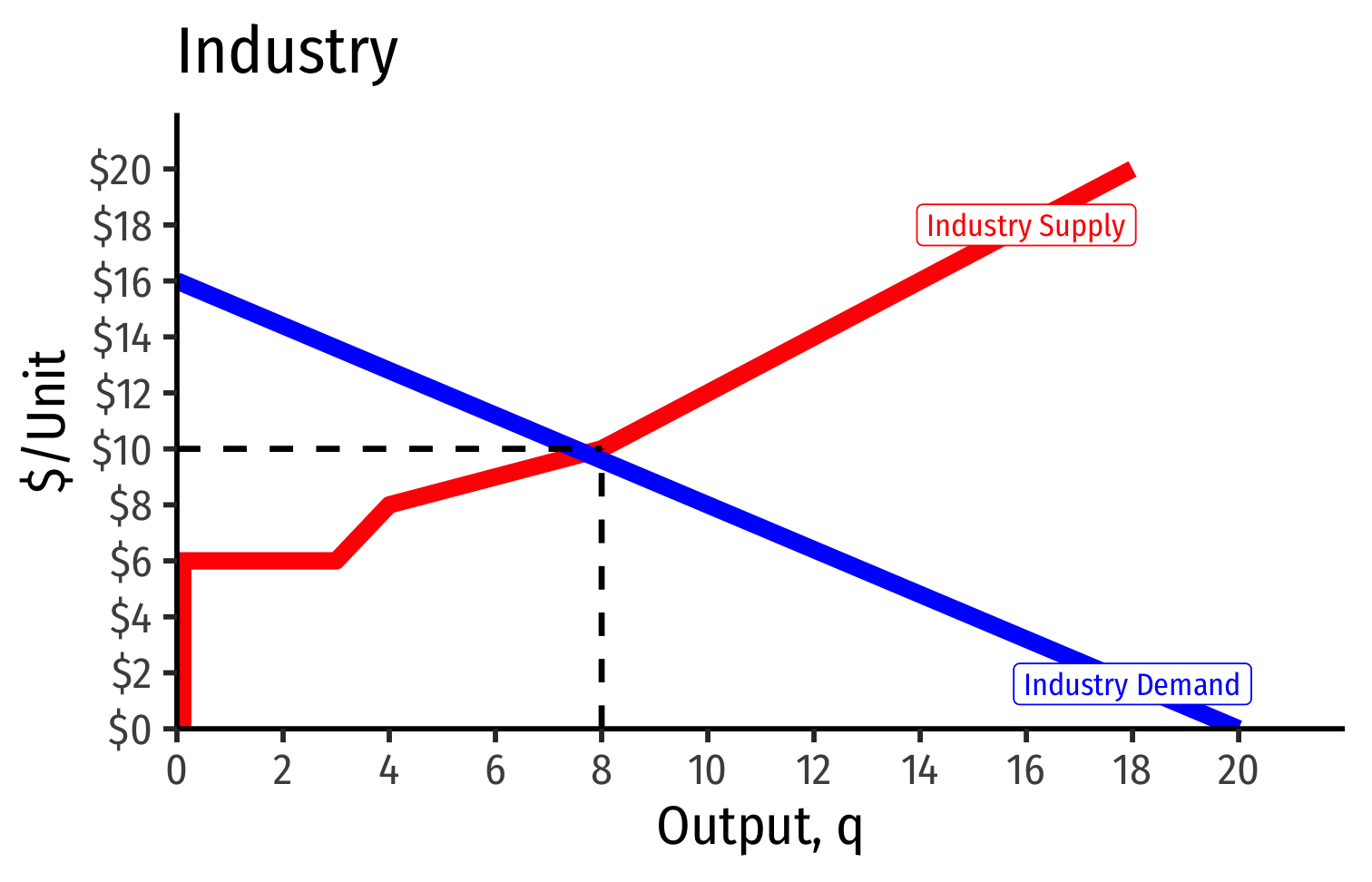

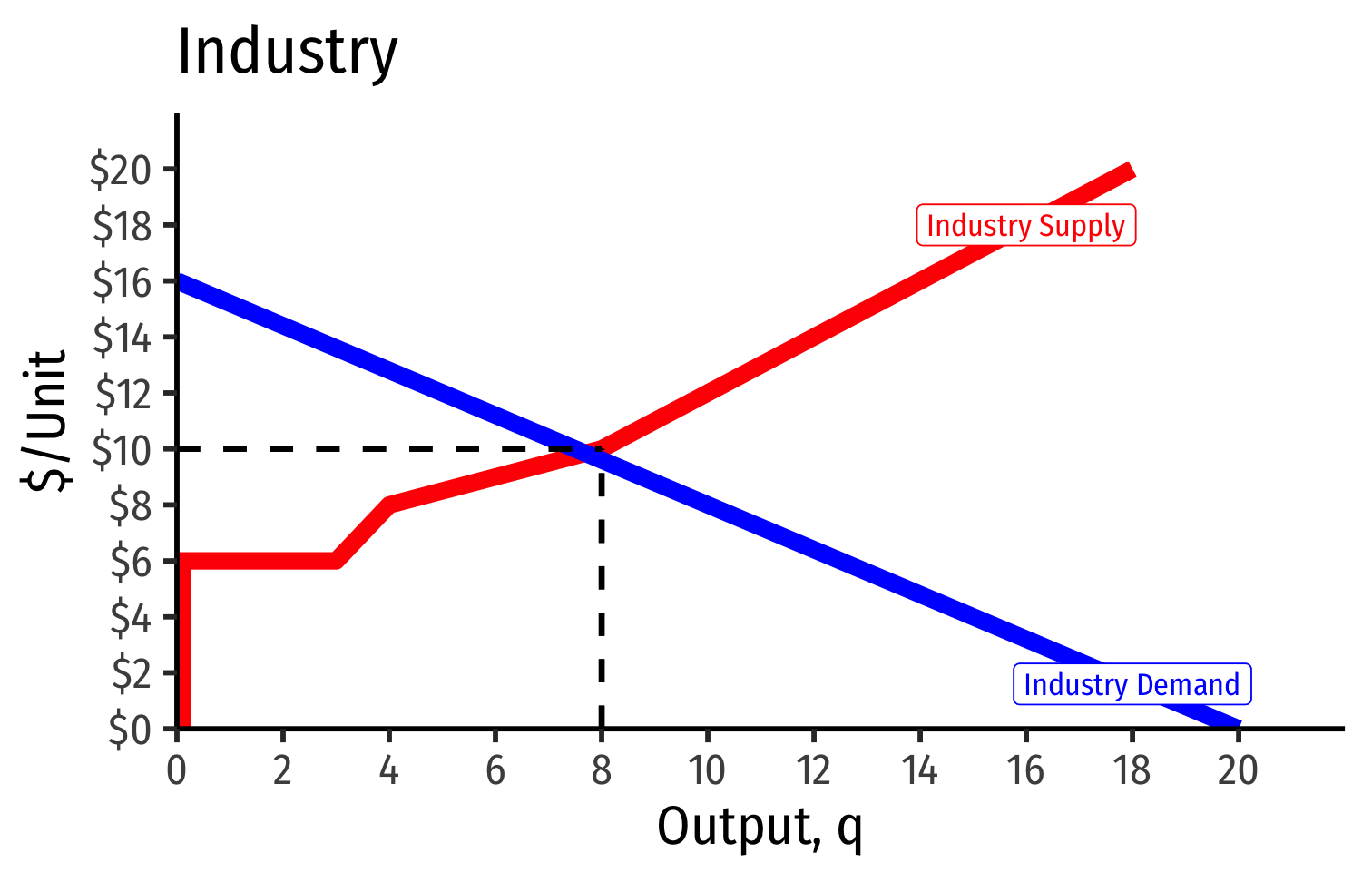

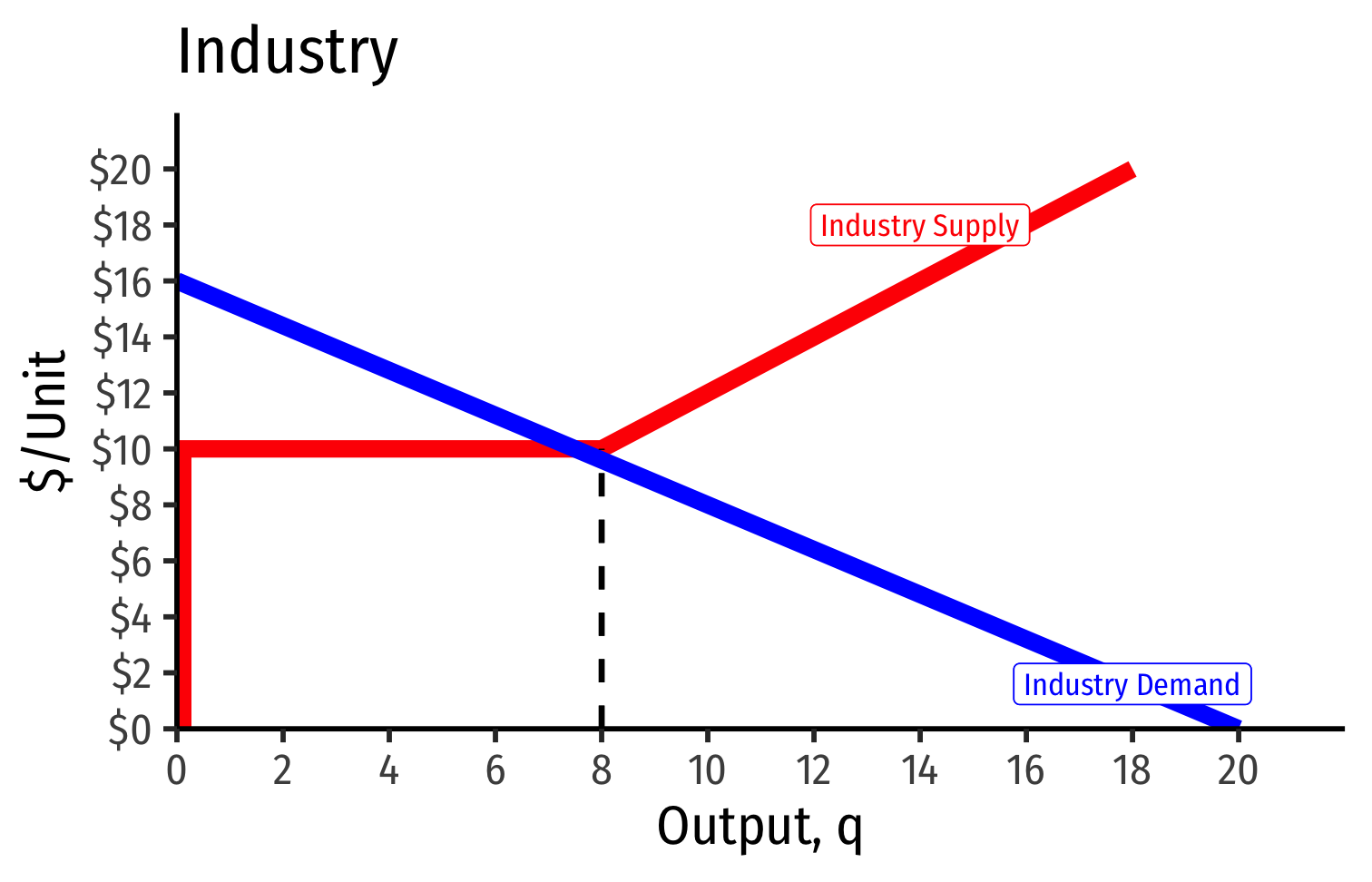

Deriving the Industry Supply Curve

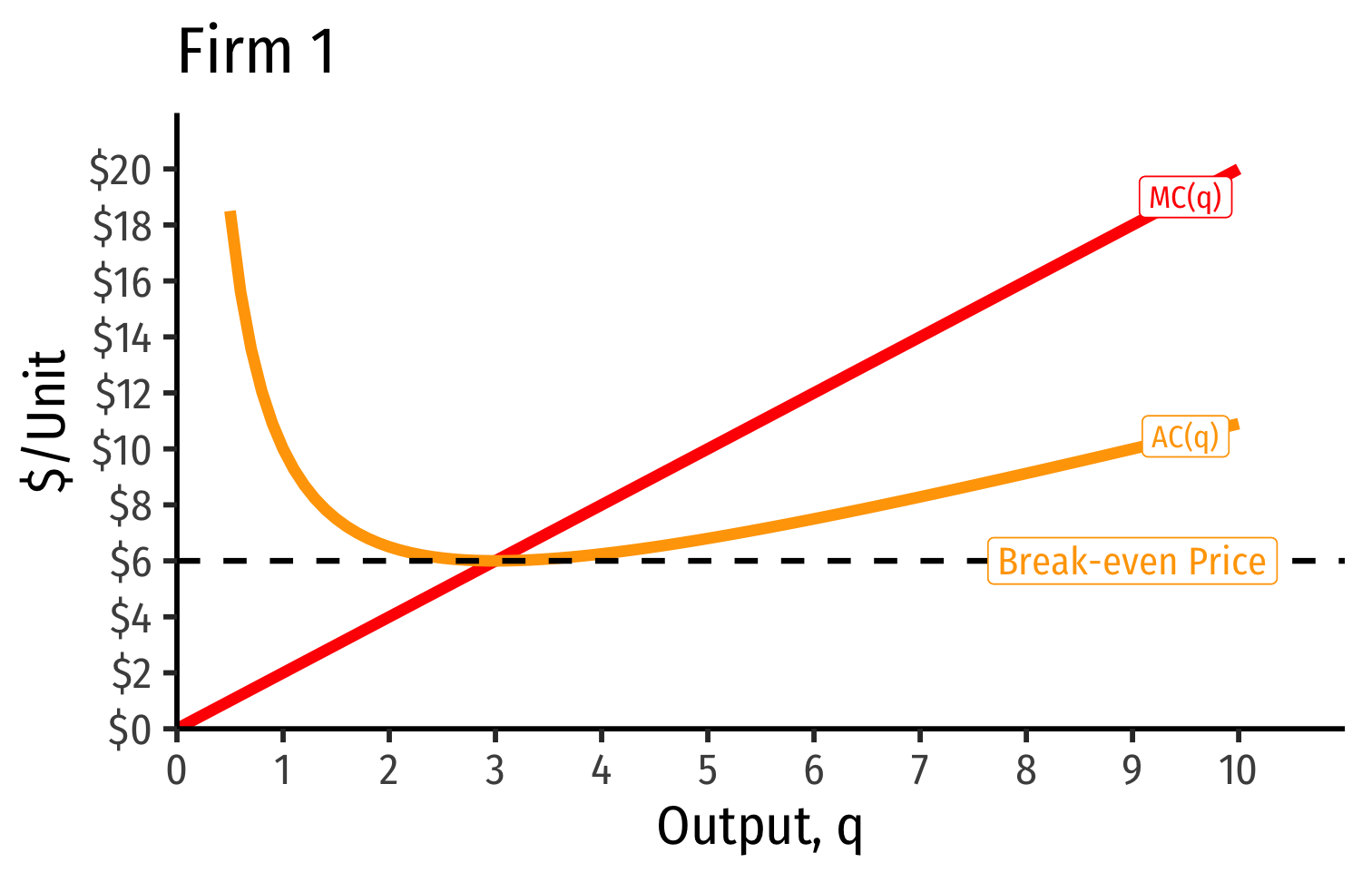

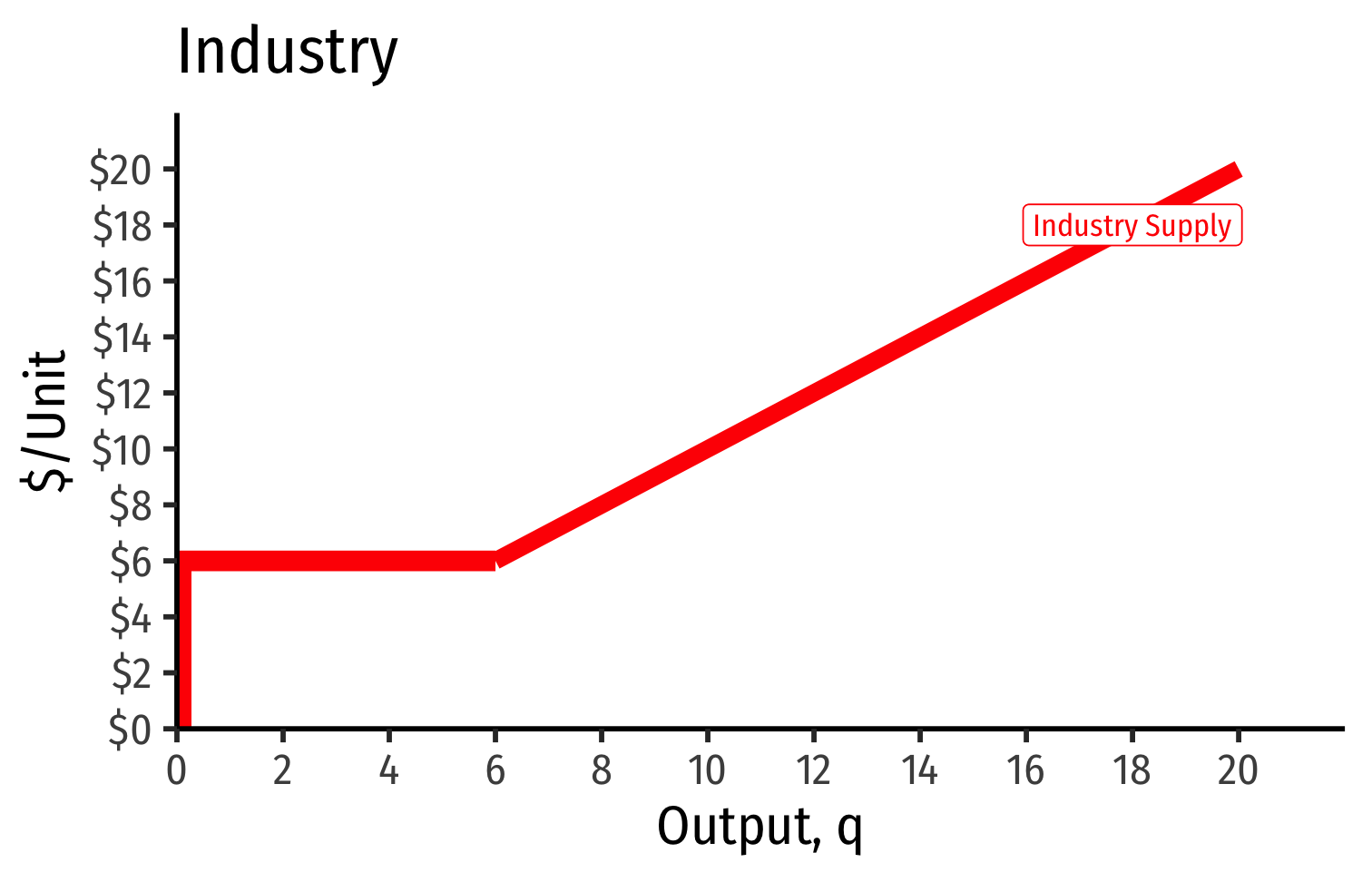

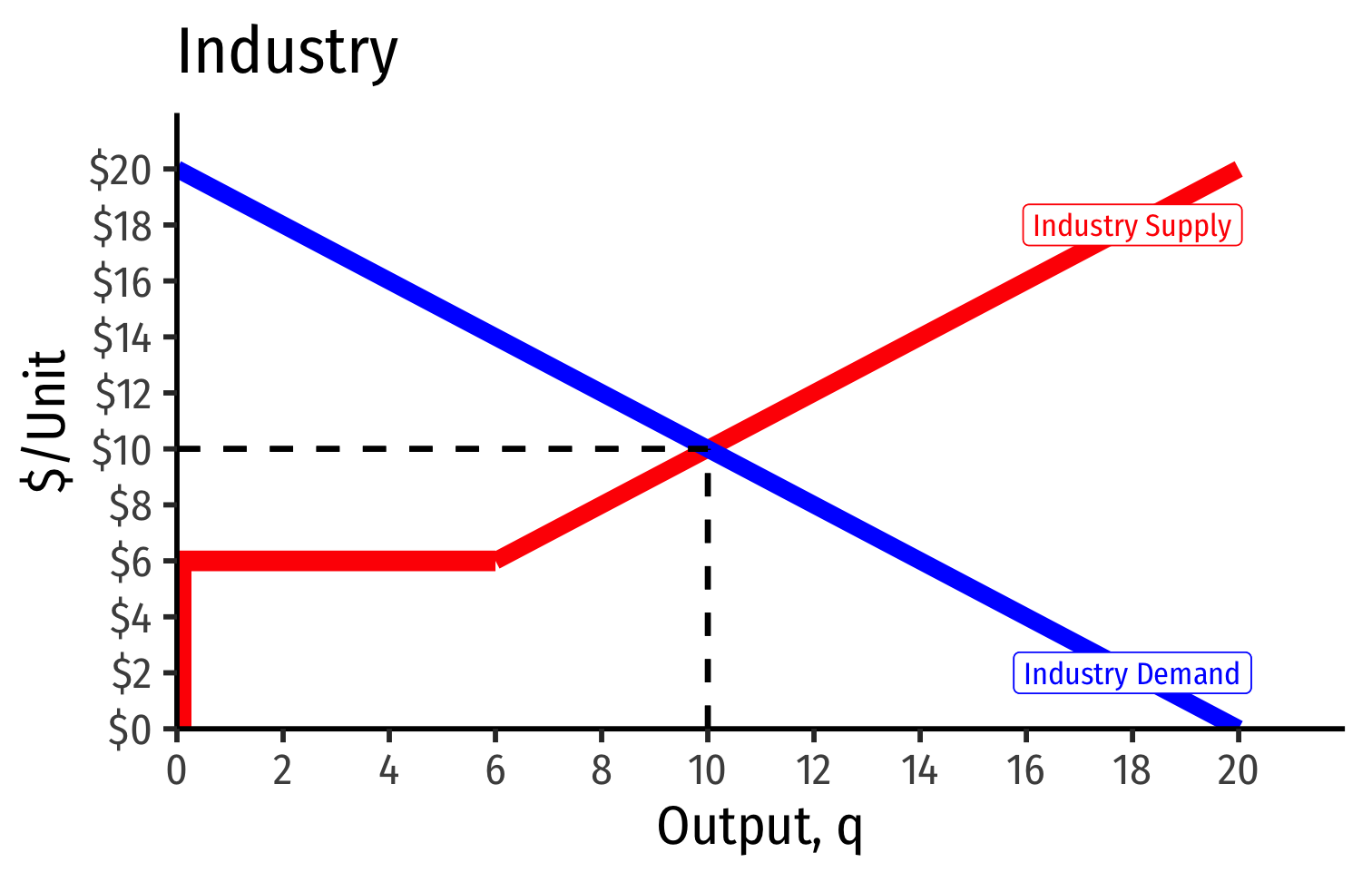

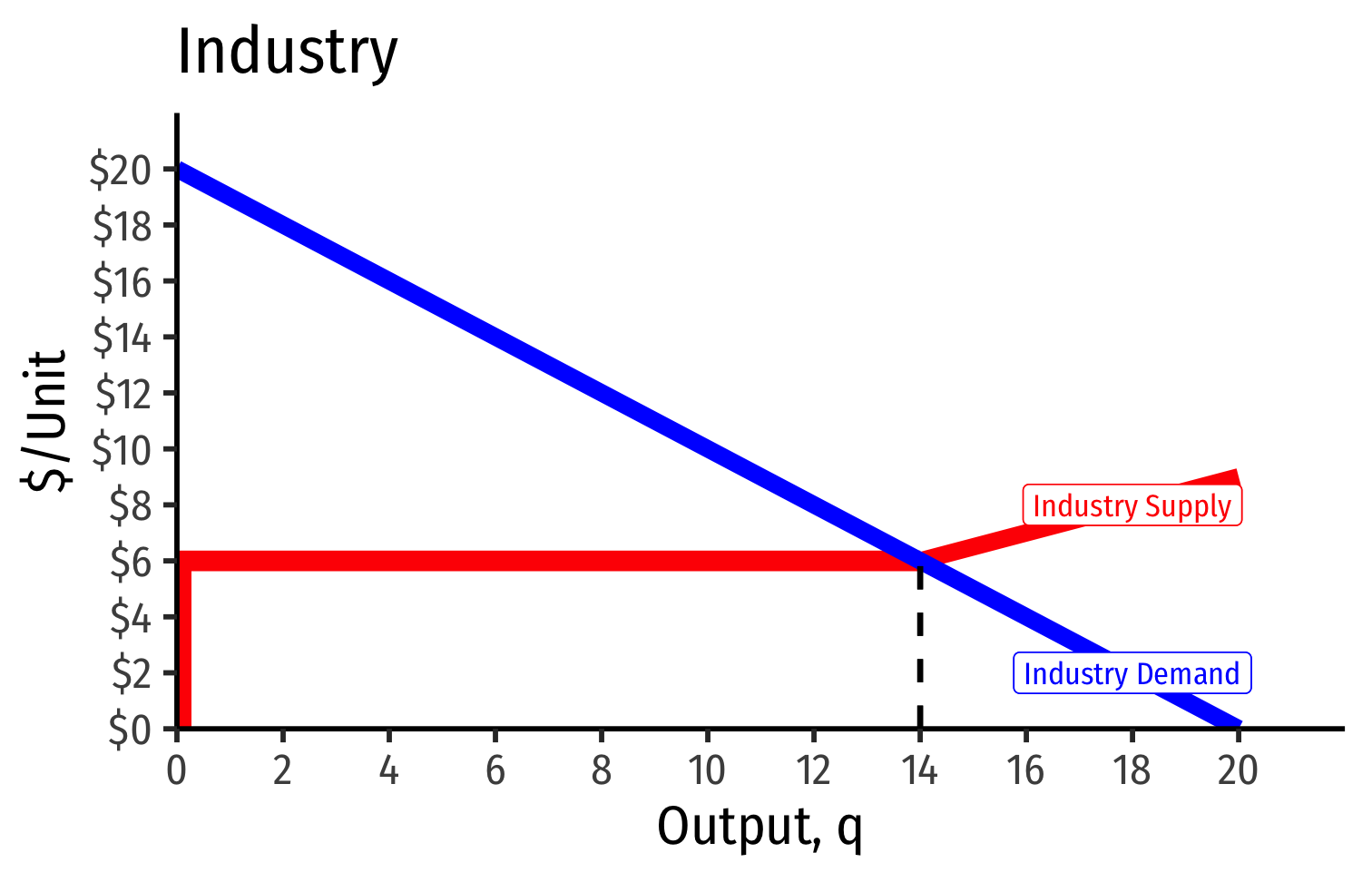

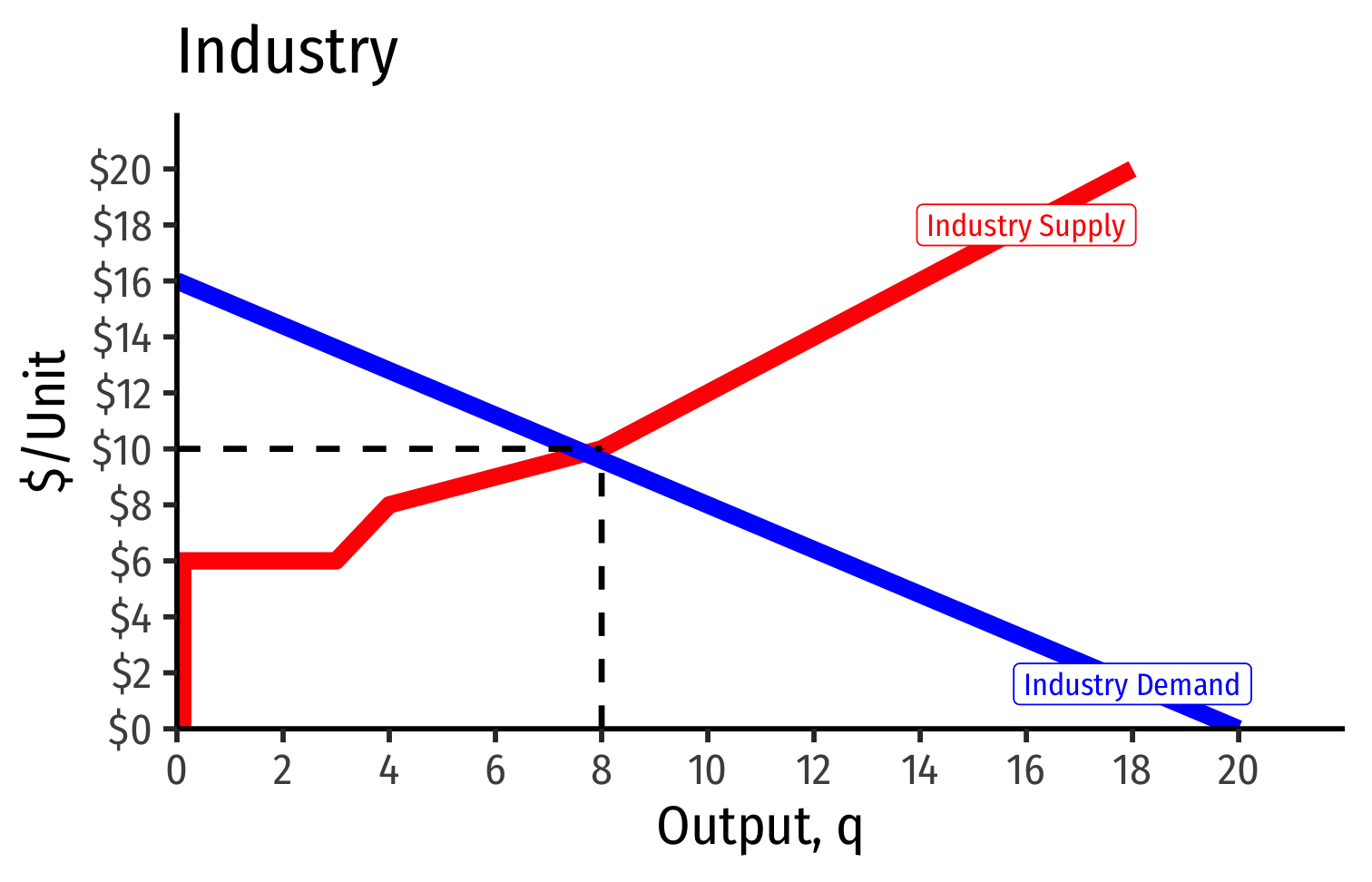

The Industry Supply Curve

Industry supply curve: horizontal sum of all individual firms' supply curves

- recall: (MC(q) curve above AVCmin) (shut down price)

To keep it simple on the following slides:

- assume no fixed costs, so AC(q)=AVC(q)

