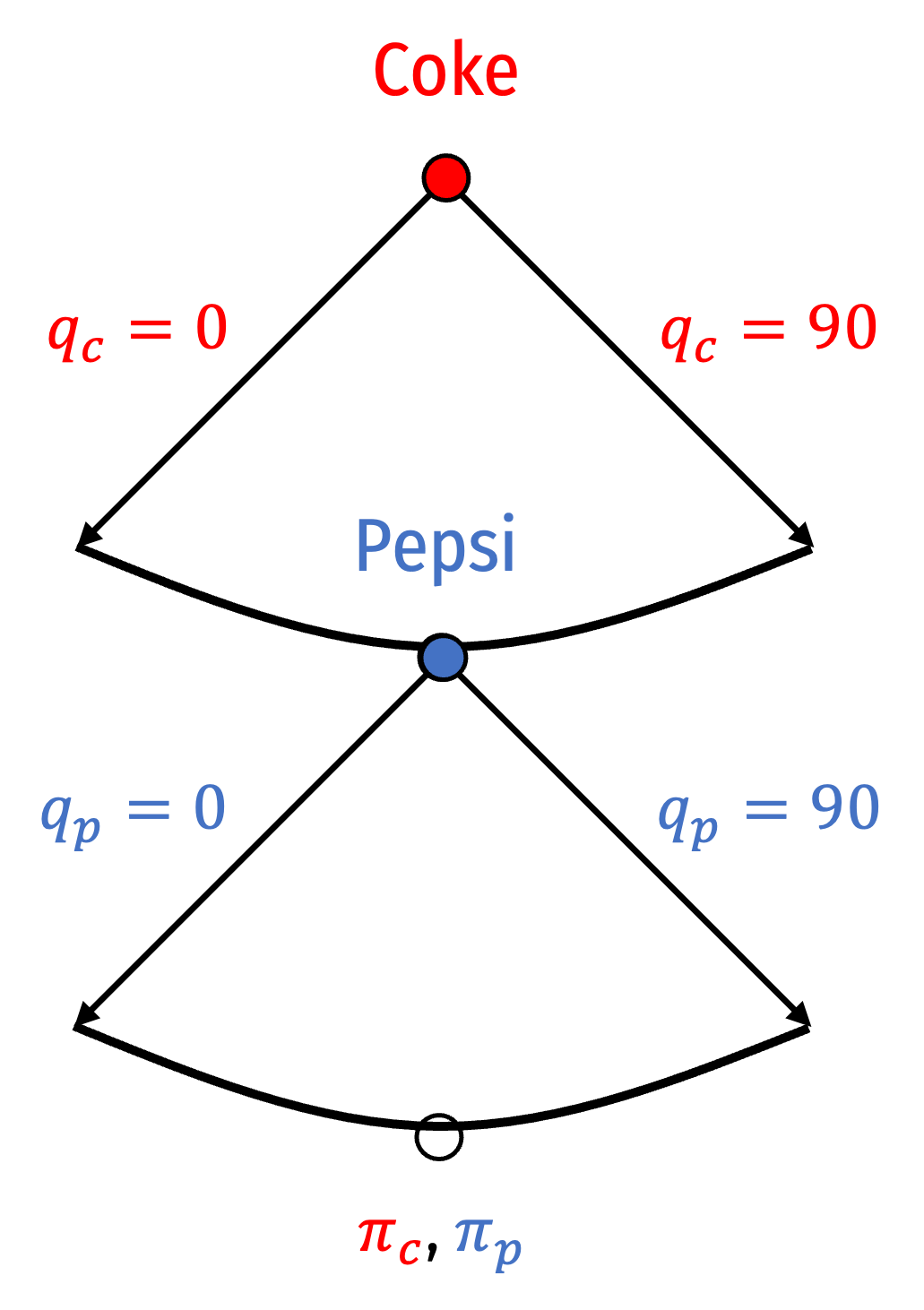

class: title-slide # 3.2 — Stackelberg Competition ## ECON 326 • Industrial Organization • Spring 2023 ### Ryan Safner<br> Associate Professor of Economics <br> <a href="mailto:safner@hood.edu"><i class="fa fa-paper-plane fa-fw"></i>safner@hood.edu</a> <br> <a href="https://github.com/ryansafner/ioS23"><i class="fa fa-github fa-fw"></i>ryansafner/ioS23</a><br> <a href="https://ioS23.classes.ryansafner.com"> <i class="fa fa-globe fa-fw"></i>ioS23.classes.ryansafner.com</a><br> --- # Stackelberg Competition: Moblab .center[  ] --- # Stackelberg Competition: Moblab .pull-left[ - Each of you is one Airline competing against another in a duopoly - Each pays same per-flight cost - Market price determined by *total* number of flights in market - **LeadAir** first chooses its number of flights, publicly announced - **FollowAir** then chooses its number of flights ] .pull-right[ .center[  ] ] --- # Stackelberg Competition .left-column[ .center[  .smallest[ Henrich von Stackelberg 1905-1946 ] ] ] .right-column[ - .hi[“Stackelberg competition”]: Cournot-style competition, two (or more) firms compete on **quantity** to sell the **same good** - Again, firms’ joint output determines the market price faced by all firms - But firms set their quantities **sequentially** - .hi-purple[Leader] produces first - .hi-purple[Follower] produces second ] --- # Stackelberg Competition: Example .pull-left[ - Return to .hi-red[Coke] and .hi-blue[Pepsi] again, with a constant marginal cost of $0.50 and the (inverse) market demand: `$$\begin{align*} P&=5-0.05Q\\ Q&=\color{red}{q_{c}}+\color{blue}{q_p}\\ \end{align*}$$` ] .pull-right[ .center[  ] ] --- # Stackelberg Competition: Example `$$\begin{align*} \color{red}{q_{c}^*}&=45-0.5\color{blue}{q_{p}}\\ \color{blue}{q_{p}^*}&=45-0.5\color{red}{q_{c}}\\ \\ \end{align*}$$` - Suppose now that .hi-red[Coke] is the .hi-purple[leader] and produces `\(\color{red}{q_c}\)` **first** -- - .hi-red[Coke] knows exactly how .hi-blue[Pepsi] will respond to its output: `$$\color{blue}{q_{p}^*}=45-0.5\color{red}{q_{c}}$$` -- - .hi-red[Coke], as leader, in theory faces **entire market demand** - But **not rational** to act like a monopolist! - knows that .hi-blue[Pepsi] (the .hi-purple[follower]) will still produce afterwards, which pushes down market price for both firms! --- # Stackelberg Competition as Sequential Game .pull-left[ - This is a sequential game, so we should solve this via .hi-purple[backward induction] - Though .hi-blue[Pepsi] will move second (last), it will be responding to .hi-red[Coke]'s output - So .hi-red[Coke] must know how .hi-blue[Pepsi] will react in order to choose its optimal output ] .pull-right[ .center[  ] ] --- # Stackelberg