- then industry supply curve is sum of individual MC(q) curves above AC(q)min

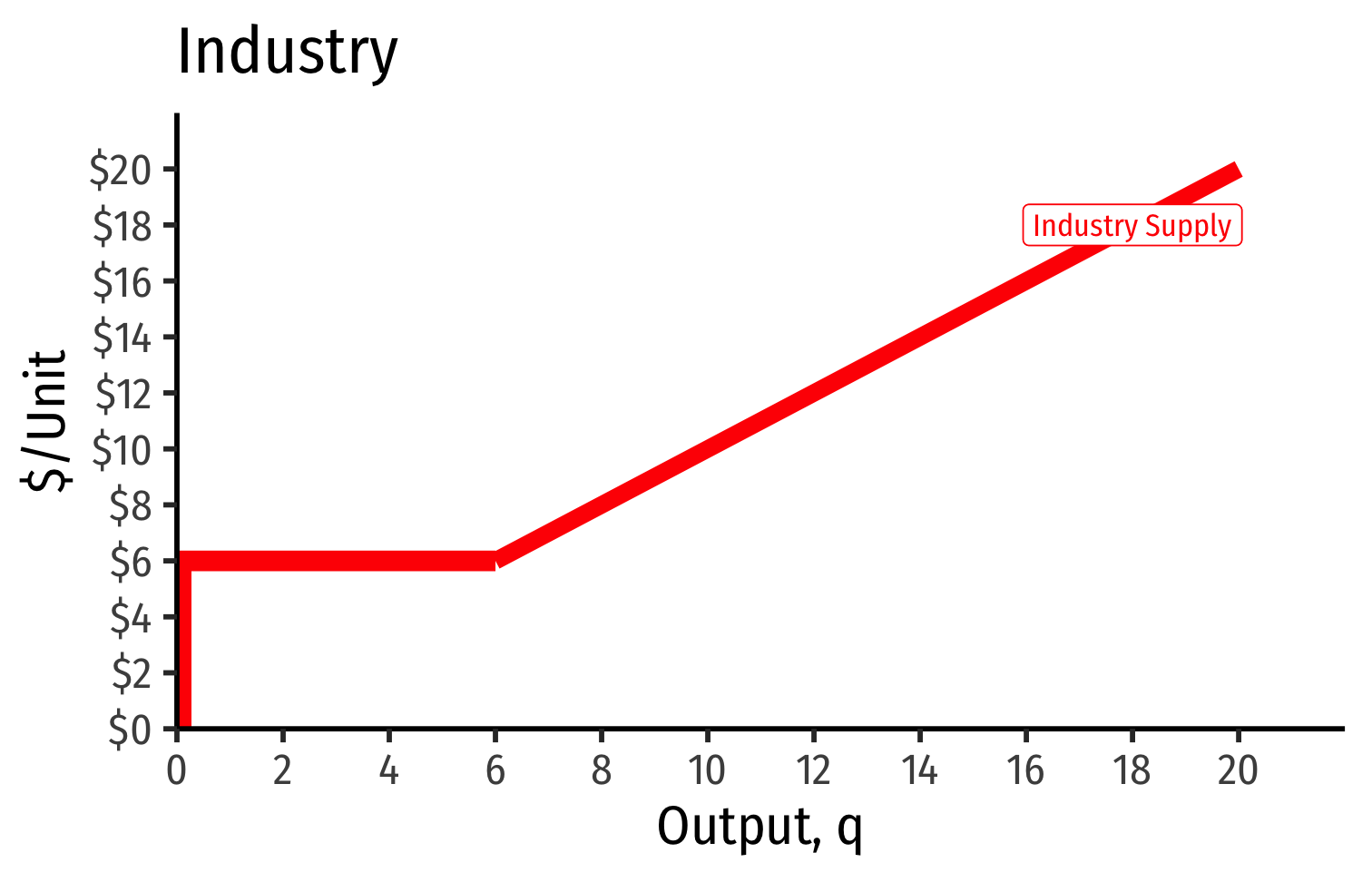

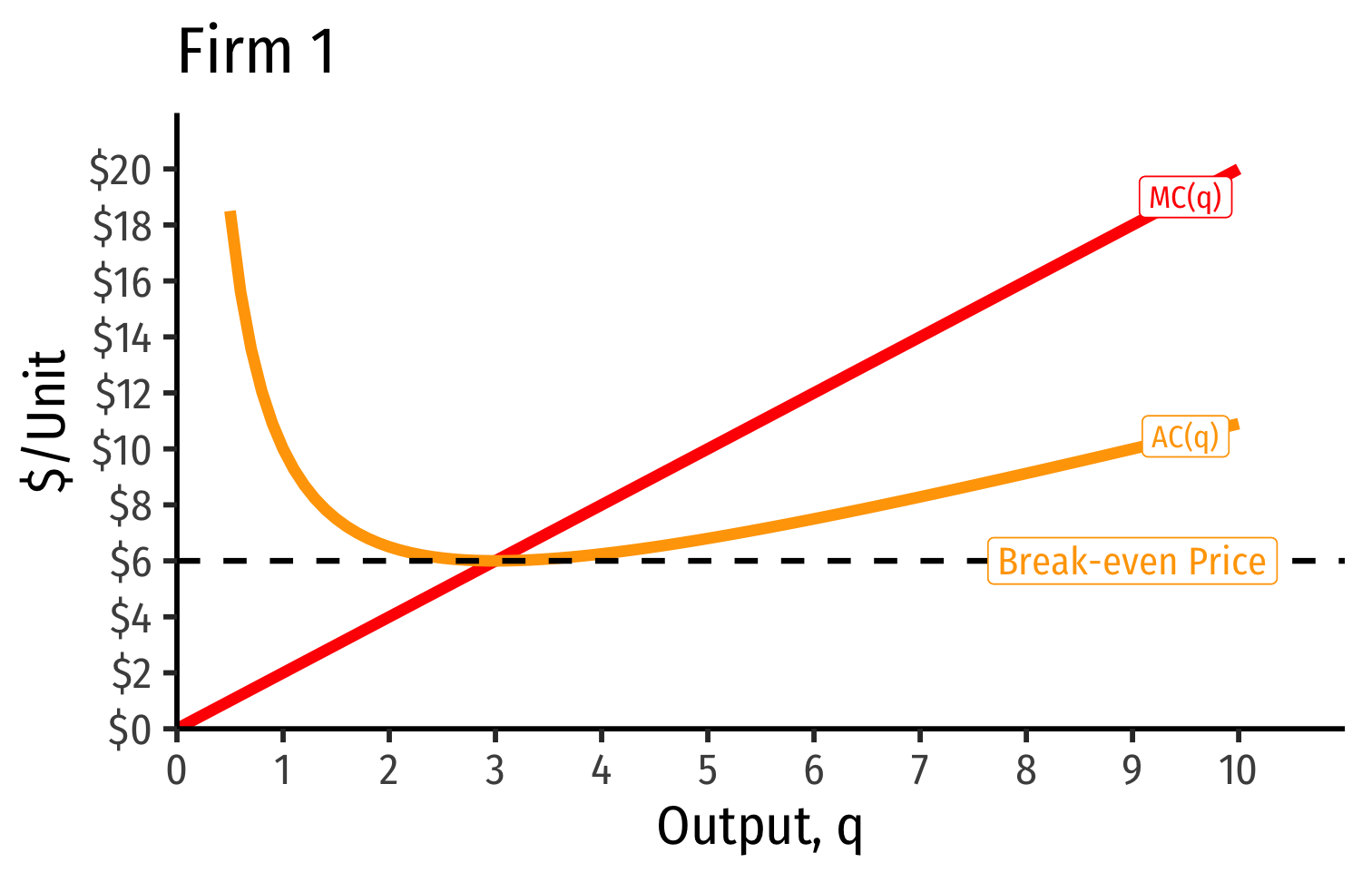

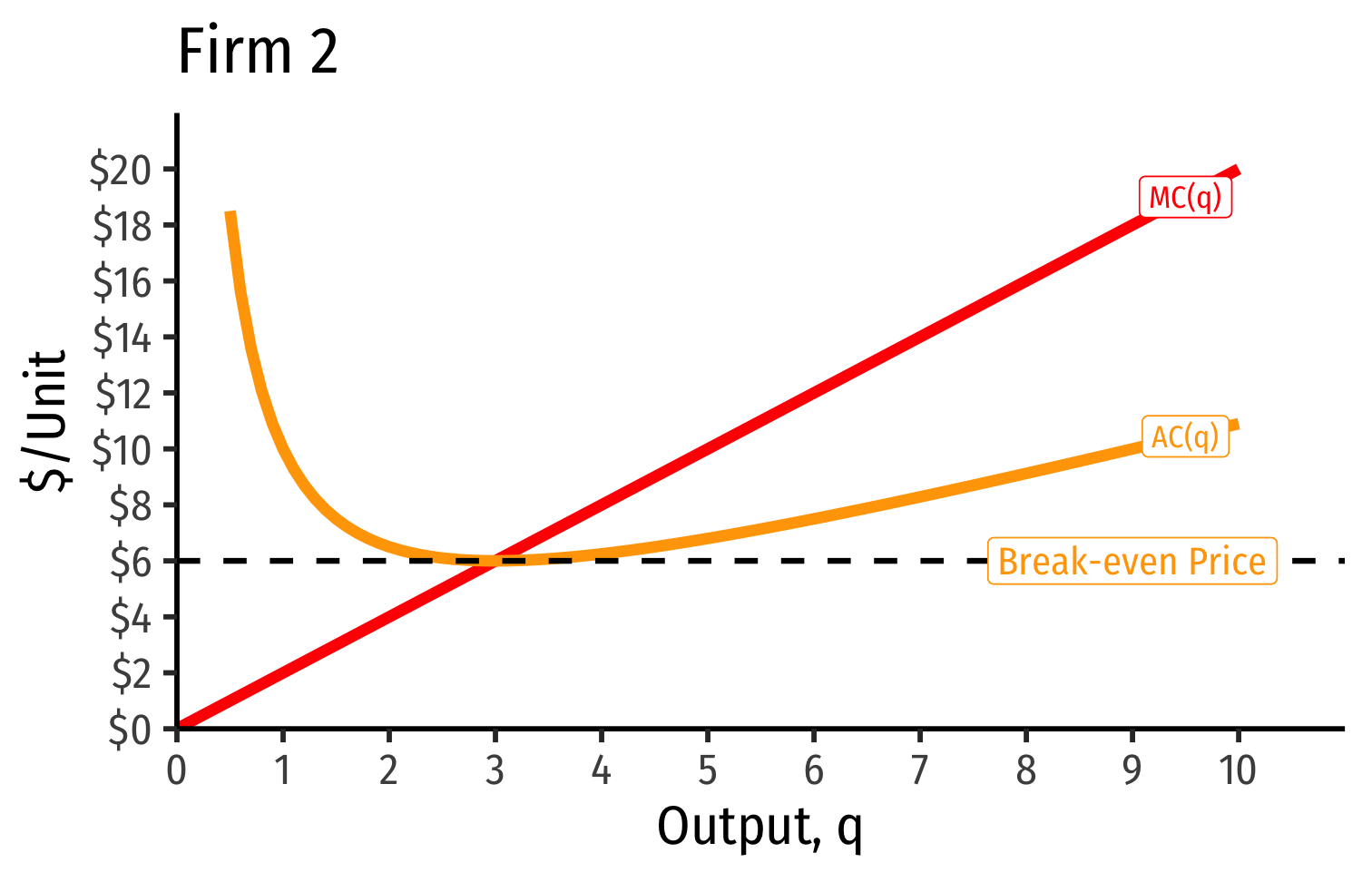

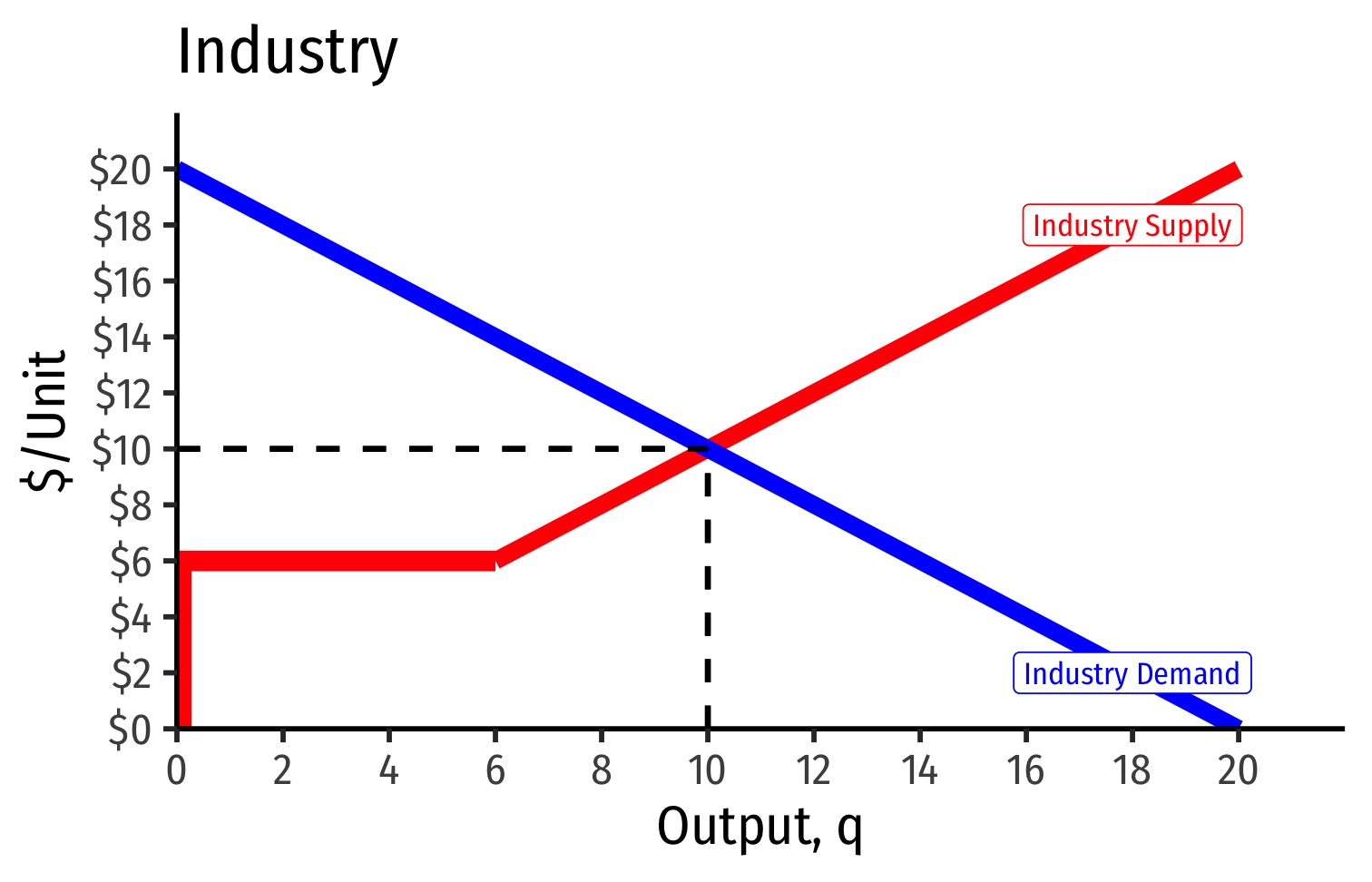

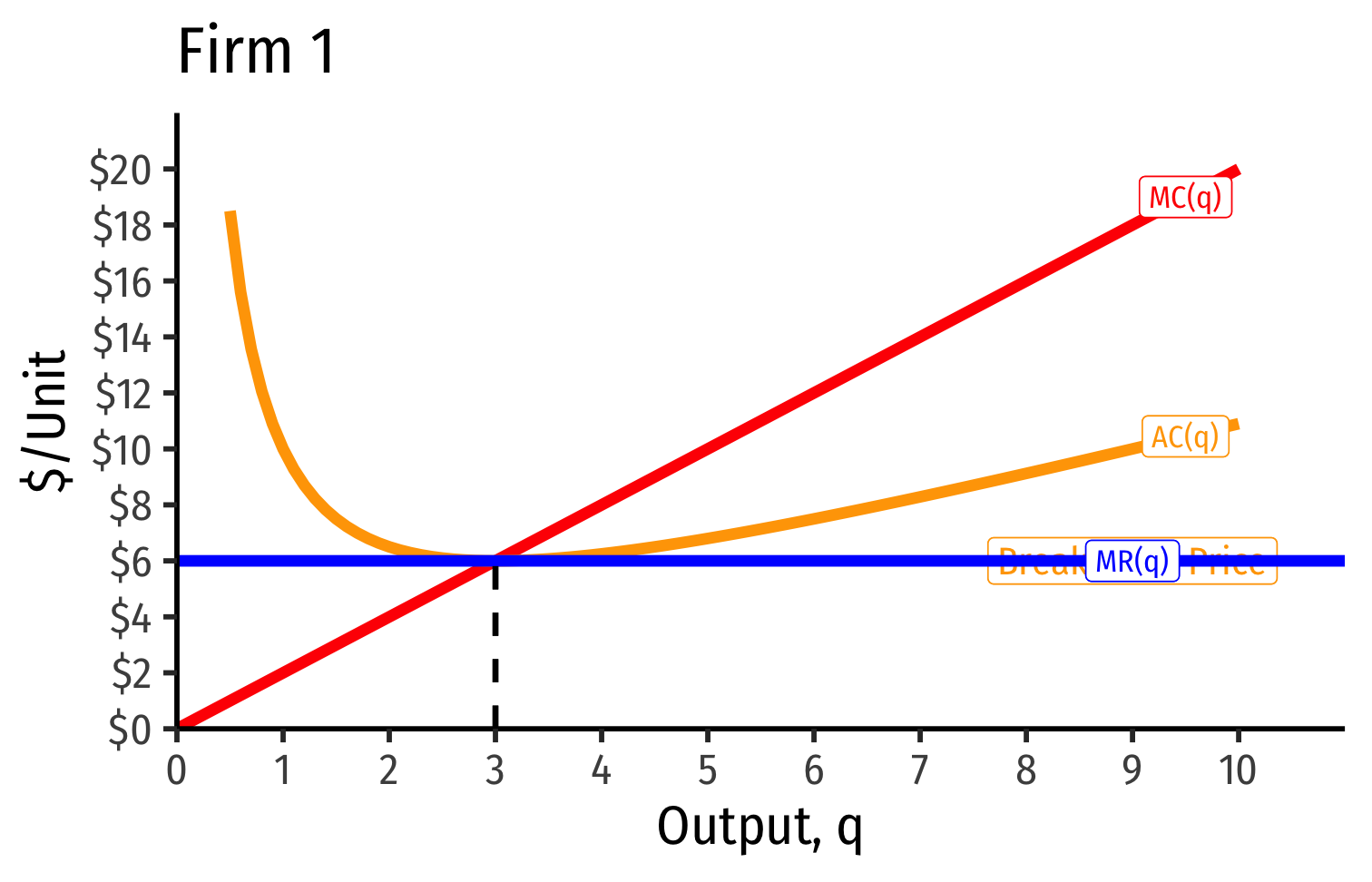

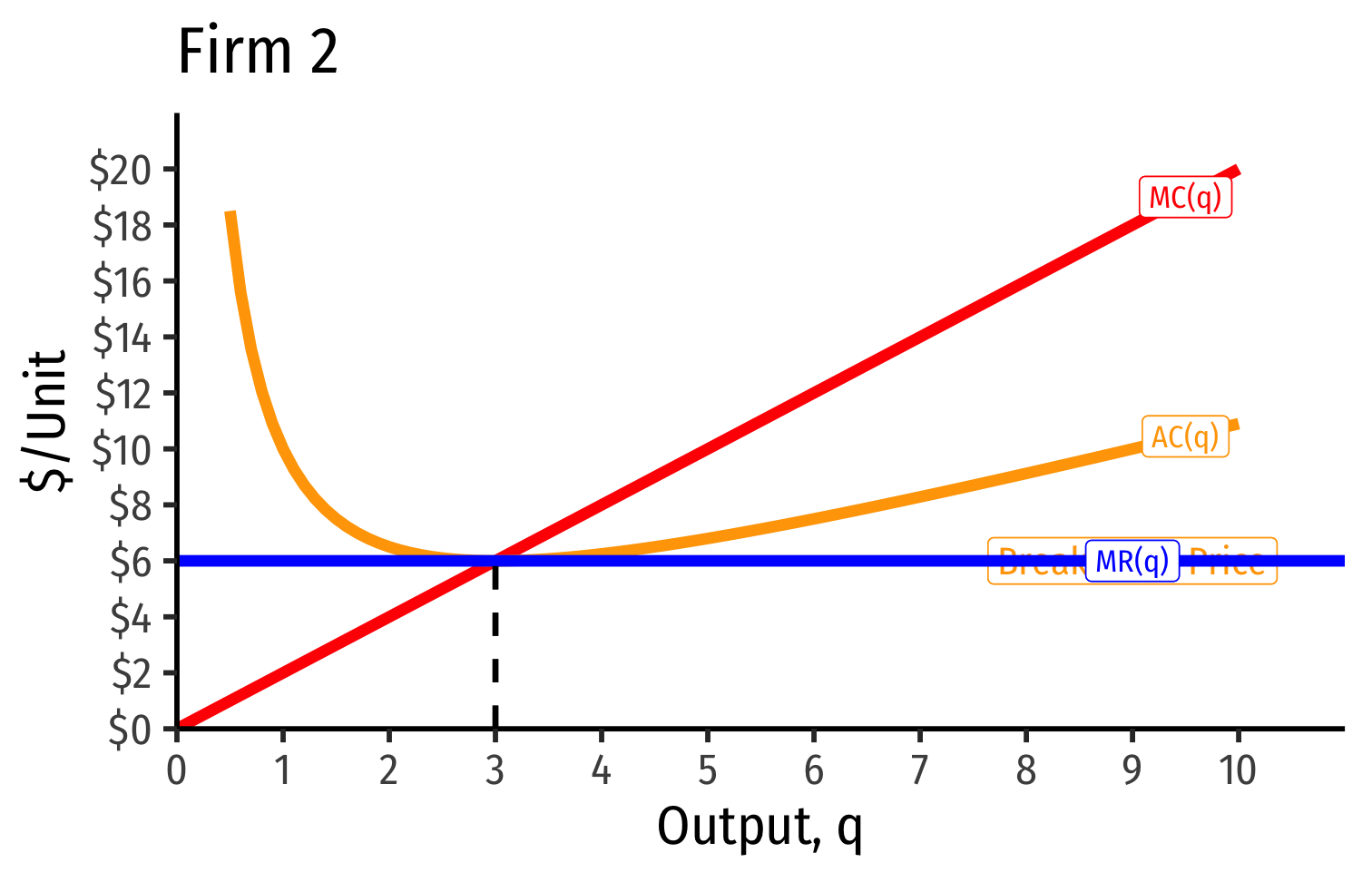

Industry Supply Curves (Identical Firms)

Industry Supply Curves (Identical Firms)

- Industry supply curve is the horizontal sum of all individual firm's supply curves

- Which are each firm's marginal cost curve above its breakeven price

Industry Supply Curves (Identical Firms)

- Industry demand curve (where equal to supply) sets market price, demand for firms

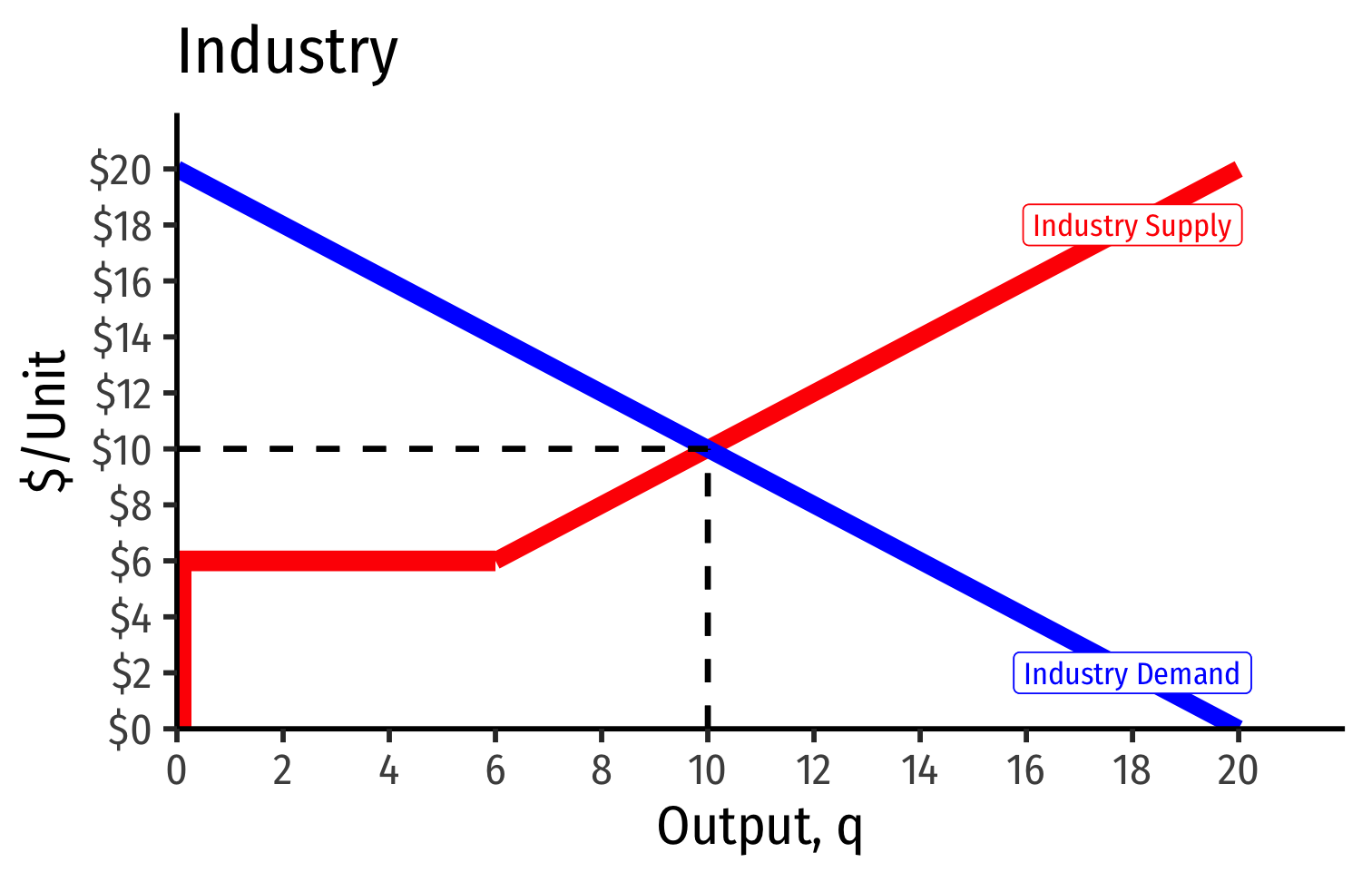

Industry Supply Curves (Identical Firms)

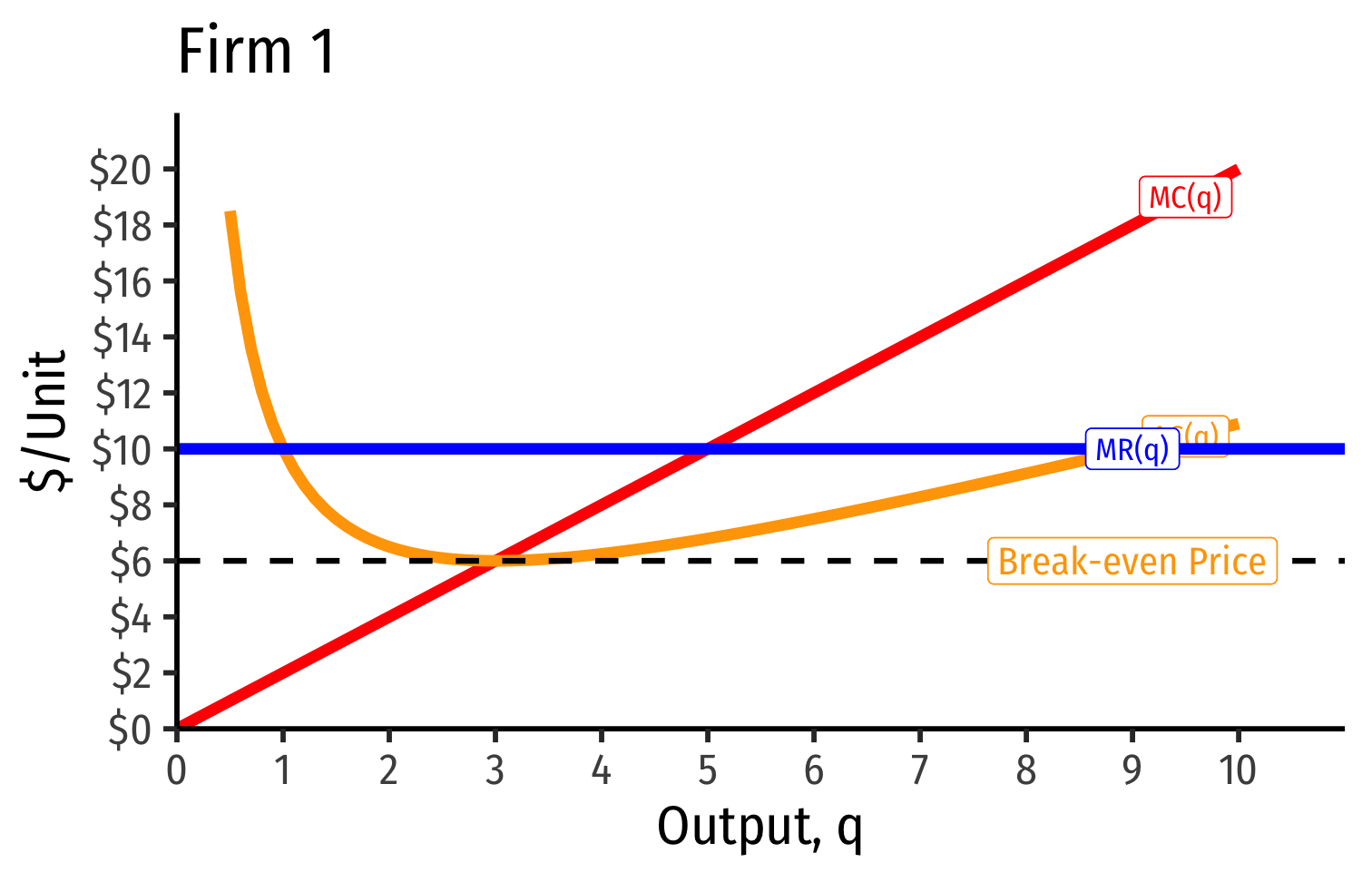

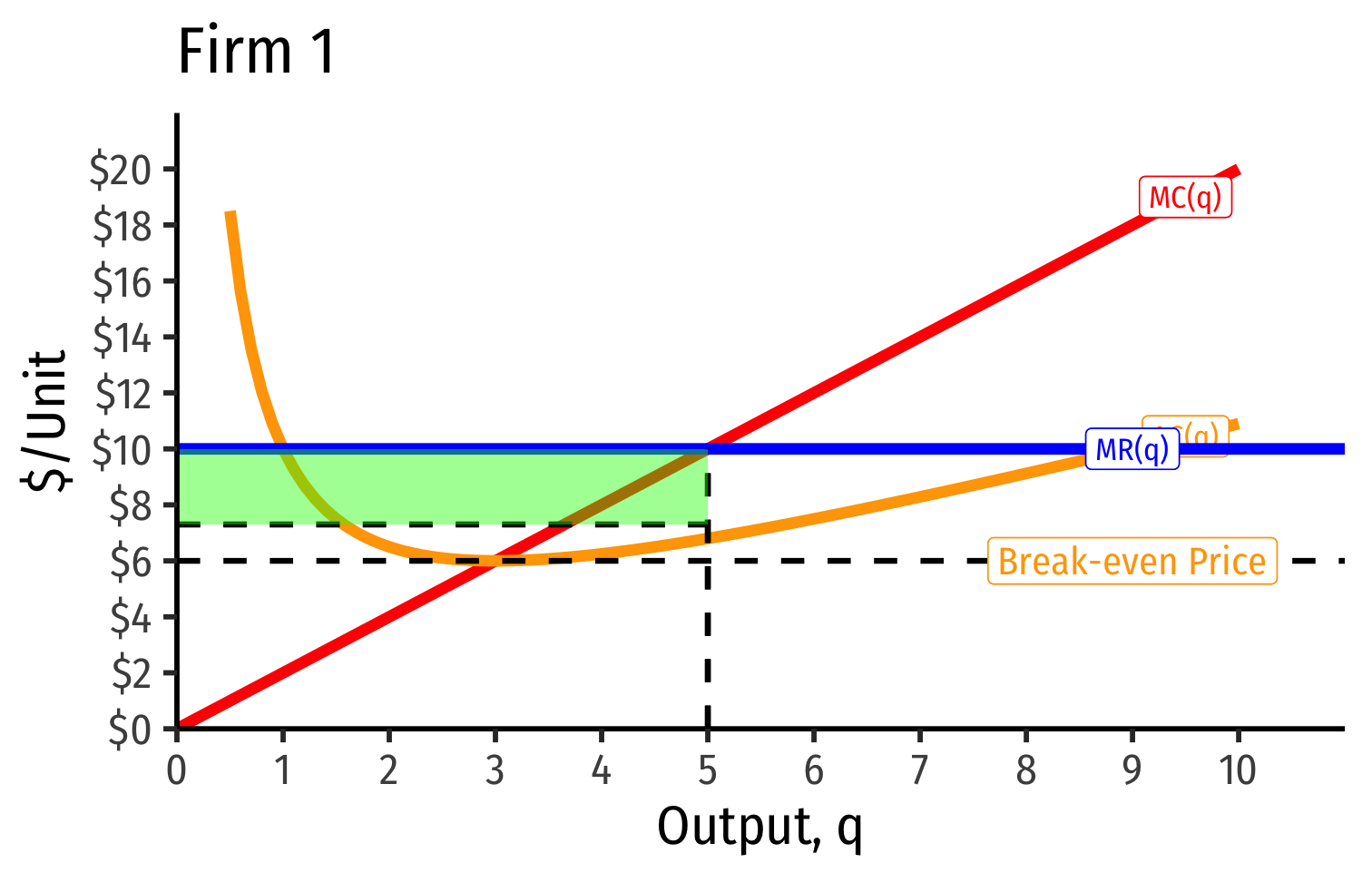

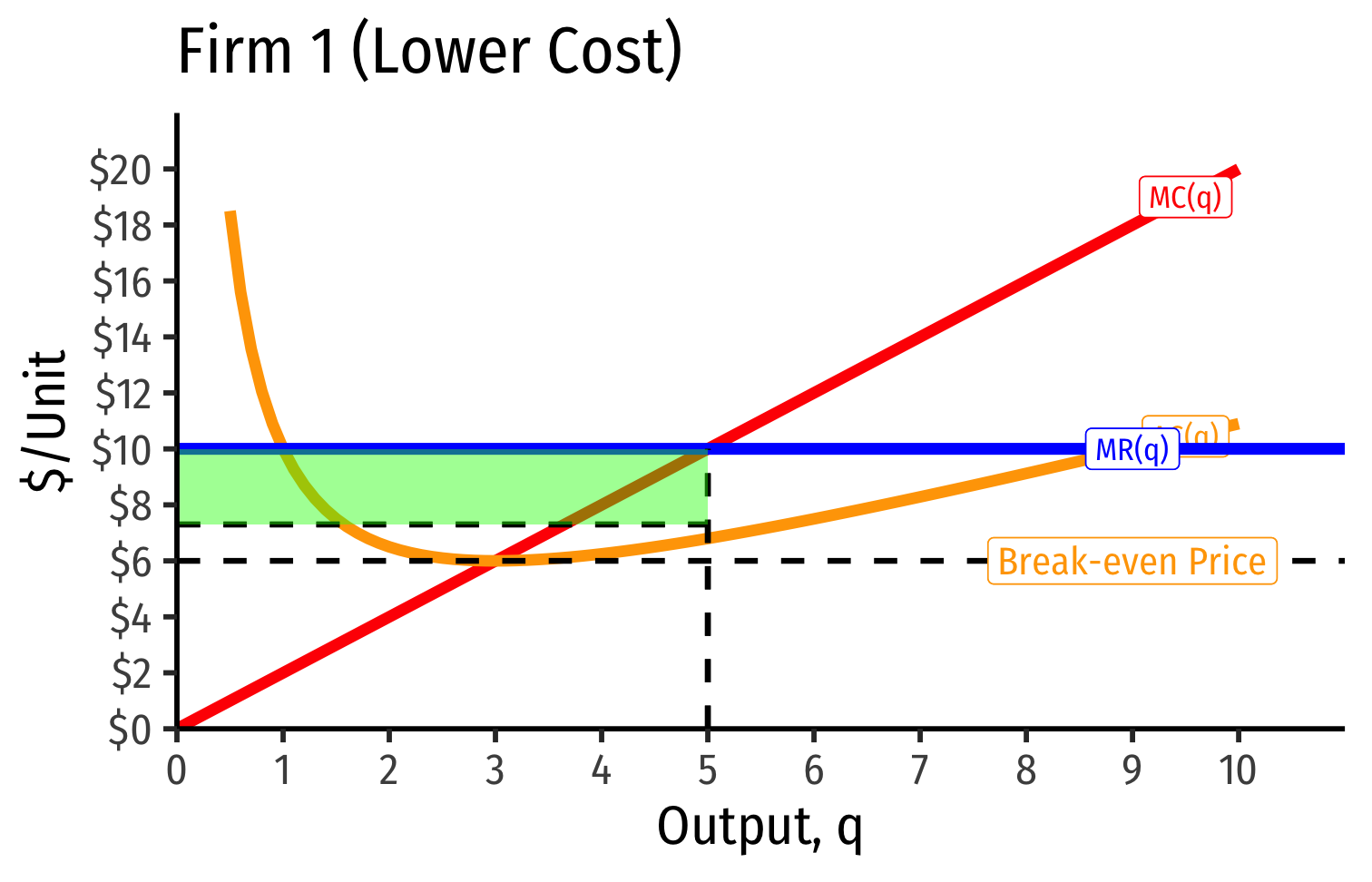

Short Run: each firm is earning profits p>AC(q)