Competition: Example - Substitute .hi-blue[follower]'s reaction function into (inverse) market demand function faced by .hi-red[leader] -- `$$\begin{align*} P&=5-0.05\color{red}{q_c}-0.05\color{blue}{p_p}\\ P&=5-0.05\color{red}{q_{c}}-0.05\color{blue}{(}45-0.5\color{red}{q_{c}}\color{blue}{)}\\ P&=2.75-0.025\color{red}{q_{c}}\\ \end{align*}$$` -- - Now find `\(MR(q)\)` for .hi-red[Coke] from this by doubling the slope: `$$MR_{c}=2.75-0.05q_{c}$$` --- # Stackelberg Competition: Example - Now .hi-red[Coke] can find its optimal quantity: `$$\begin{align*} MR_{c}&=MC\\ 2.75-0.05q_{c}&=0.50\\ 45&=q_{c}^*\\ \end{align*}$$` -- - .hi-blue[Pepsi] will optimally respond by producing: `$$\begin{align*} q_p^*&=45-0.5q_{c}\\ q_p^*&=45-0.5(45)\\ q_p^*&=22.5\\ \end{align*}$$` --- # Stackelberg Competition: Example .pull-left[ <img src="3.2-slides_files/figure-html/unnamed-chunk-34-1.png" width="504" style="display: block; margin: auto;" /> ] .pull-right[ - **Stackelberg Nash Equilibrium**: `$$\big( \color{red}{q^*_{c}=45}, \color{blue}{q^*_{p}=22.5} \big)$$` ] --- # Stackelberg Competition: Example - With `\(\color{red}{q^*_{c}=45}\)` and `\(\color{blue}{q^*_p=22.5}\)`, this sets a market-clearing price of: `$$\begin{align*} P&=5-0.05(67.5)\\ P&=\$1.625\\ \end{align*}$$` -- .pull-left[ - .hi-red[Coke's] profit would be: `$$\begin{align*} \pi_{c}&=(1.625-0.50)45\\ \pi_{c}&=\$50.625\\ \end{align*}$$` ] -- .pull-right[ - .hi-blue[Pepsi's] profit would be: `$$\begin{align*} \pi_{p}&=(1.625-0.50)22.5\\ \pi_{p}&=\$25.3125\\ \end{align*}$$` ] --- # Stackelberg-Nash Equilibrium, The Market <img src="3.2-slides_files/figure-html/unnamed-chunk-35-1.png" width="504" style="display: block; margin: auto;" /> --- # Cournot vs. Stackelberg Competition <div class="datatables html-widget html-fill-item-overflow-hidden html-fill-item" id="htmlwidget-3c068f32eab275168532" style="width:100%;height:auto;"></div> <script type="application/json" data-for="htmlwidget-3c068f32eab275168532">{"x":{"filter":"none","vertical":false,"class":"display","data":[["Coke","Pepsi","INDUSTRY"],["30.00","30.0","60.0"],["$45.00","$45.00","$90.00"],["45.00","22.50","67.50"],["$50.63","$25.31","$75.94"]],"container":"<table class=\"display\">\n <thead>\n <tr>\n <th rowspan=\"2\">Firm<\/th>\n <th colspan=\"2\">Cournot (p = $2.00)<\/th>\n <th colspan=\"2\">Stackelberg (p = $1.63)<\/th>\n <\/tr>\n <tr>\n <th>output<\/th>\n <th>profit<\/th>\n <th>output<\/th>\n <th>profit<\/th>\n <\/tr>\n <\/thead>\n<\/table>","options":{"dom":"t","columnDefs":[],"order":[],"autoWidth":false,"orderClasses":false}},"evals":[],"jsHooks":[]}</script> --- # Stackelberg and First-Mover Advantage .pull-left[ - Stackelberg **leader** clearly has a .hi-purple[first-mover advantage] over