Long run: induces entry by firm 3, firm 4, ⋯, firm n

Industry Supply Curves (Identical Firms)

Short Run: each firm is earning profits p>AC(q)

Long run: induces entry by firm 3, firm 4, ⋯, firm n

- Long run industry equilibrium:

Industry Supply Curves (Identical Firms)

Short Run: each firm is earning profits p>AC(q)

Long run: induces entry by firm 3, firm 4, ⋯, firm n

Long run industry equilibrium: p=AC(q)min, π=0 at p= $6; supply becomes more elastic

Economic Rents, Profits, & Competition

Back to Zero Economic Profits

- Recall, we've essentially defined a firm as a completely replicable recipe (production function) of resources

q=f(L,K)

- “Any idiot” can enter market, buy required (L,K) at prices (w,r), produce q∗ at market price p and earn the market rate of π

Back to Zero Economic Profits

Zero long run economic profit ≠ industry disappears, just stops growing

Less attractive to entrepreneurs & start ups to enter than other, more profitable industries

These are mature industries (again, often commodities), the backbone of the economy, just not sexy!

Back to Zero Economic Profits

All factors are paid their market price

- i.e. their opportunity cost — what they could earn elsewhere in economy

Firms earn normal market rate of return

- No excess rewards (economic profits) to attract new resources into the industry, nor losses to push resources out of industry

Back to Zero Economic Profits

But we've so far been imagining a market where every firm is identical, just a recipe “any idiot” can copy

What about if firms have different technologies or costs?

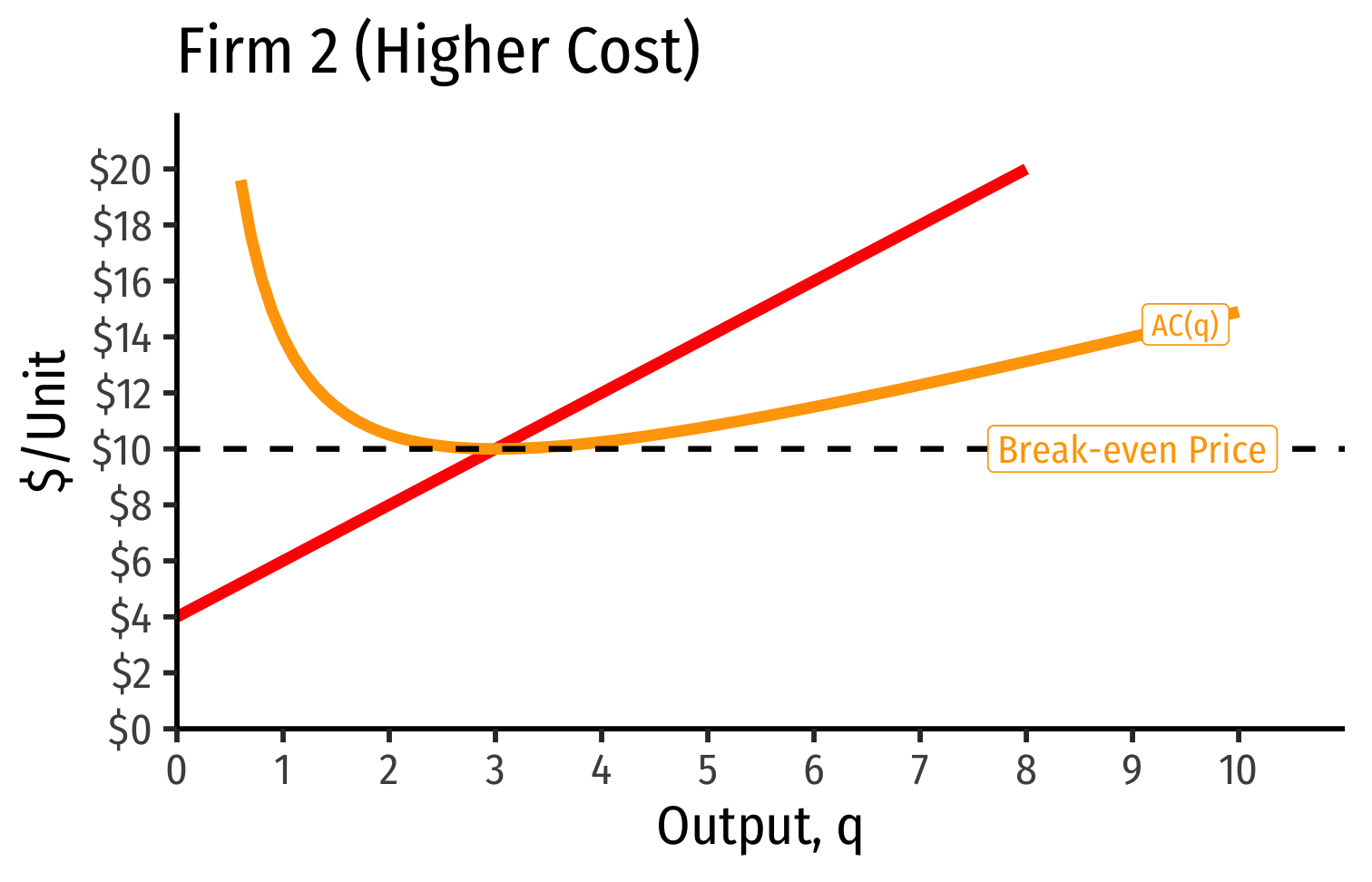

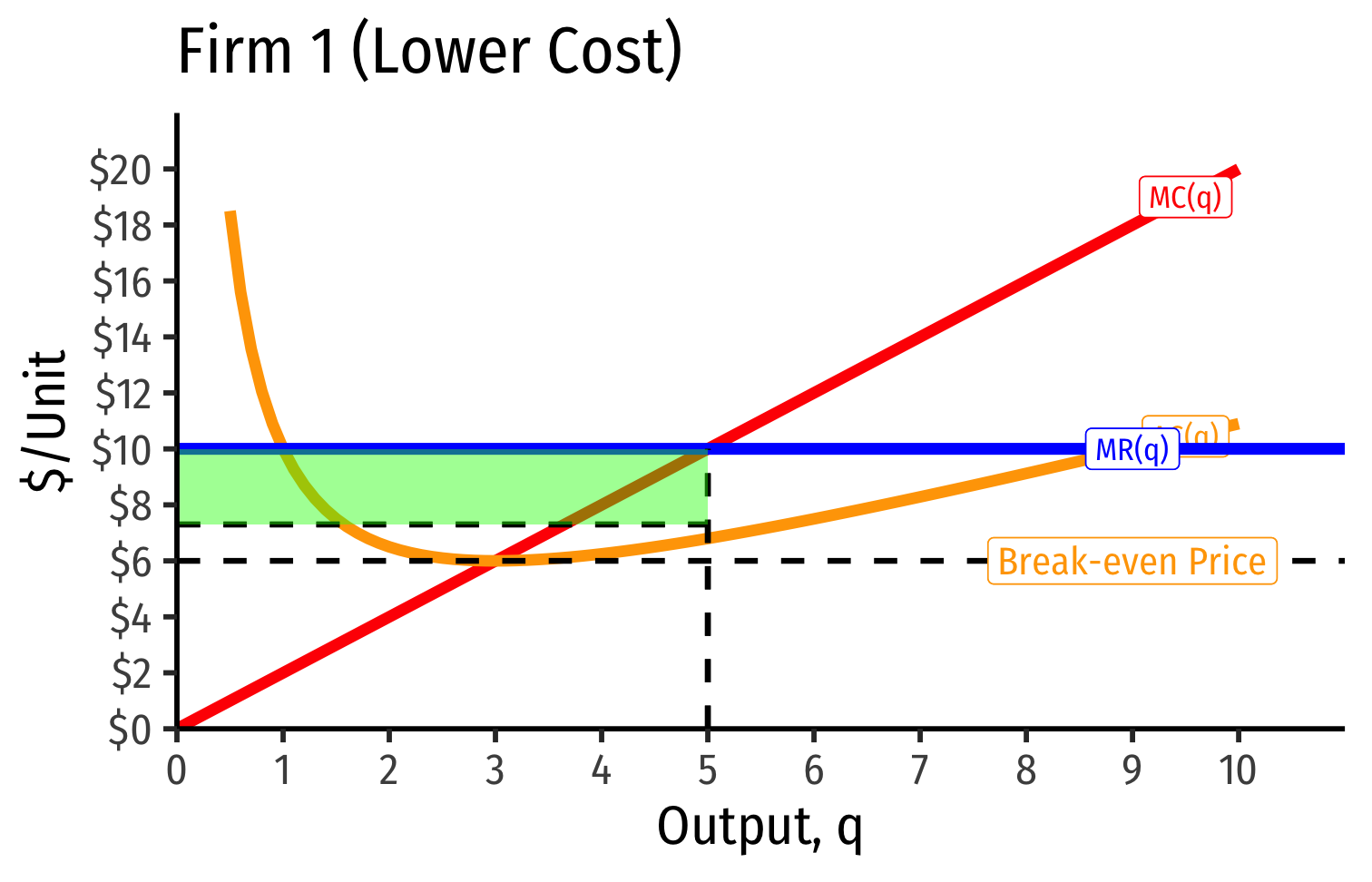

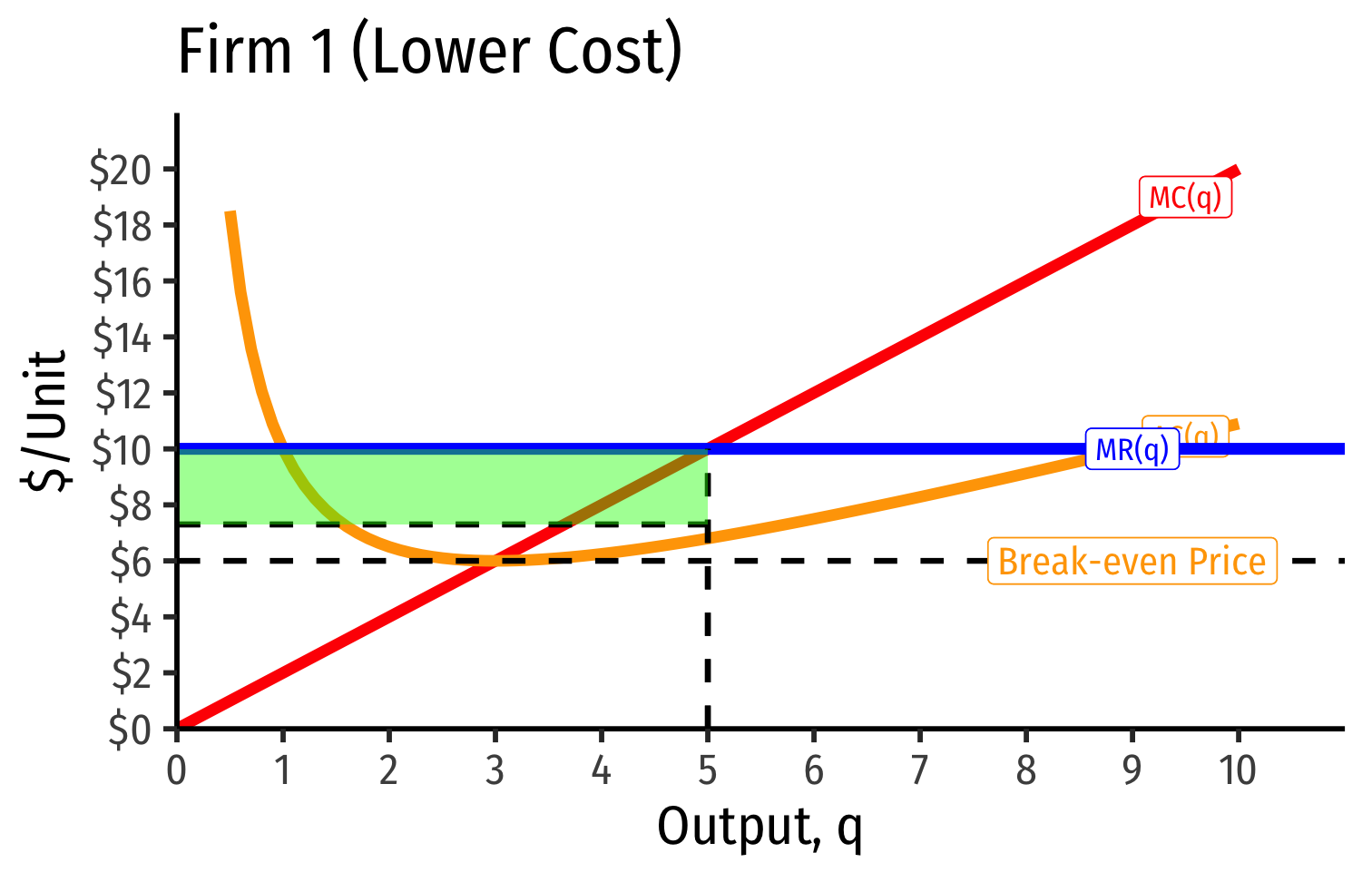

Industry Supply Curves (Different Firms) I

Firms have different technologies/costs due to relative differences in:

- Managerial talent

- Worker talent

- Location

- First-mover advantage

- Technological secrets/IP

- License/permit access

- Political connections

- Lobbying

Let's derive industry supply curve again, and see how this may affect profits

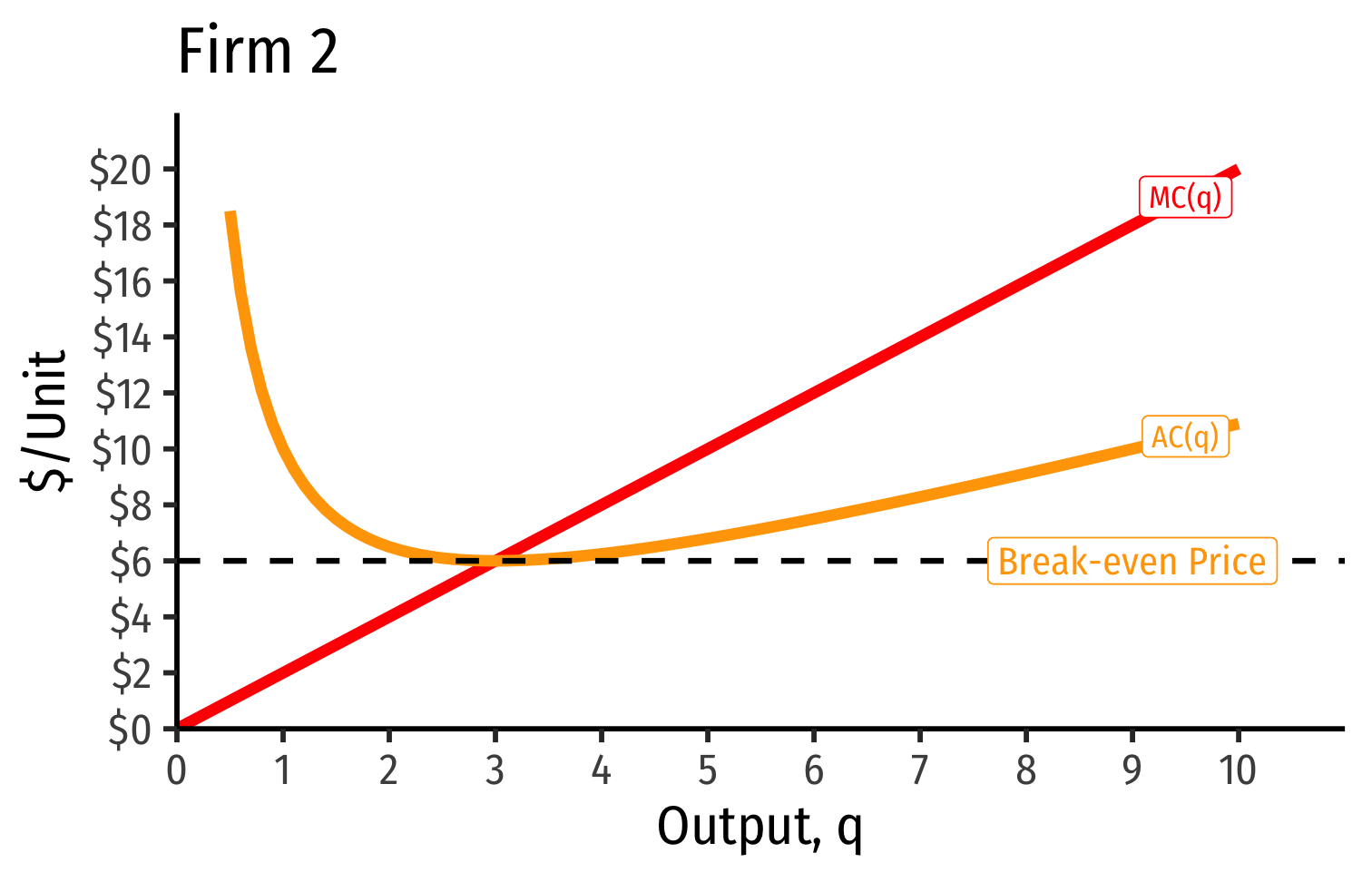

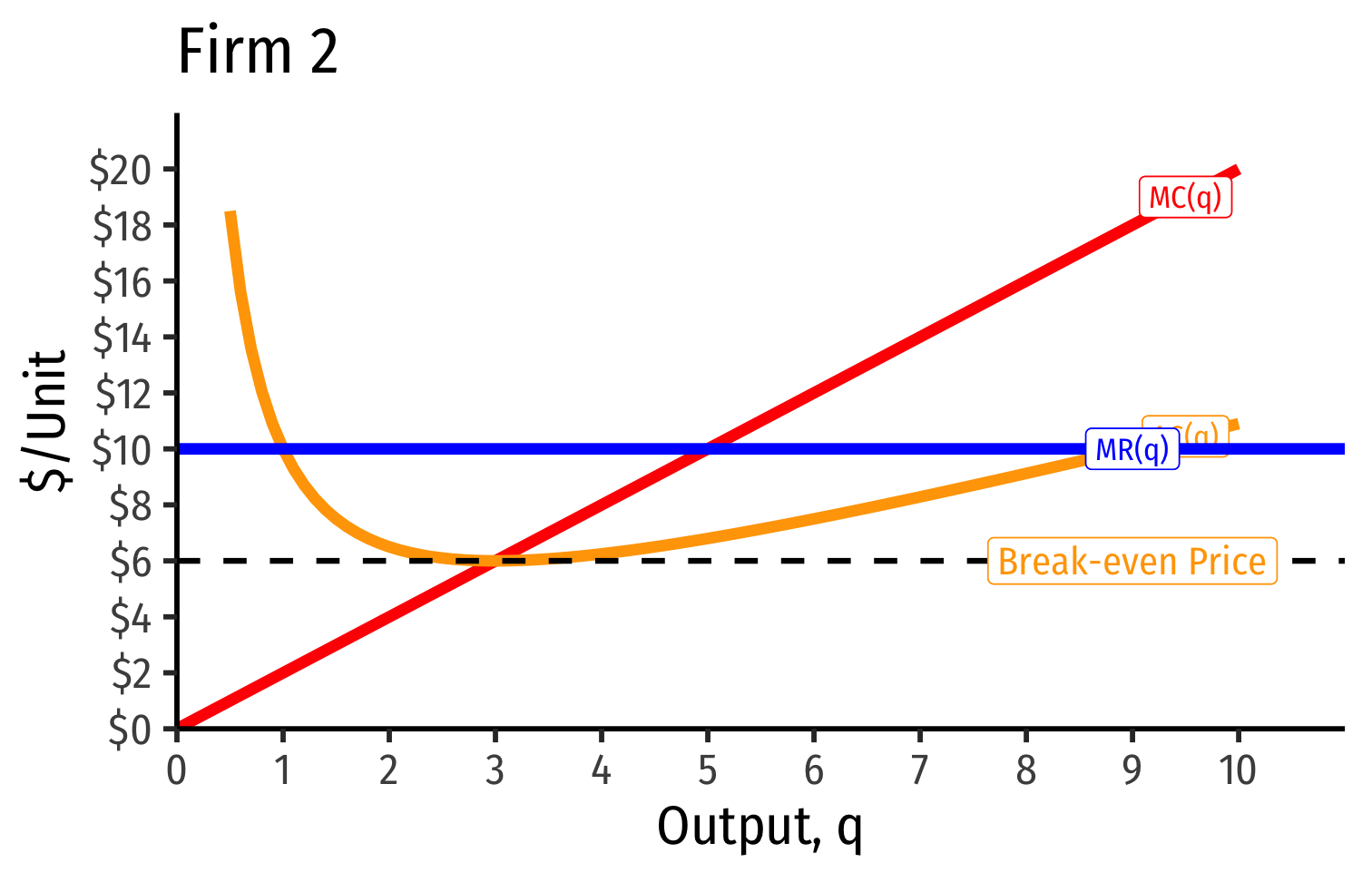

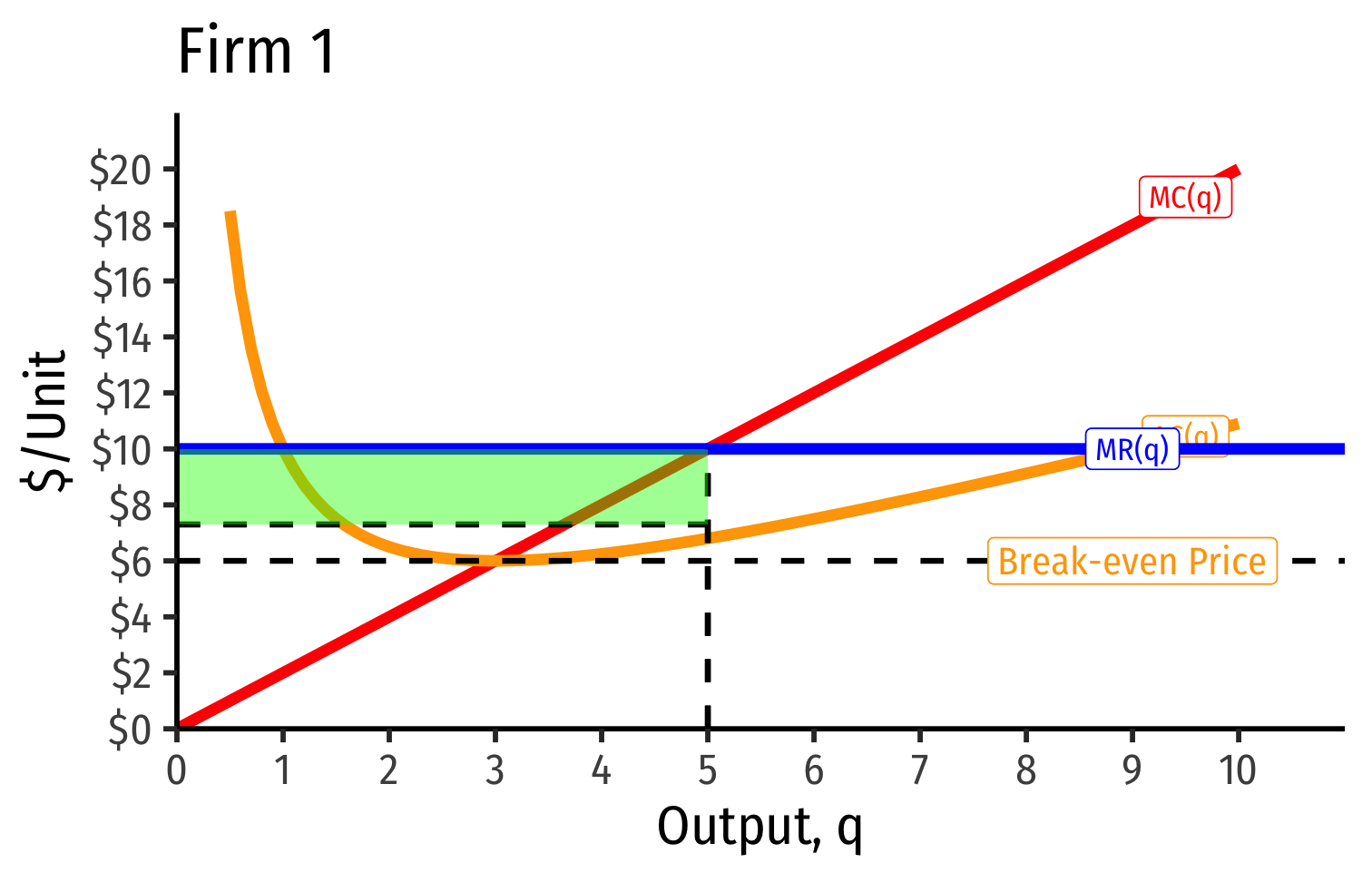

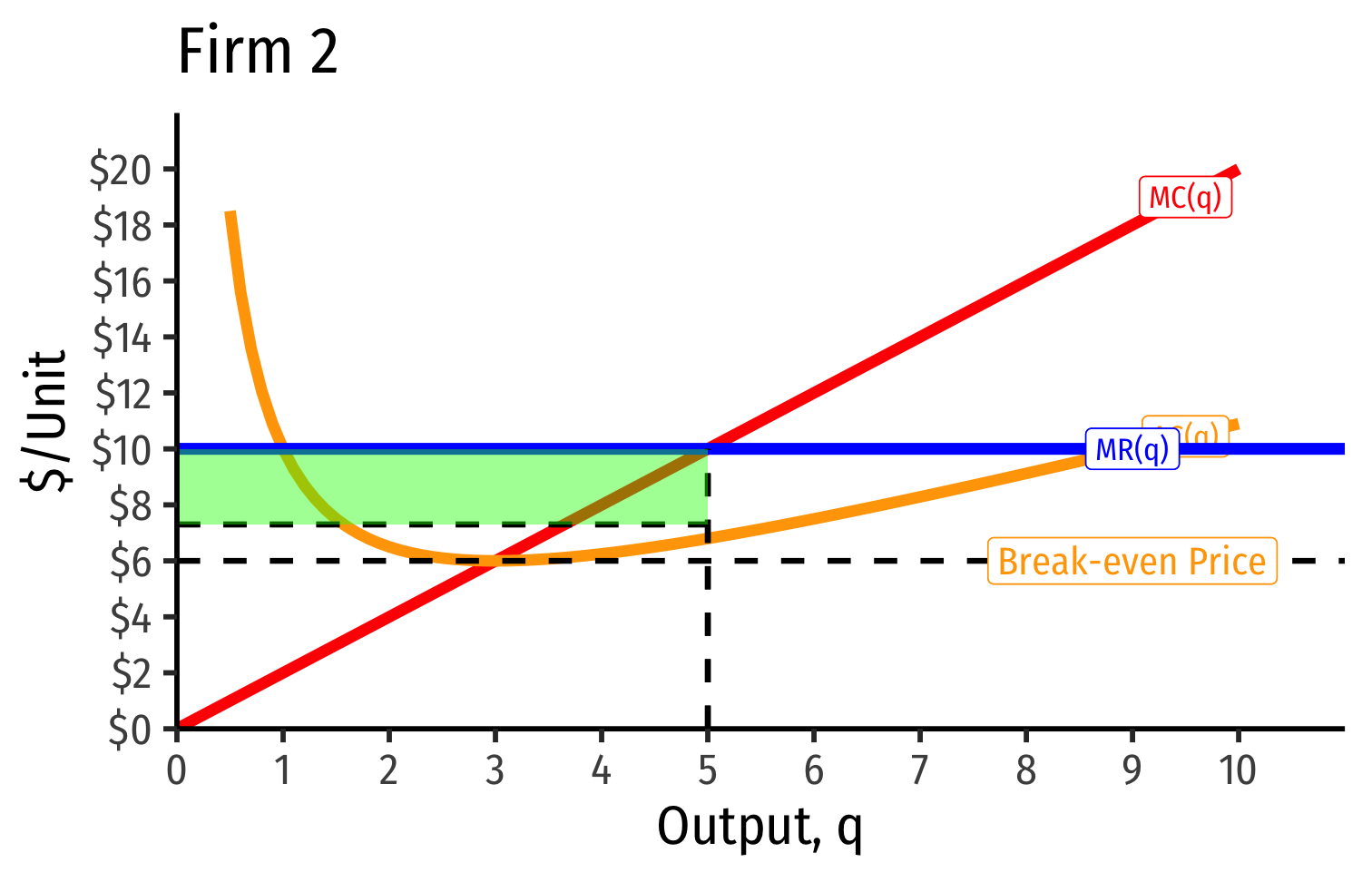

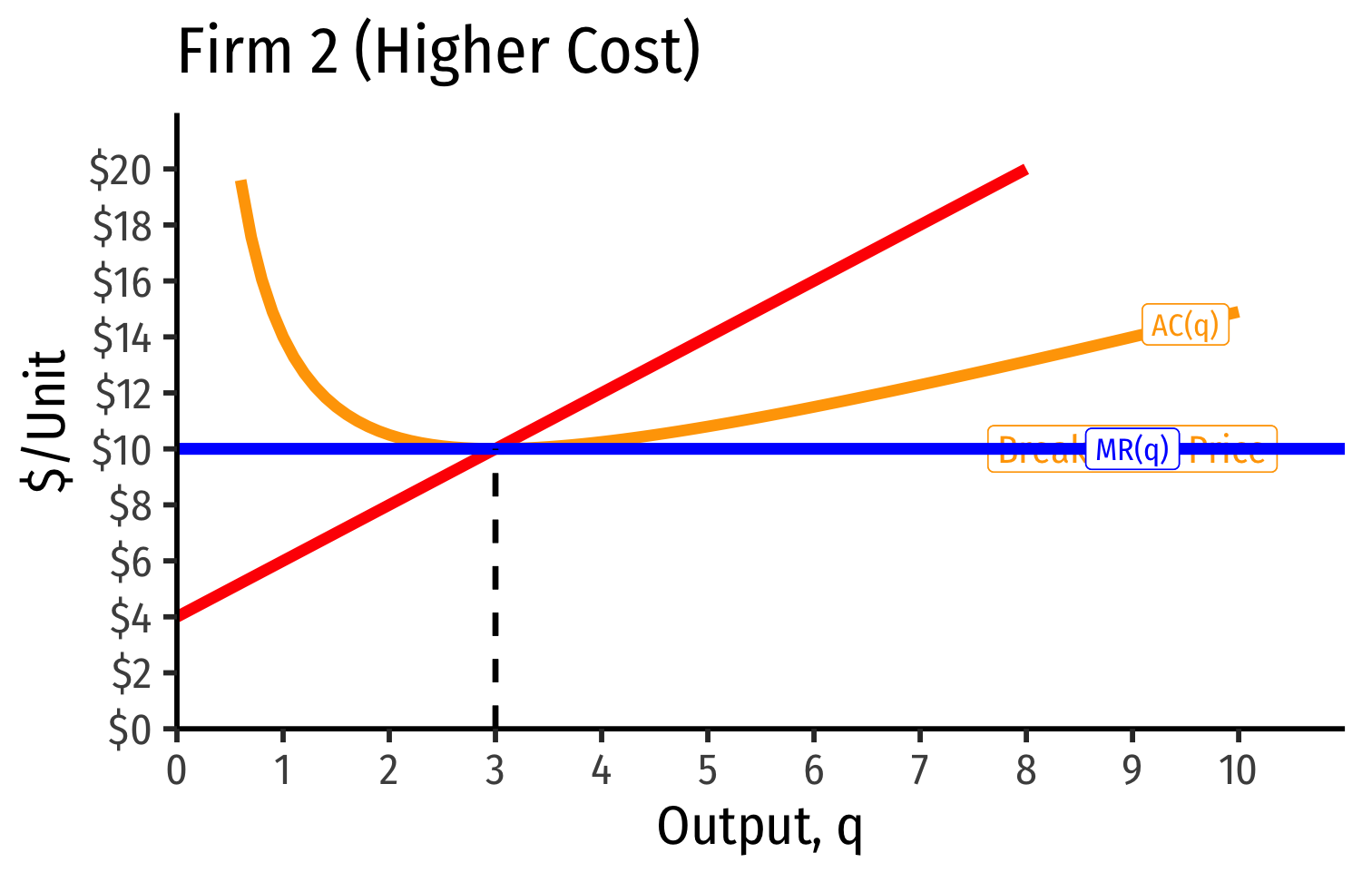

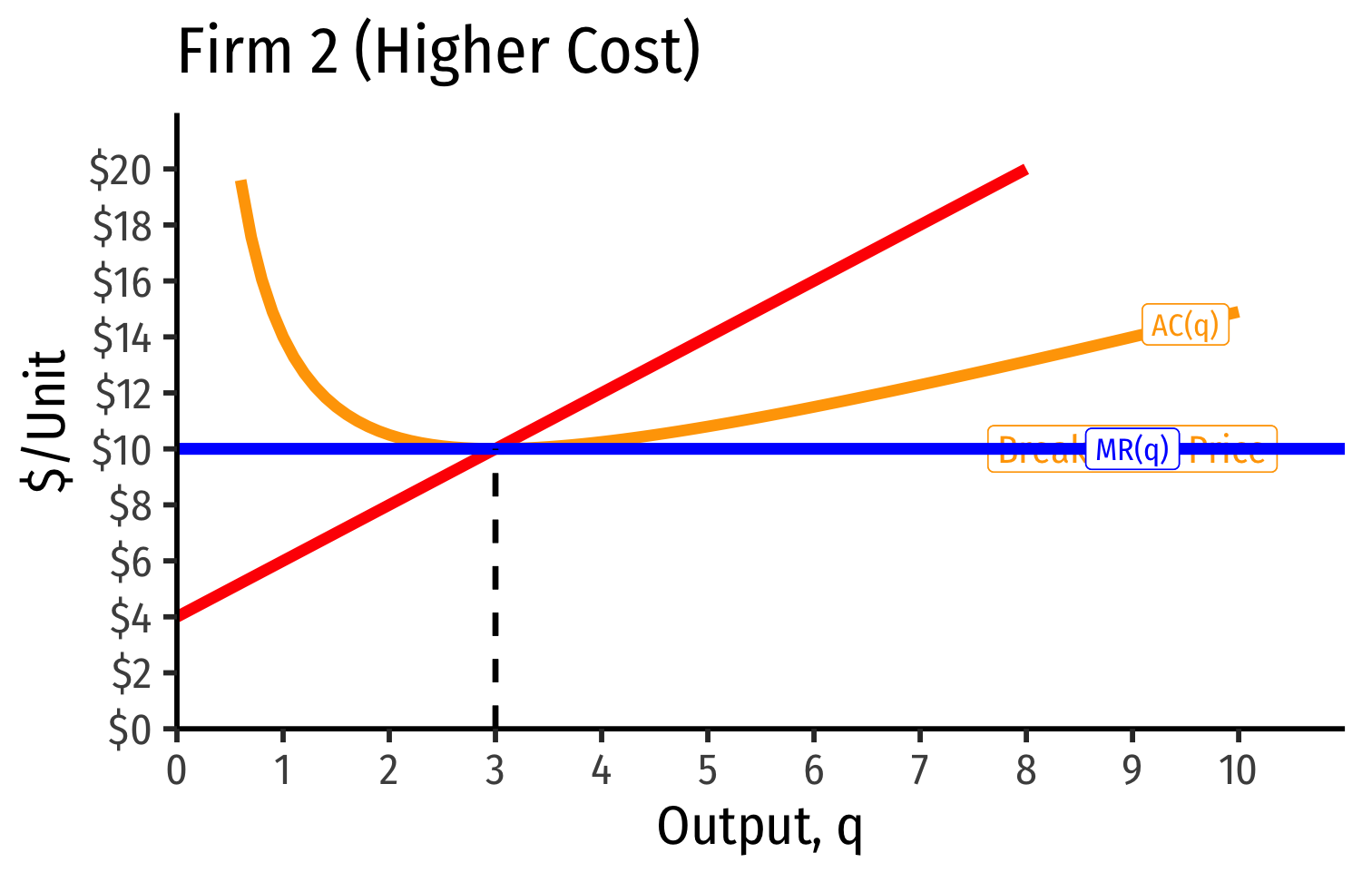

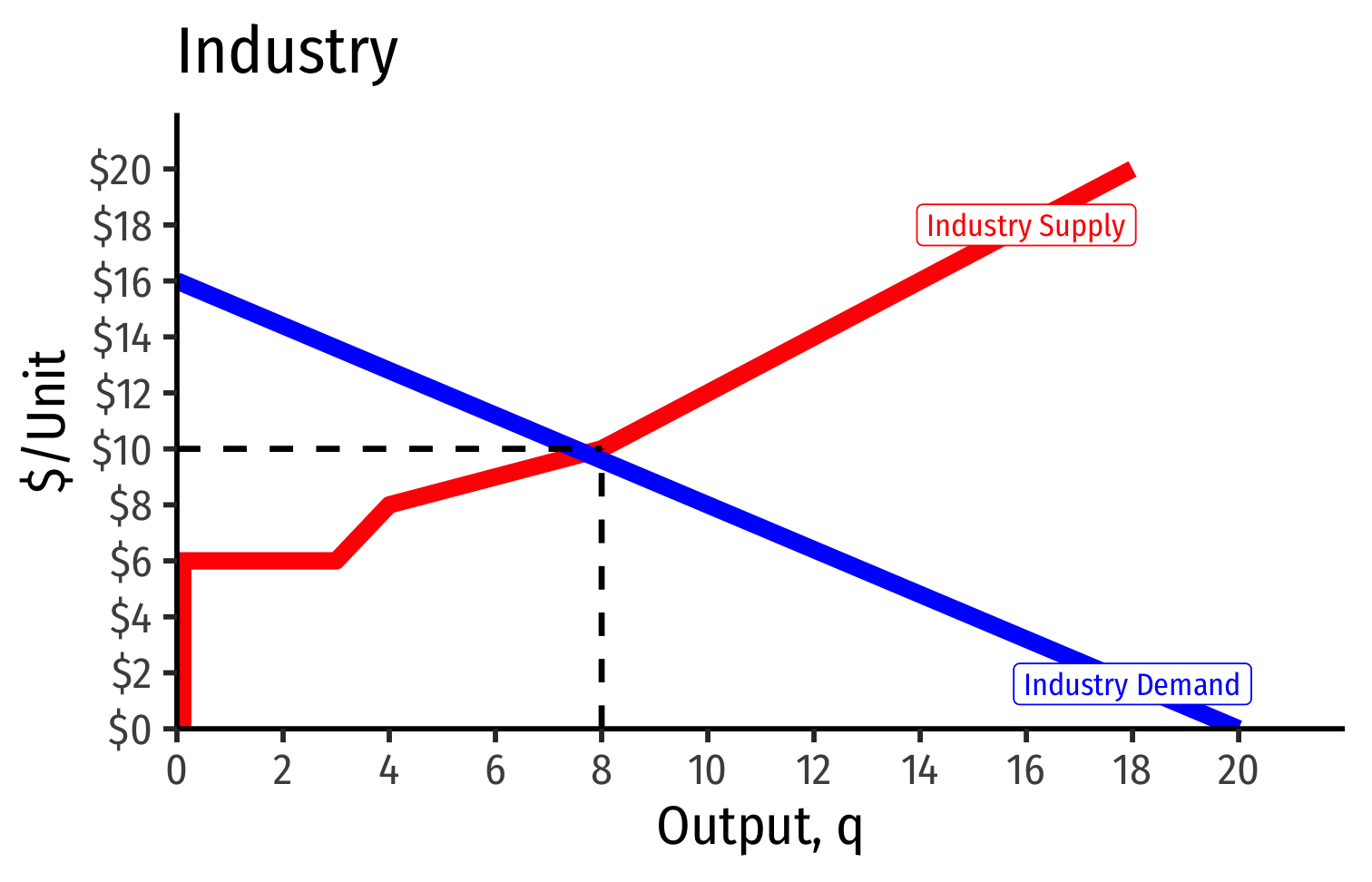

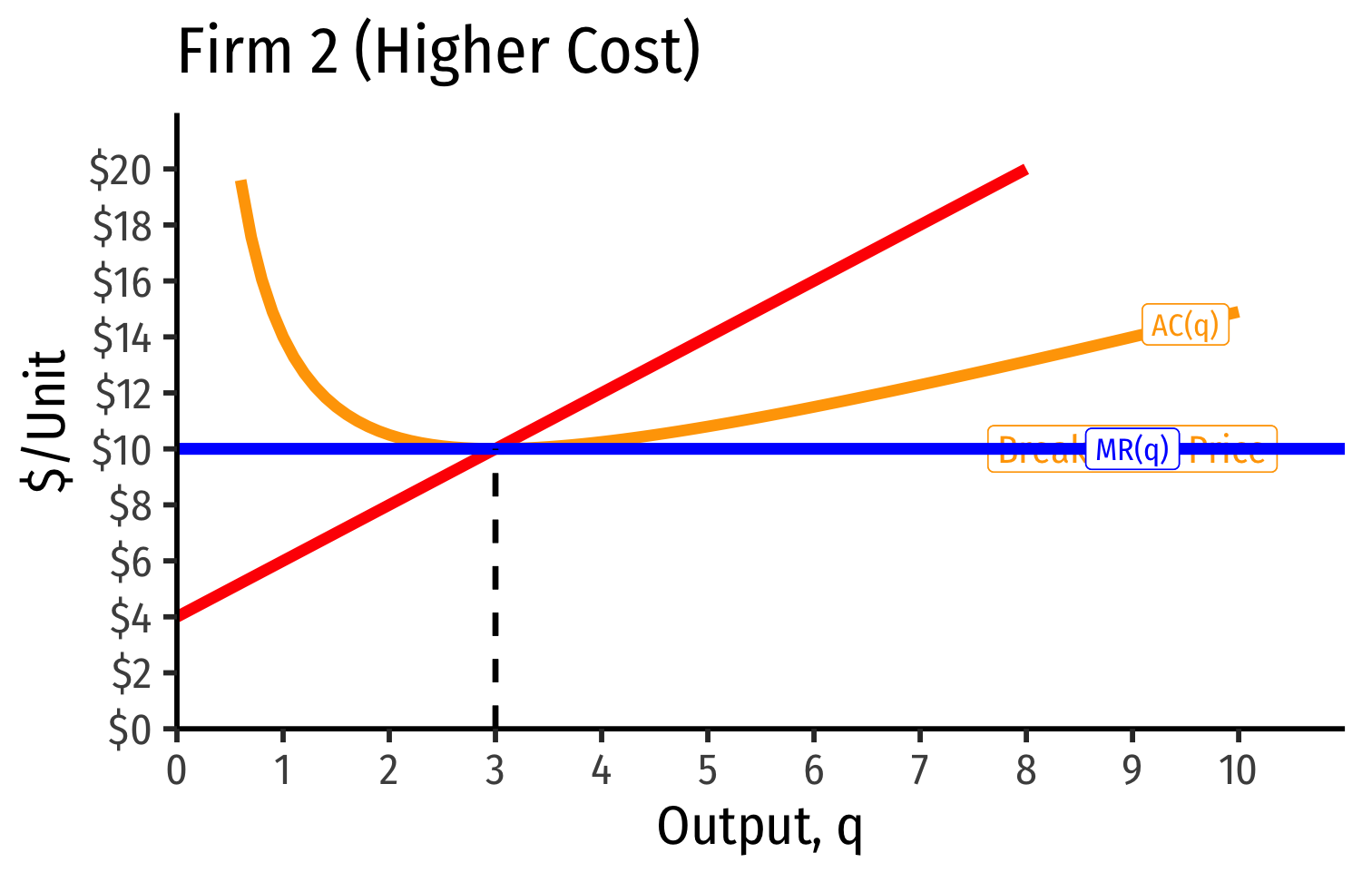

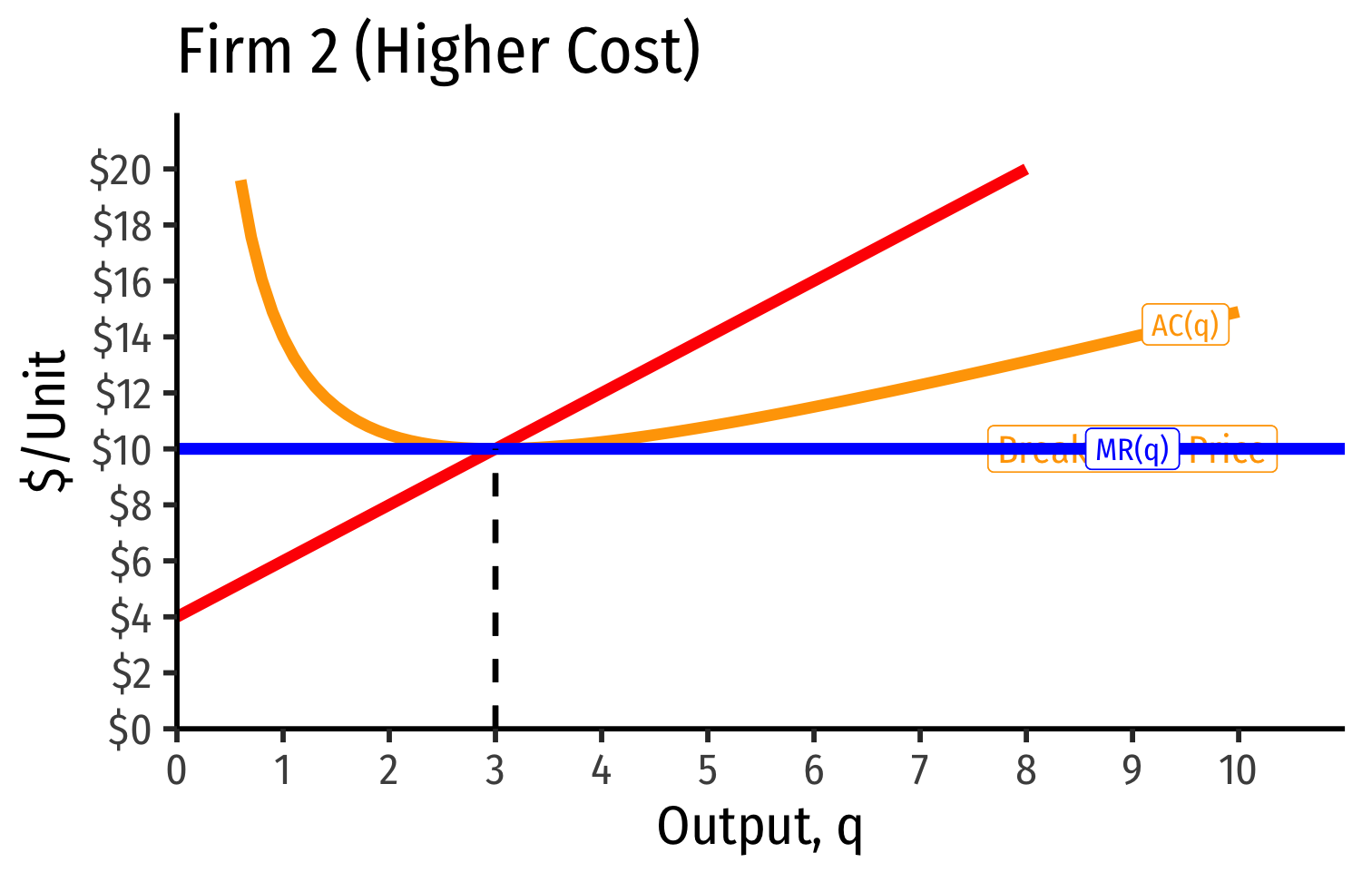

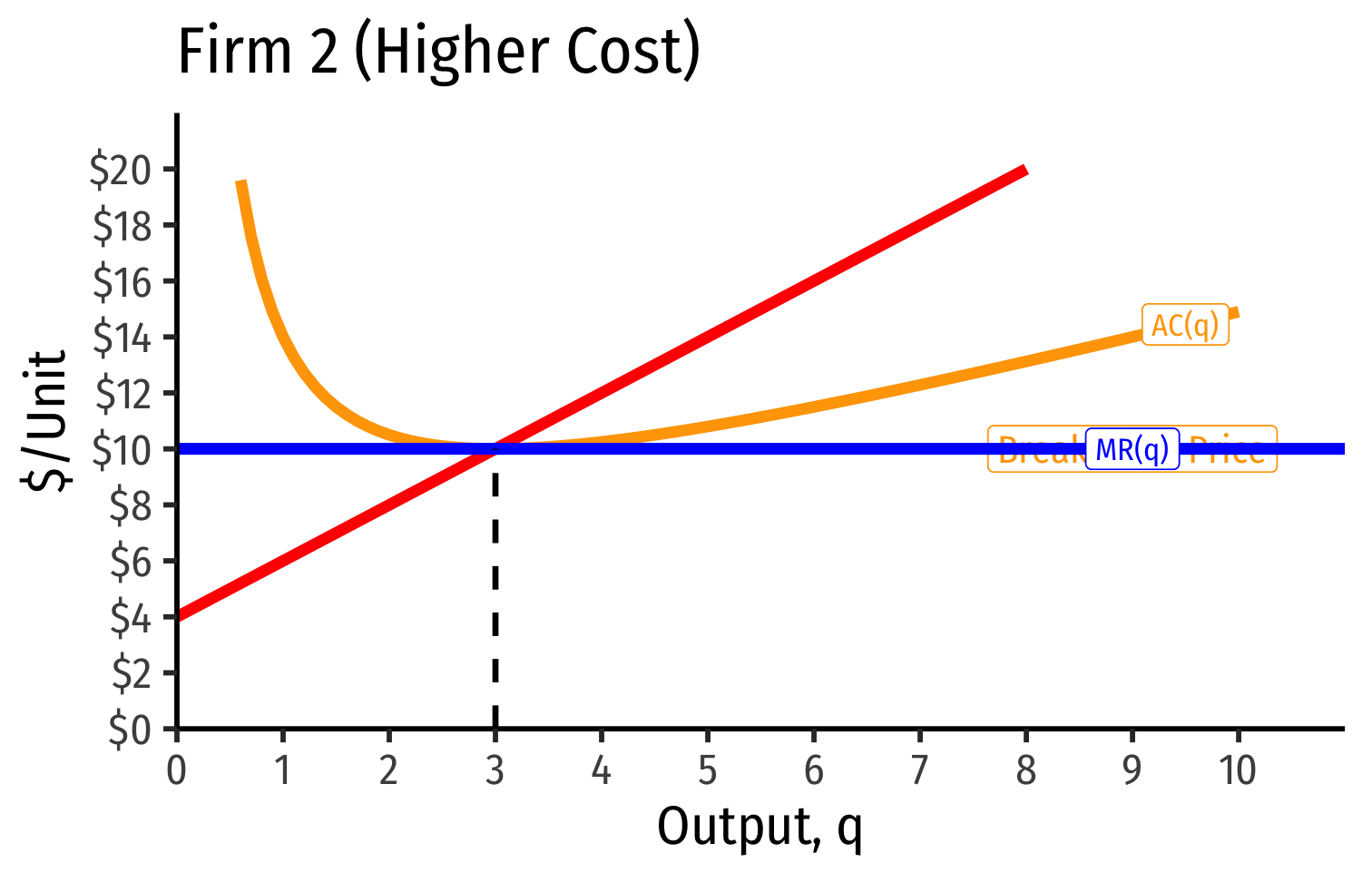

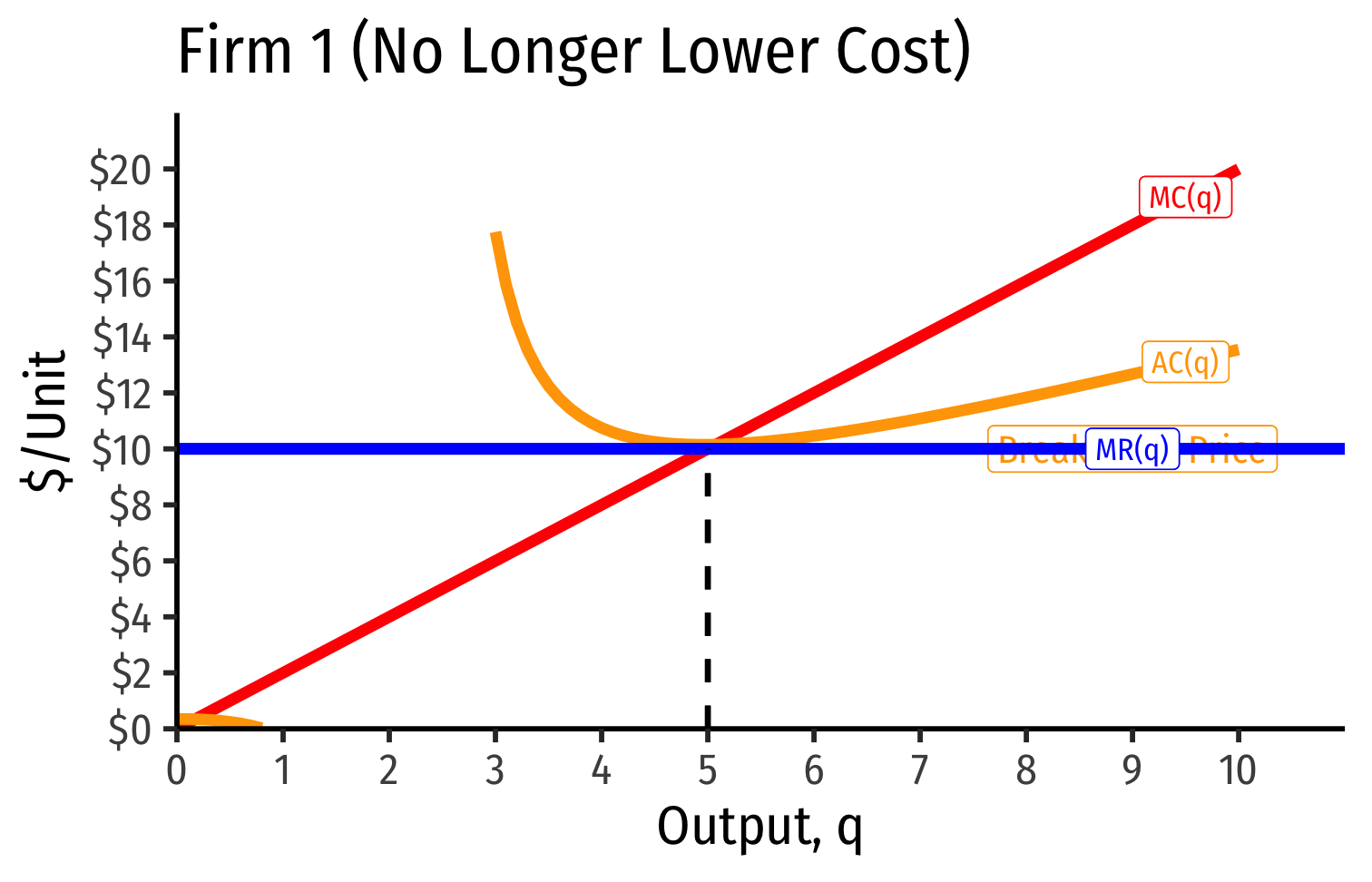