the **follower** - **Leader**: `\(q^*=45\)`, π = $50.63 - **Follower**: `\(q^*=22.5\)`, π = $25.31 - If firms compete **simultaneously** (.hi[Cournot]): `\(q^*=30\)`, π = $45.00 each - Leading `\(\succ\)` simultaneous `\(\succ\)` Following ] .pull-right[ <img src="3.2-slides_files/figure-html/stackrf-1.png" width="504" style="display: block; margin: auto;" /> ] --- # Stackelberg and First-Mover Advantage .pull-left[ - Stackelberg Nash equilibrium requires .hi-purple[perfect information] for **both** leader and follower - Follower must be able to **observe** leader's output to choose its own - Leader must **believe** follower will see leader's output and react optimally - .hi-purple[Imperfect information] reduces the game to (simultaneous) .hi[Cournot competition] ] .pull-right[ <img src="3.2-slides_files/figure-html/unnamed-chunk-37-1.png" width="504" style="display: block; margin: auto;" /> ] --- # Stackelberg and First-Mover Advantage .pull-left[ - Again, leader *cannot* act like a monopolist - A strategic game! Market output (that pushes down market price) is `\(Q=q_{c}+q_{p}\)` - Leader's choice of 45 is optimal **only if** follower responds with 22.5 ] .pull-right[ <img src="3.2-slides_files/figure-html/unnamed-chunk-38-1.png" width="504" style="display: block; margin: auto;" /> ] --- # Comparing All Oligopoly Models <div class="datatables html-widget html-fill-item-overflow-hidden html-fill-item" id="htmlwidget-6ea30860779d71098f5e" style="width:100%;height:auto;"></div> <script type="application/json" data-for="htmlwidget-6ea30860779d71098f5e">{"x":{"filter":"none","vertical":false,"class":"display","data":[["Coke","Pepsi","INDUSTRY"],["45.00","45.00","90.00"],["$0.00","$0.00","$0.00"],["30.00","30.00","60.00"],["$45.00","$45.00","$90.00"],["45.00","22.50","67.50"],["$50.63","$25.31","$75.94"],["22.50","22.50","45.00"],["$50.63","$50.63","$101.25"]],"container":"<table class=\"display\">\n <thead>\n <tr>\n <th rowspan=\"2\">Firm<\/th>\n <th colspan=\"2\">Bertrand (p = $0.50)<\/th>\n <th colspan=\"2\">Cournot (p = $2.00)<\/th>\n <th colspan=\"2\">Stackelberg (p = $1.63)<\/th>\n <th colspan=\"2\">Collusion (p = $2.75)<\/th>\n <\/tr>\n <tr>\n <th>output<\/th>\n <th>profit<\/th>\n <th>output<\/th>\n <th>profit<\/th>\n <th>output<\/th>\n <th>profit<\/th>\n <th>output<\/th>\n <th>profit<\/th>\n <\/tr>\n <\/thead>\n<\/table>","options":{"dom":"t","columnDefs":[],"order":[],"autoWidth":false,"orderClasses":false}},"evals":[],"jsHooks":[]}</script> .smaller[ - Output: `\(Q_m < Q_c < Q_s < Q_b\)` - Market price: `\(P_b < P_s < P_c < P_m\)` - Profit: `\(\pi_b=0 < \pi_s < \pi_c < \pi_m\)` Where subscript `\(m\)` is monopoly (collusion), `\(c\)` is Cournot, `\(s\)` is Stackelberg, `\(b\)` is Bertrand ]