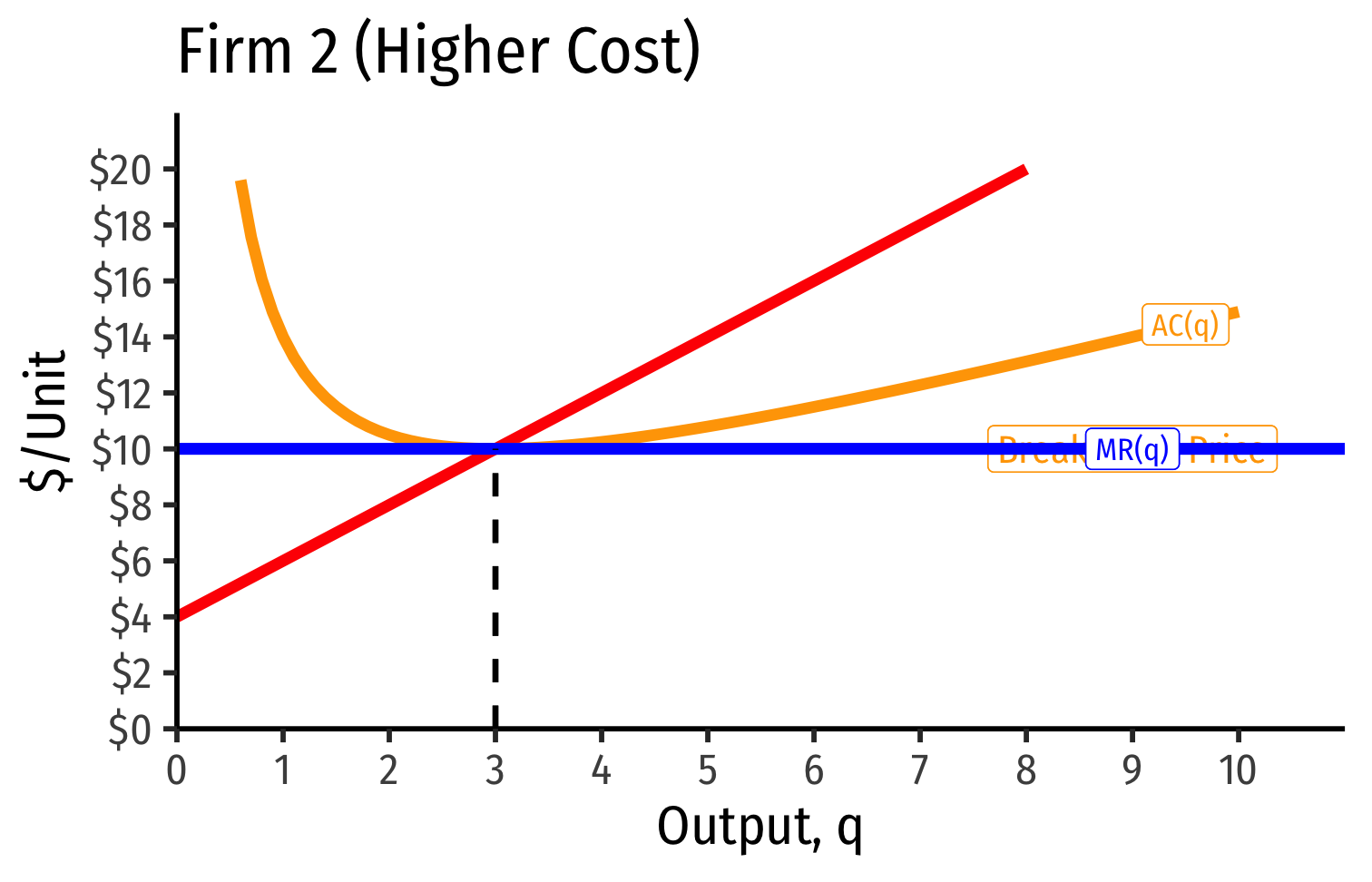

Industry Supply Curves (Different Firms) II

Industry Supply Curves (Different Firms) II

- Industry supply curve is the horizontal sum of all individual firm's supply curves

- Which are each firm's marginal cost curve above its breakeven price

Industry Supply Curves (Different Firms) II

Industry Supply Curves (Different Firms) II

- Industry demand curve (where equal to supply) sets market price, demand for firms

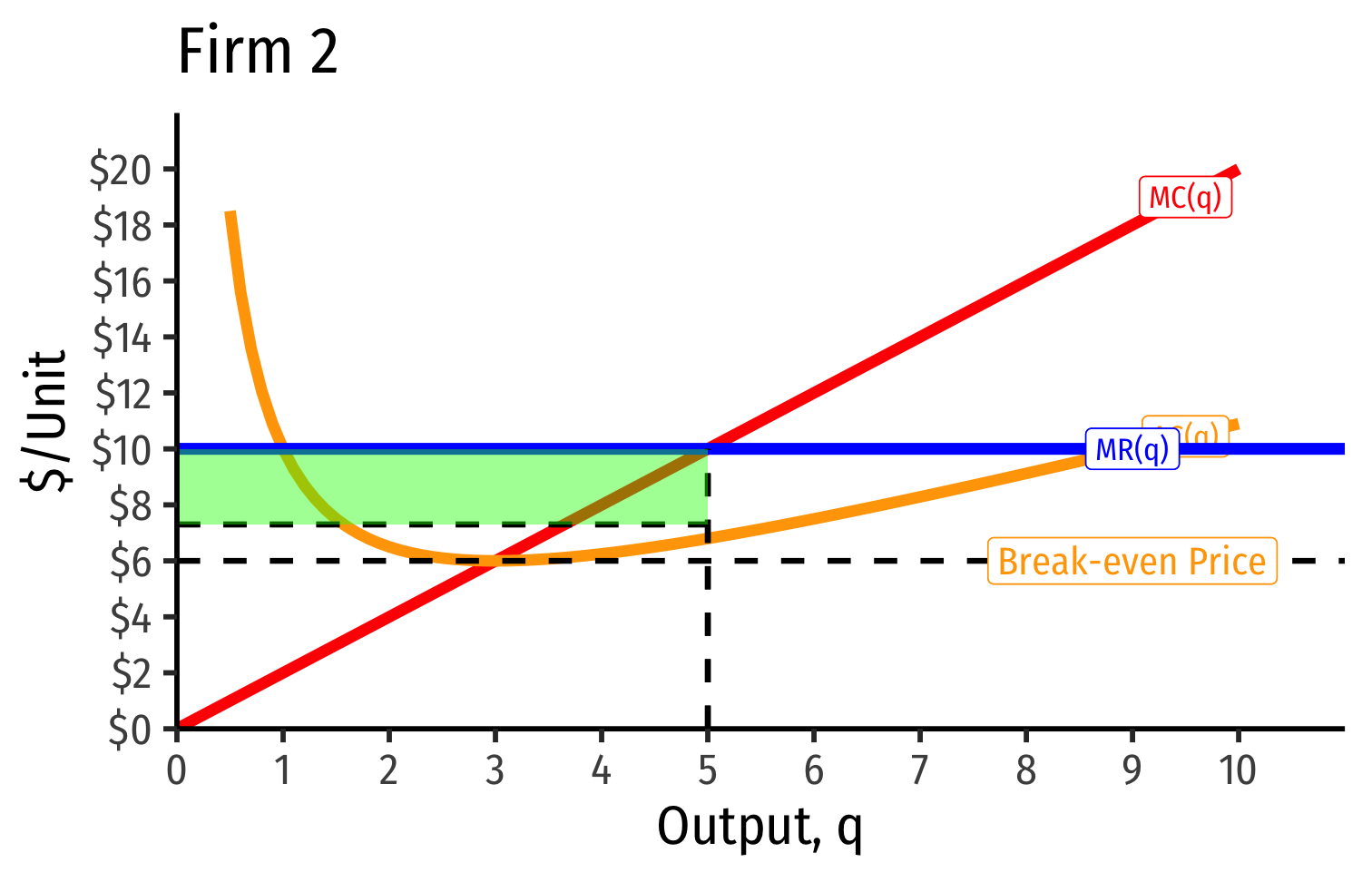

Industry Supply Curves (Different Firms) II

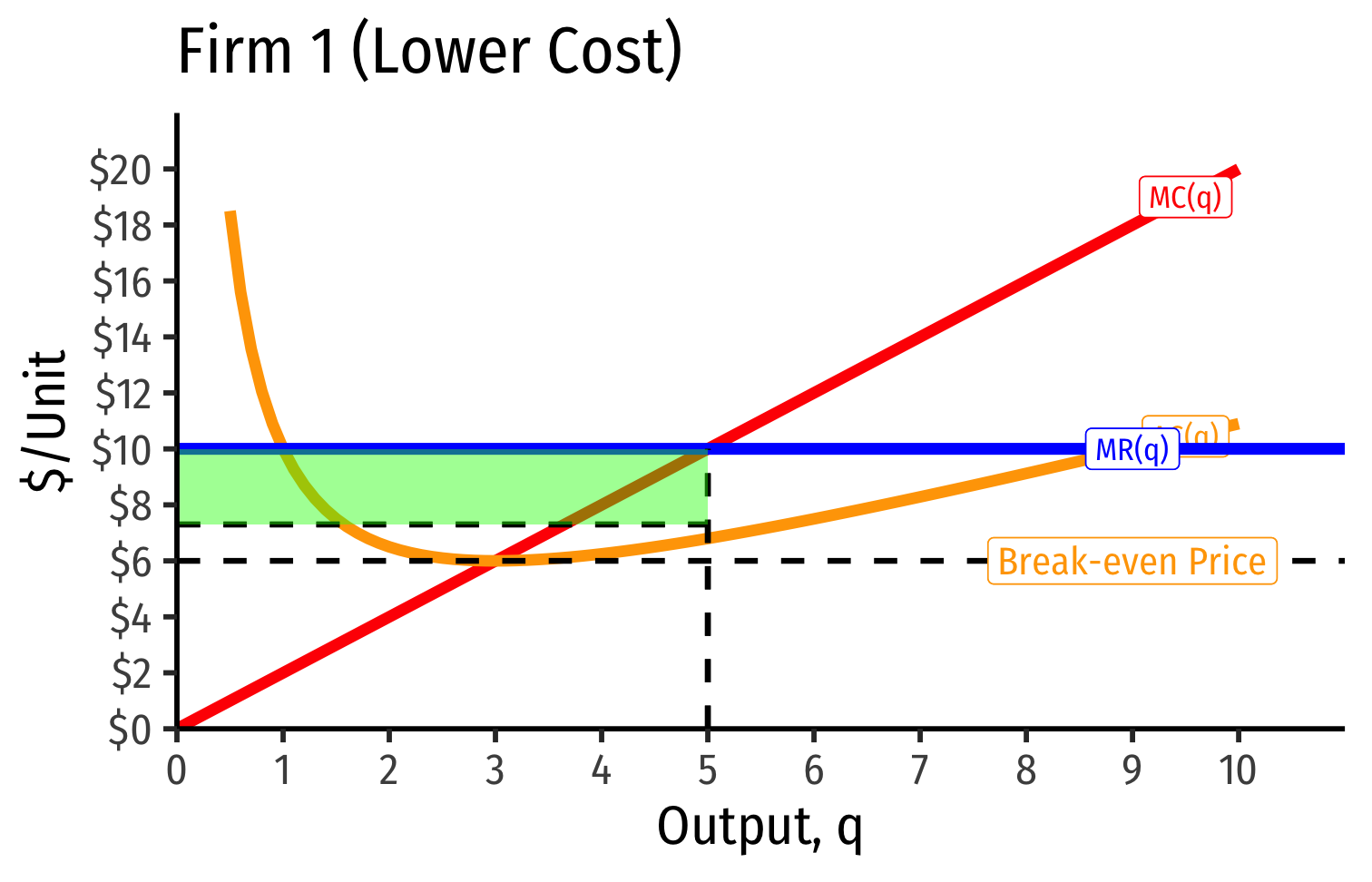

- Industry demand curve (where equal to supply) sets market price, demand for firms

- Long run industry equilibrium: p=AC(q)min, π=0 for marginal (highest cost) firm (Firm 2)

Industry Supply Curves (Different Firms) II

- Industry demand curve (where equal to supply) sets market price, demand for firms

- Long run industry equilibrium: p=AC(q)min, π=0 for marginal (highest cost) firm (Firm 2)

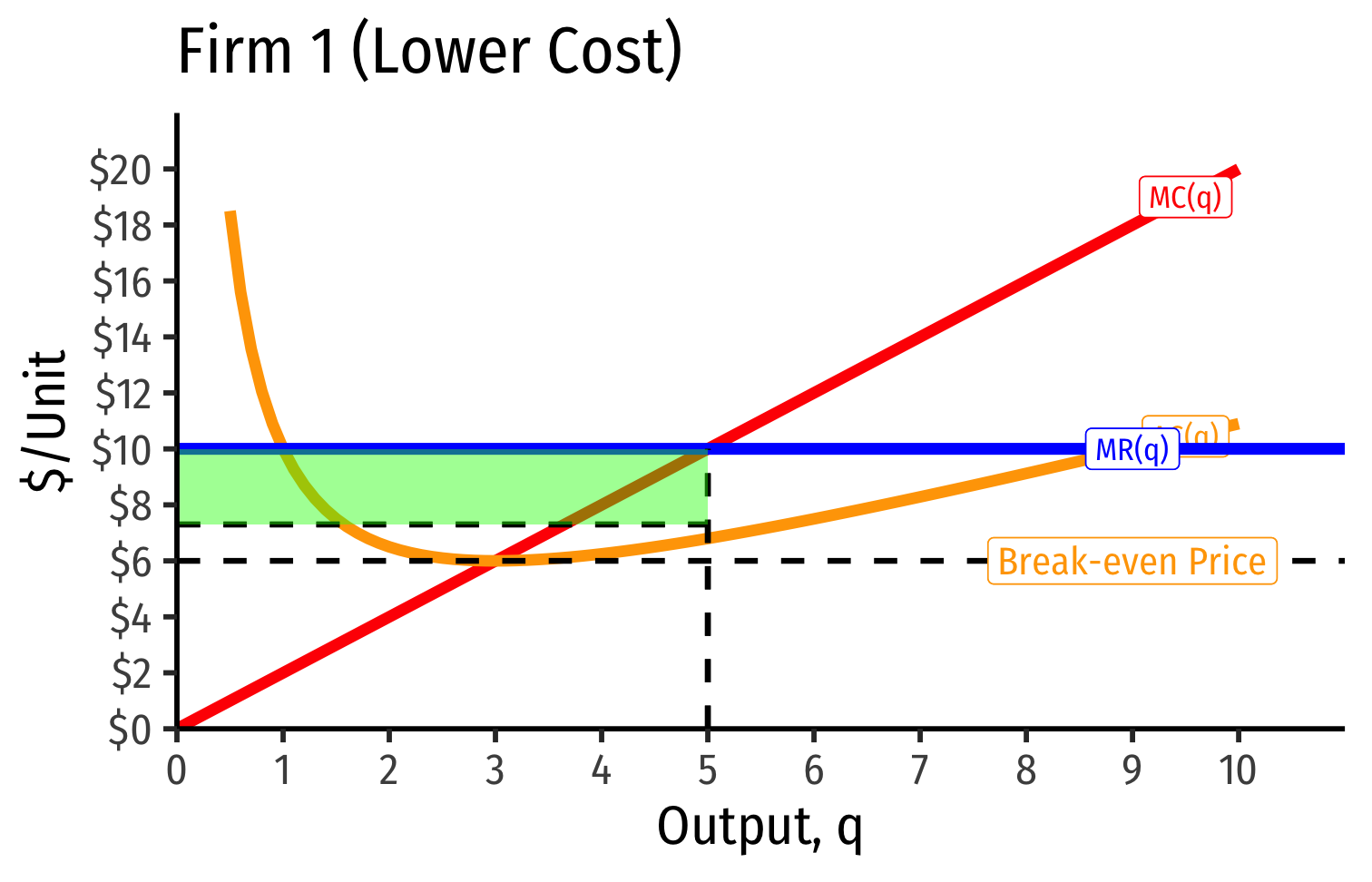

- Firm 1 (lower cost) appears to be earning profits...(we’ll come back to this)

Economic Rents and Zero Economic Profits I

Long-run equilibrium p=AC(q)min of the marginal (highest-cost) firm

The marginal firm earns normal economic profit (of zero)

- Otherwise, if p>AC(q) for that firm, would induce more entry into industry!

Generalized, No-Profitable Entry Condition: in equilibrium, no firm can earn positive profits by entering the industry

Economic Rents and Zero Economic Profits I

“Inframarginal” (lower-cost) firms are using resources that earn economic rents

- returns higher than their opportunity cost (what is needed to bring them into this industry)

Economic rents arise from relative differences between resources

Economic Rent

Economic rent: a return or payment for a resource above its normal market return (opportunity cost)

Has no allocative effect on resources, entirely “inframarginal”

A windfall return that resource owners get for free

Sources of Economic Rents

- Some factors are relatively scarce in the whole economy

- (talent, location, secrets, IP, licenses, being first, political favoritism)

Firms Using Resources with Economic Rents

Inframarginal firms that employ these scarce factors gain a short-run profits from having lower costs/higher productivity

...But what will happen to the prices for their scarce factors over time?

Economic Rents Examples

Economic Rents and Zero Economic Profits

In a competitive market, over the long run, profits are dissipated through competition

- Rival firms willing to pay for the scarce factor to gain an advantage

Competition over acquiring the scarce factors pushes up their prices

- i.e. higher costs to firms of using the factor!

Rents are included in the opportunity cost (price) for inputs over long run

- Must pay a factor enough to keep it out of other uses

Economic Rents and Zero Economic Profits

From the firm’s perspective, over the long-run, rents are included in the price (opportunity cost) of the scarce factor

- Must pay a factor enough to keep it out of other uses

Firm does not earn the rents, they raise firm's costs and squeeze profits to zero!

Economic Rents Reduce Firms’ Profits Over Long Run

- Short Run: firm that possesses scarce rent-generating factors has lower costs, perhaps short-run profits

Economic Rents Reduce Firms’ Profits Over Long Run

Short Run: firm that possesses scarce rent-generating factors has lower costs, perhaps short-run profits

Long run: competition over those factors pushes up their prices, raising costs to firm, until its profits go to zero as well

- Increase in fixed cost (scarce factor), raising AC(q), which now includes rents (more info in appendix)

Economic Rents Go To Resource Owners

Owners of scarce factors (workers, landowners, inventors, etc) earn the rents as higher income for their services (wages, land rent, interest, royalties, etc).

Often induces competition to supply alternative factors, which may dissipate the rents (to zero)

- More workers invest in becoming talented, try to create new inventions, build new land, etc.

Recall: Accounting vs. Economic Point of View

Recall “economic point of view”:

Producing your product pulls scarce resources out of other productive uses in the economy

Profits attract resources: pulled out of other (less valuable) uses

Losses repel resources: pulled away to other (more valuable) uses

Zero profits keep resources where they are

- Implies society is using resources optimally

Example

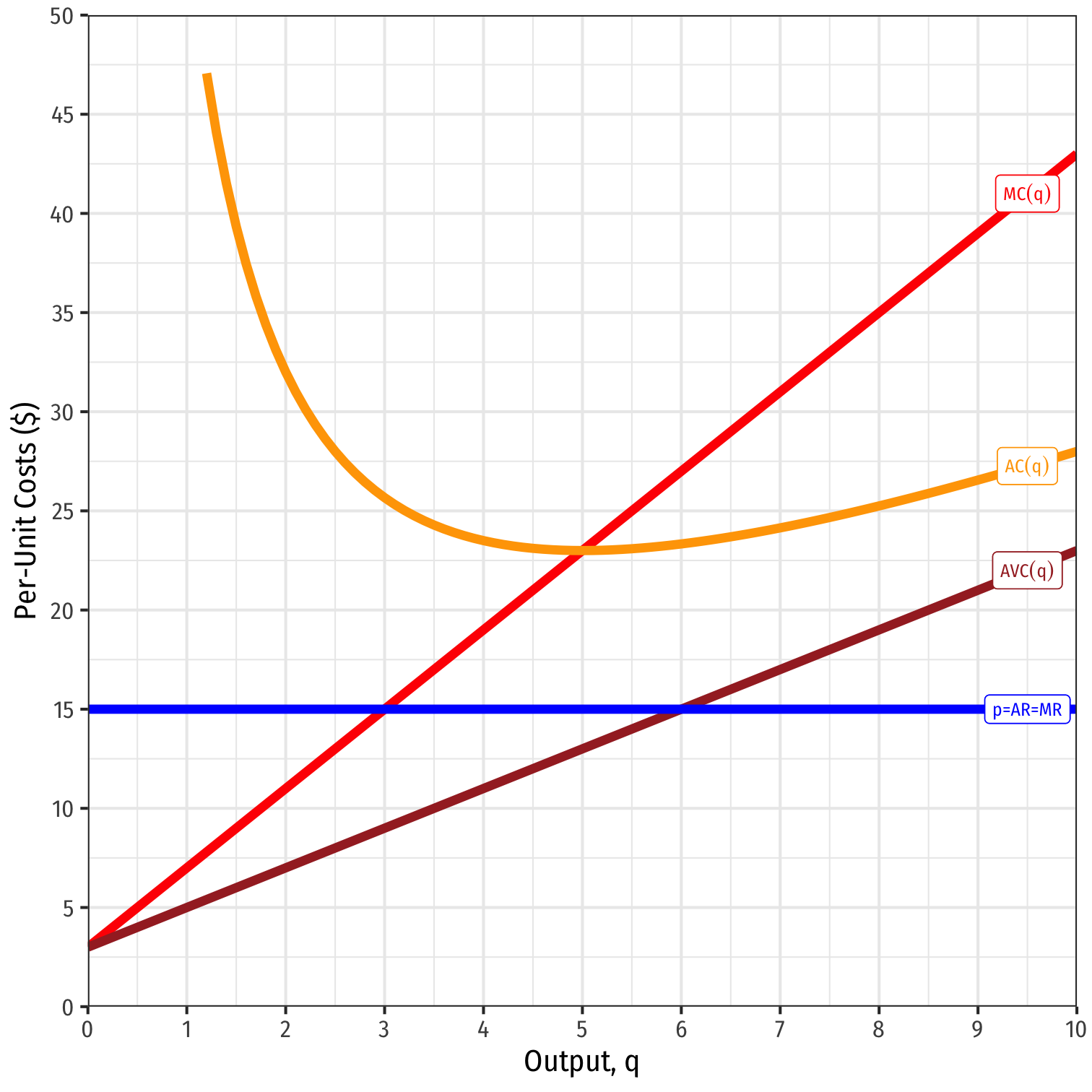

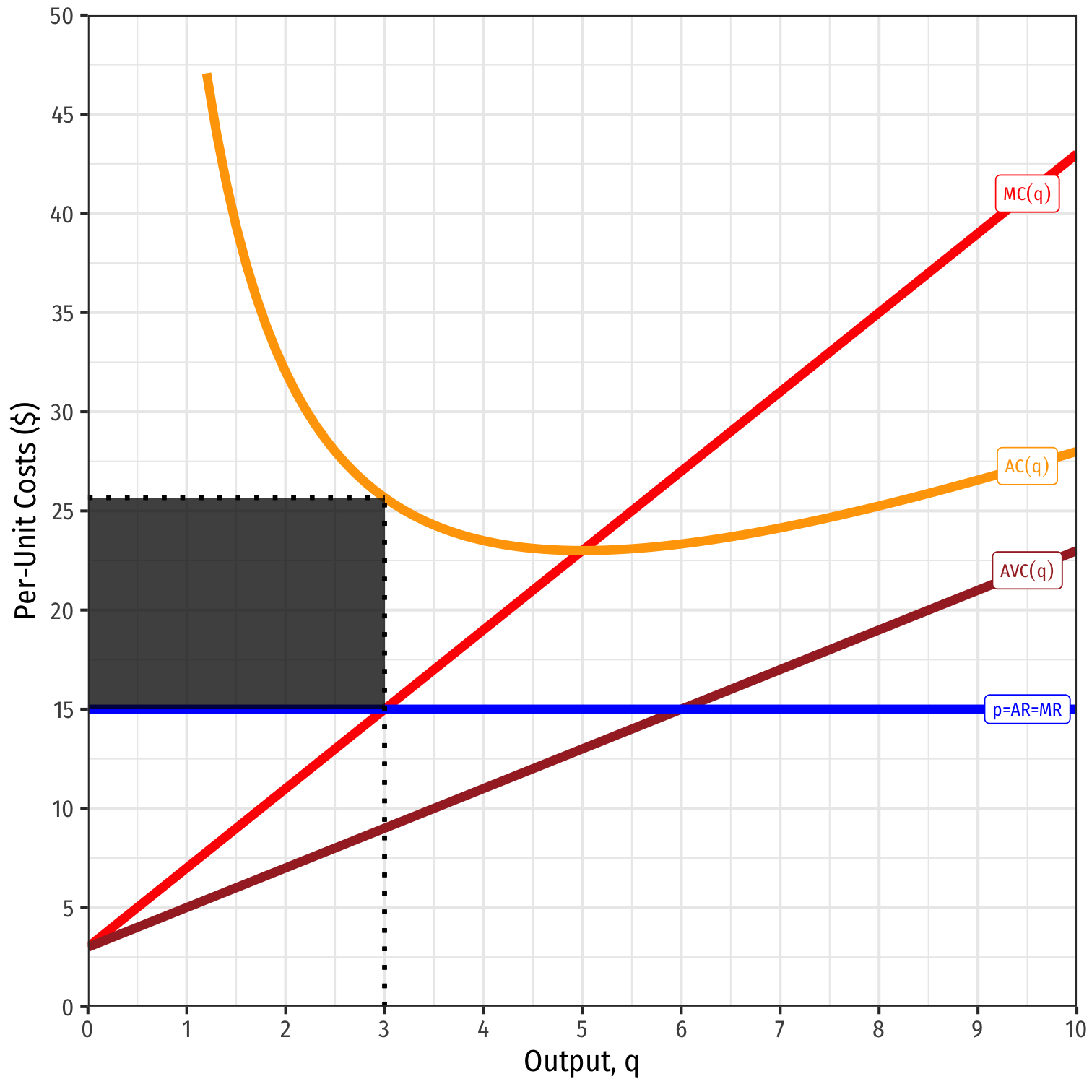

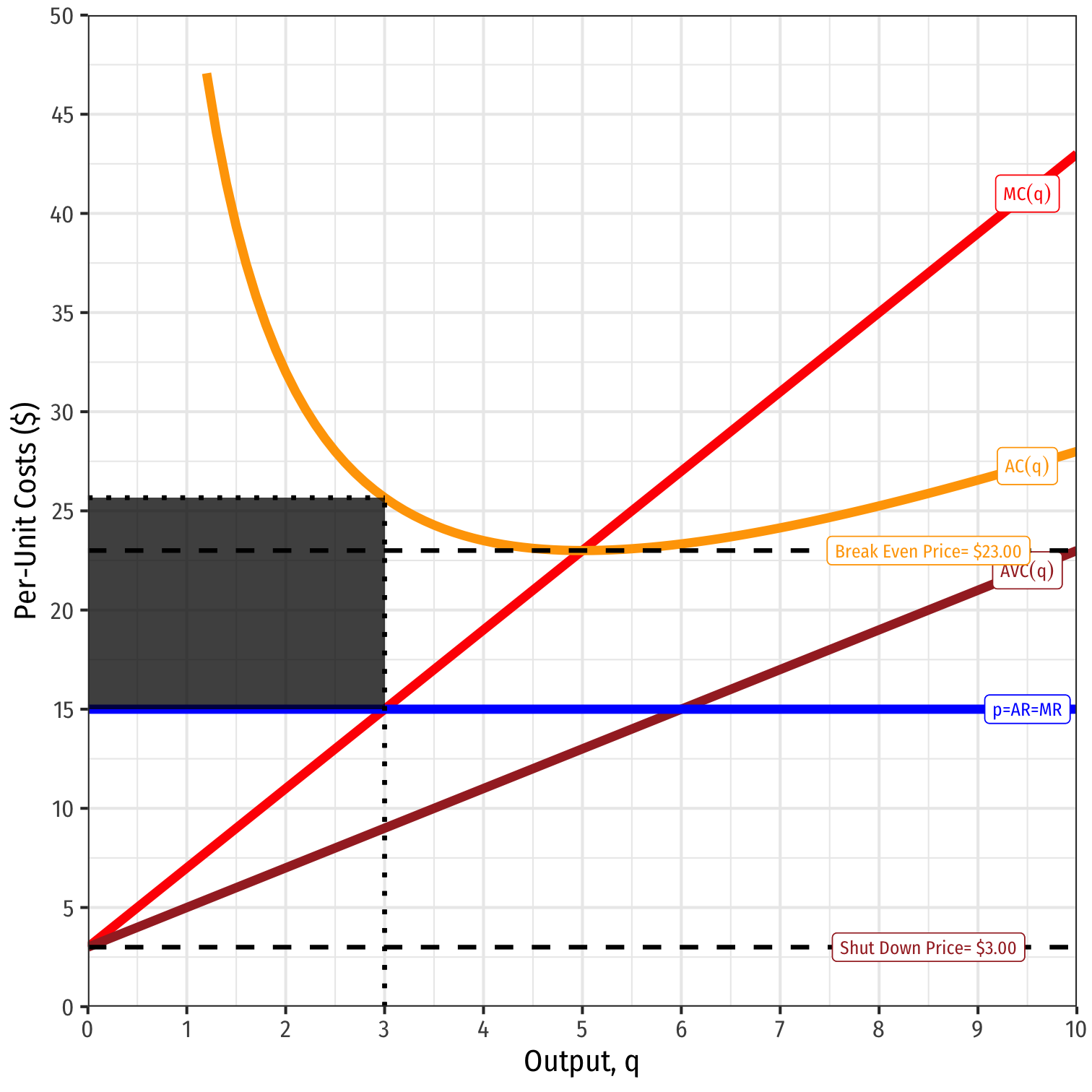

Example: Daniel’s Midland Archers has the following cost structure for producing archery bows:

C(q)=2q2+3q+50MC(q)=4q+3

Suppose the market is very competitive and the current market price is $15.

How many bows should the firm produce?

How much profit will it earn per day?

At what price would the firm break even?

At what price should the firm shut down in the short run?

Write equations for firm’s short-run supply curve and long-run supply curve.

Example: Visualized

Example: Visualized

Example: Visualized

Example: Visualized

Example: Visualized

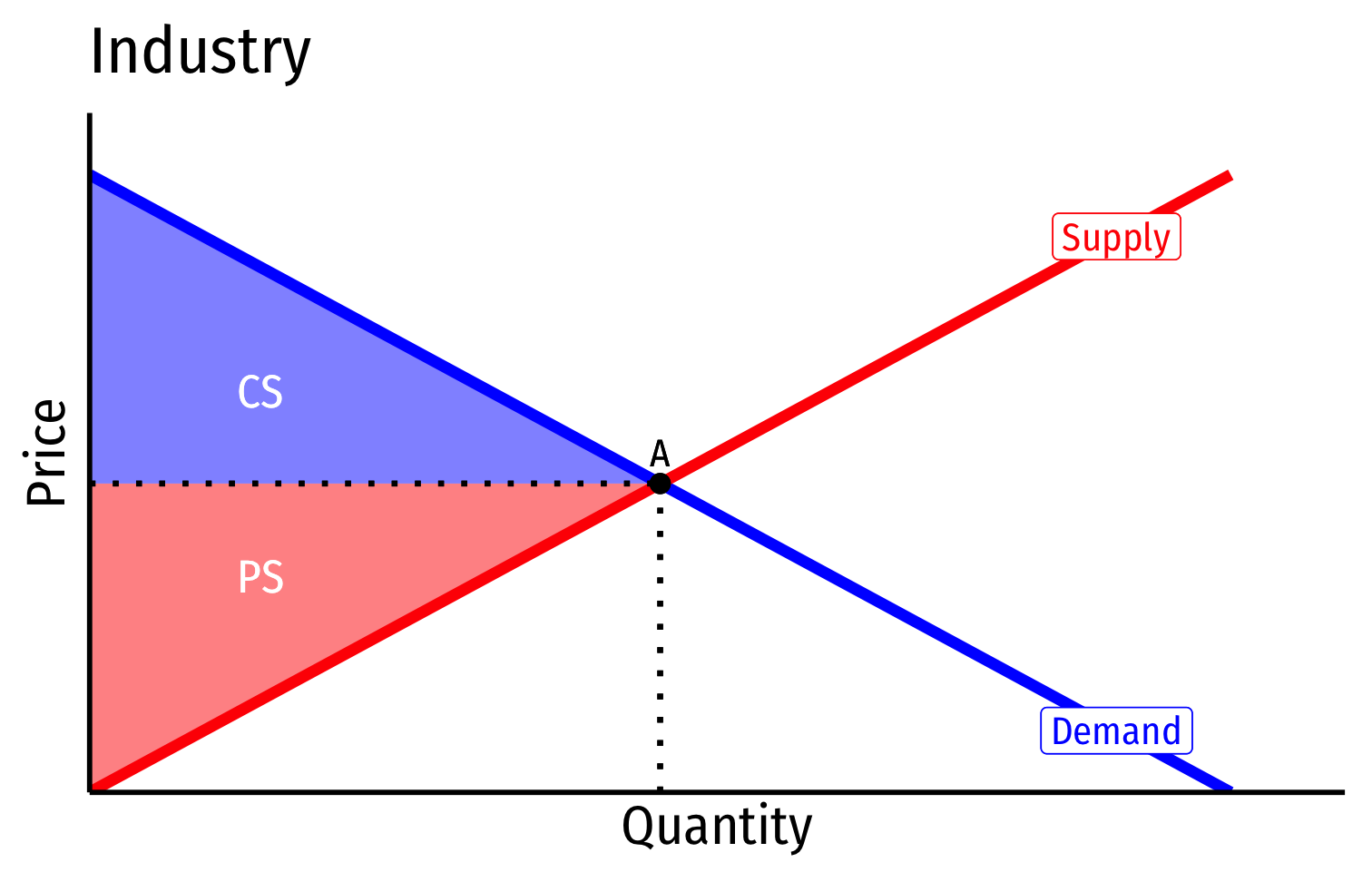

Welfare Effects of Perfect Competition

Perfectly Competitive Market

- In a competitive market in long run equilibrium:

- Economic profit is driven to $0; resources (factors of production) optimally allocated

- Allocatively efficient: p=MC(q), maximized CS + PS

- Productively efficient: p=AC(q)min (otherwise firms would enter/exit)

Market-Clearing Prices

- Supply and demand set the market-clearing price for all units exchanged (bought and sold)

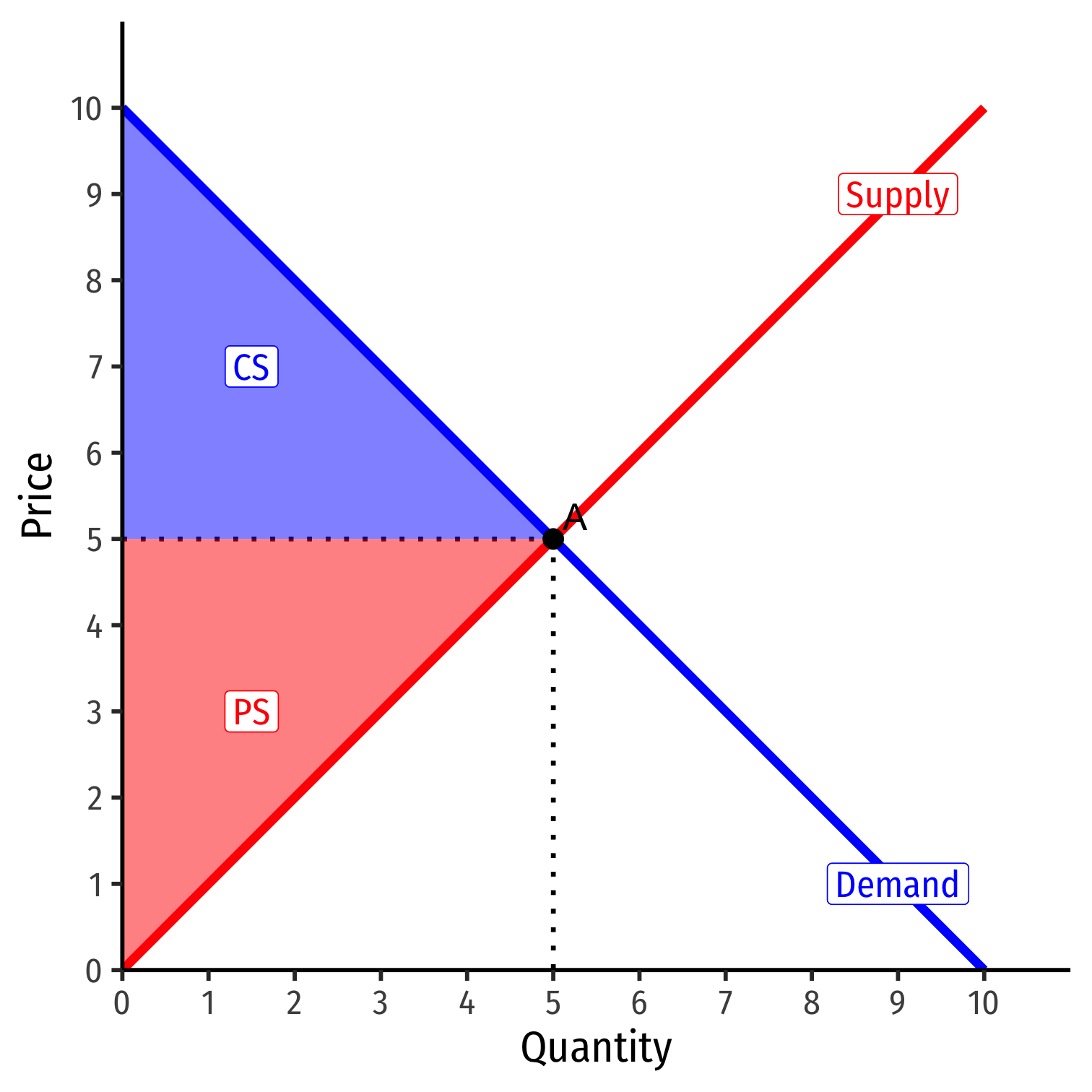

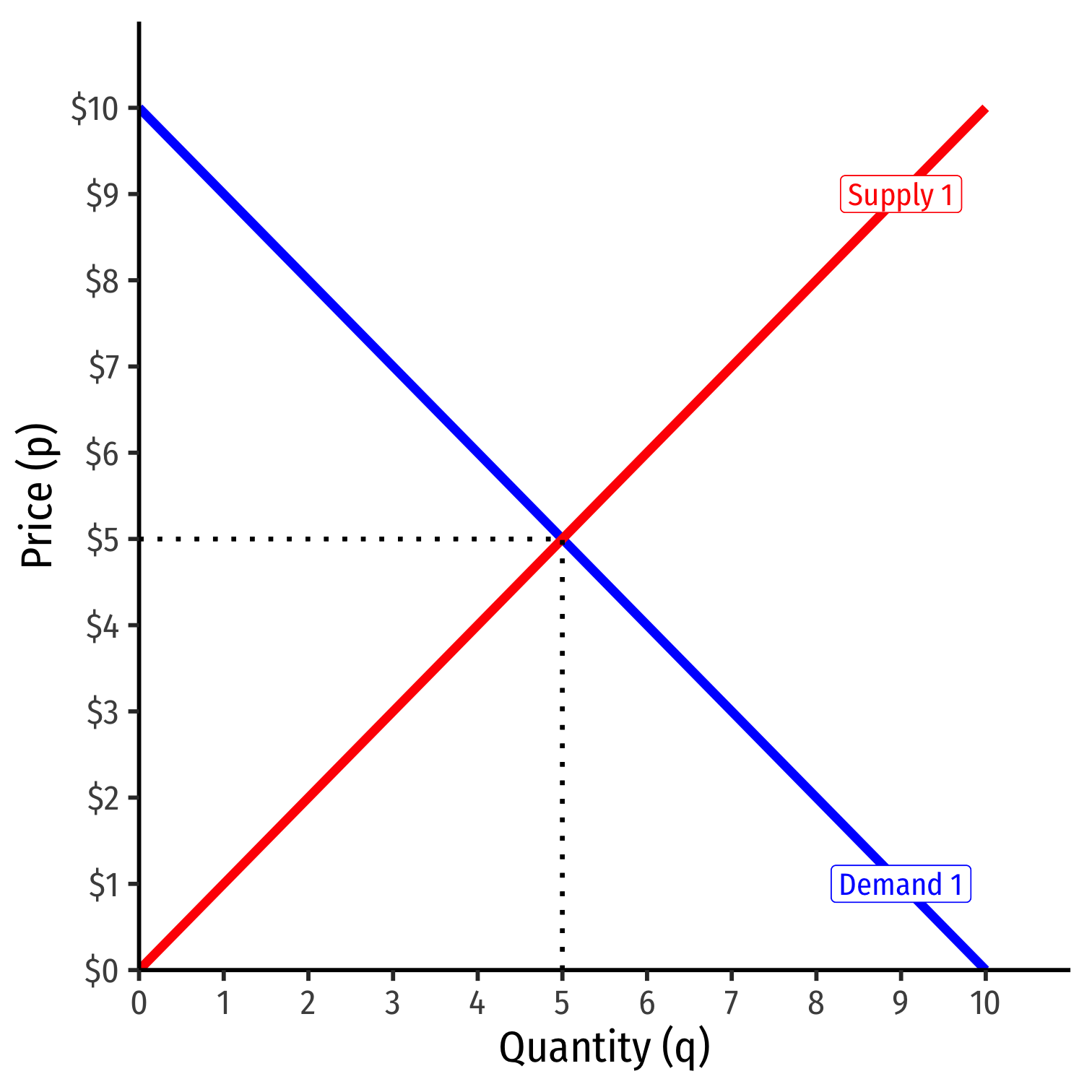

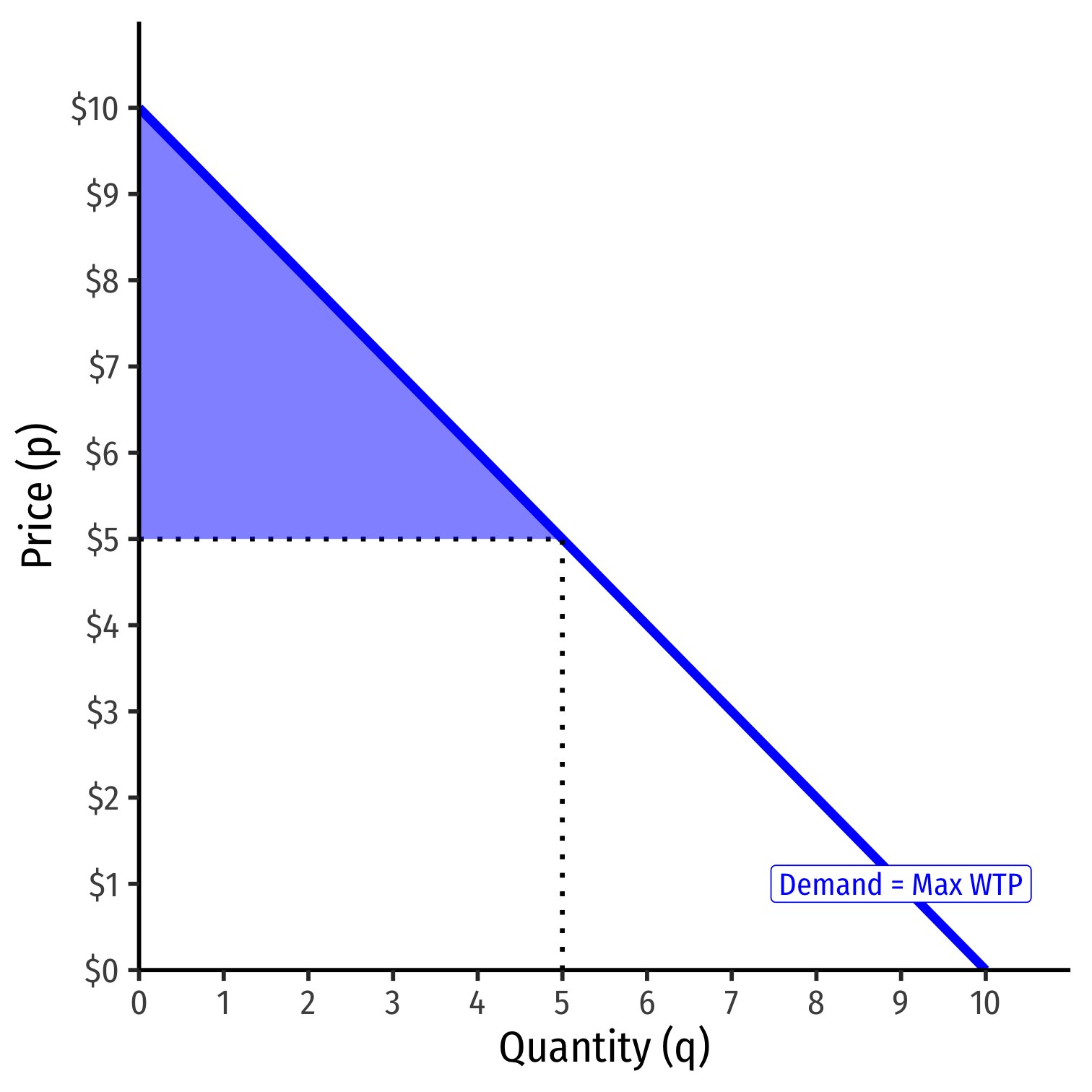

Consumer Surplus I

Demand function measures how much you would hypothetically be willing to pay for various quantities

- "reservation price"

You often actually pay (the market-clearing price, p∗) a lot less than your reservation price

The difference is consumer surplus

CS=WTP−p∗

Consumer Surplus II

CS=12bhCS=12(5−0)($10−$5)CS=$12.50

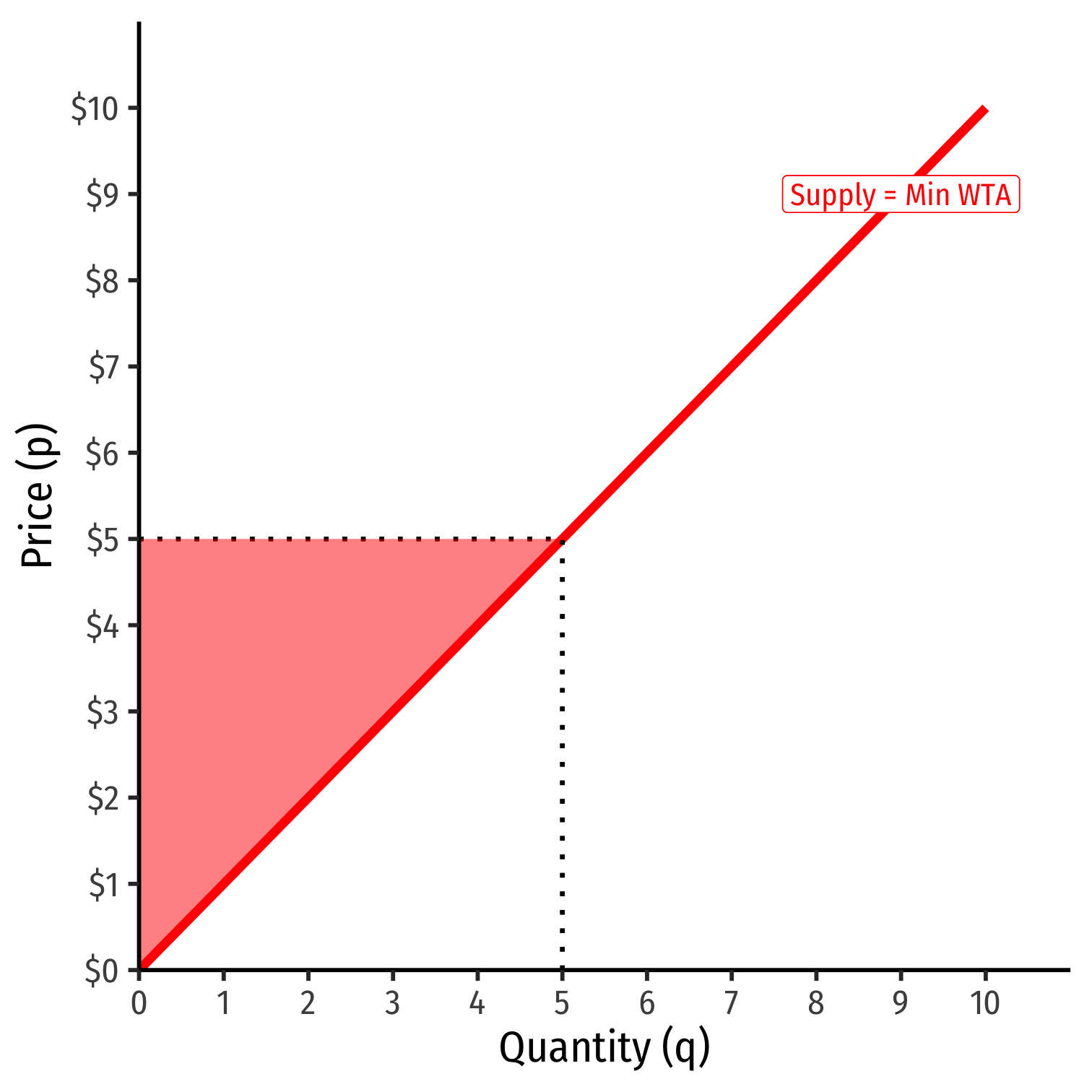

Producer Surplus I

Supply function measures how much you would hypothetically be willing to accept to sell various quantities

- "reservation price"

You often actually receive (the market-clearing price, p∗) a lot more than your reservation price

The difference is producer surplus

PS=p∗−WTA

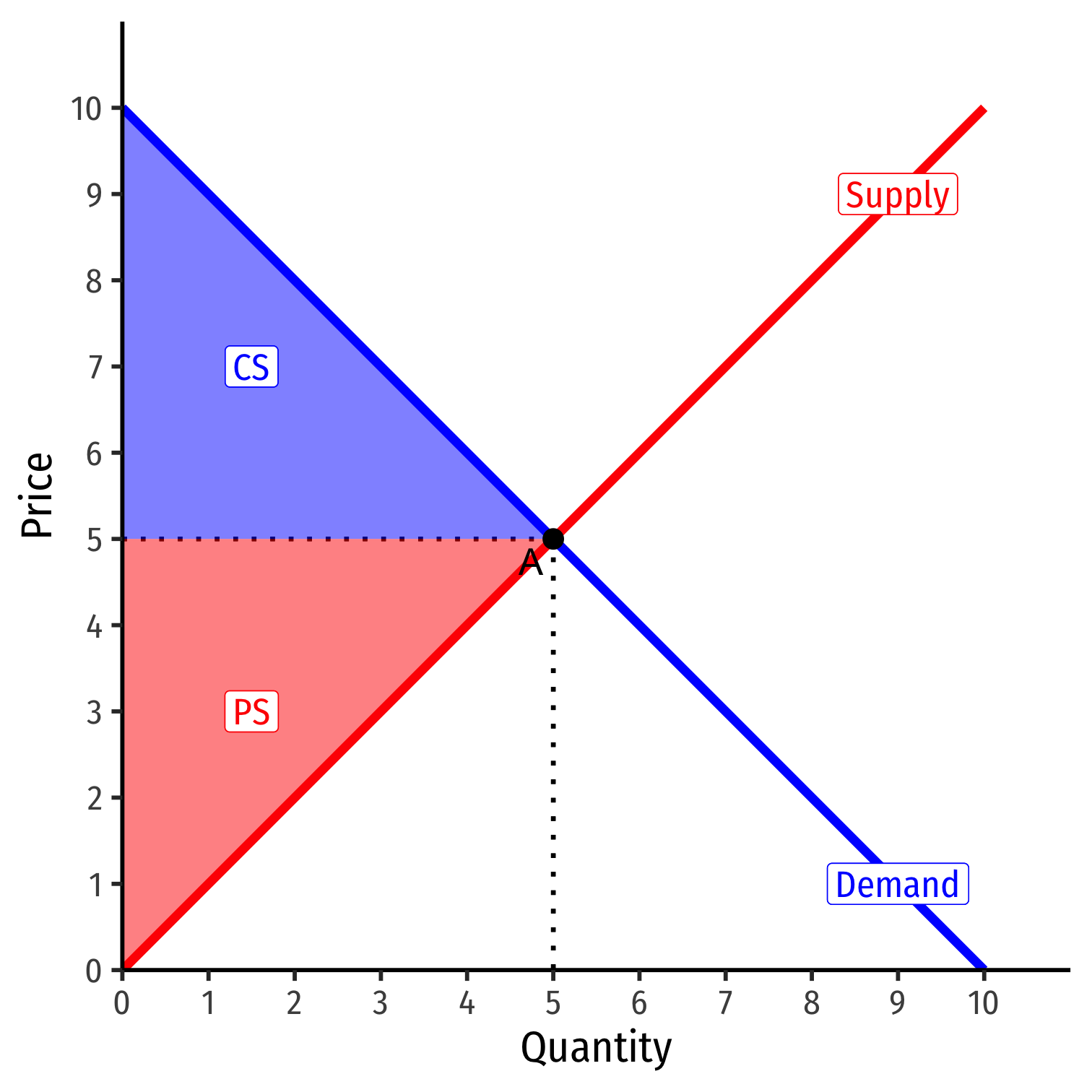

Market Efficiency in Competitive Equilibrium I

Allocative efficiency: resources are allocated to highest-valued uses

- Goods produced up to the point where MB=MC (p=MC)

All potential gains from trade are fully exhausted

Market Efficiency in Competitive Equilibrium II

Economic surplus = Consumer surplus + Producer surplus

Maximized in competitive equilibrium

Resources flow away from those who value them the lowest to those that value them the highest

The social value of resources is maximized by allocating them to their highest valued uses!